- Trading

- Trading

- Markets

- Markets

- Products overview

- Forex

- Commodities

- Metals

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- Platforms

- Platforms

- Platforms

- Platforms

- Platforms overview

- MetaTrader 4

- MetaTrader 5

- Education

- Education

- Education

- Education

- News & analysis

- Education Hub

- Economic calendar

- Help & support

- Help & support

- About

- Trading

- Trading

- Markets

- Markets

- Products overview

- Forex

- Commodities

- Metals

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- Platforms

- Platforms

- Platforms

- Platforms

- Platforms overview

- MetaTrader 4

- MetaTrader 5

- Education

- Education

- Education

- Education

- News & analysis

- Education Hub

- Economic calendar

- Help & support

- Help & support

- About

- Home

- News & Analysis

- Economic Updates

- Technical Analysis – Retracement for US Dollar

- Home

- News & Analysis

- Economic Updates

- Technical Analysis – Retracement for US Dollar

News & AnalysisNews & Analysis

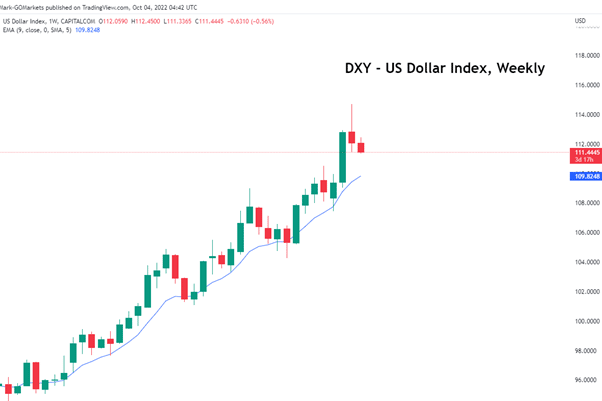

News & AnalysisNews & AnalysisStarting from the weekly timeframe, US Dollar Index has been consistently trending upwards for the last 16 months. Using the 9 exponential moving average (EMA) on the weekly time frame, we can see the US Dollar retracing back to the EMA, bouncing off of it, then continuing with the trend, as seen below:

Looking at the structure of the uptrend, last week’s candlestick closed bearish, perhaps signalling a retracement back to the 9 EMA on the weekly time frame.

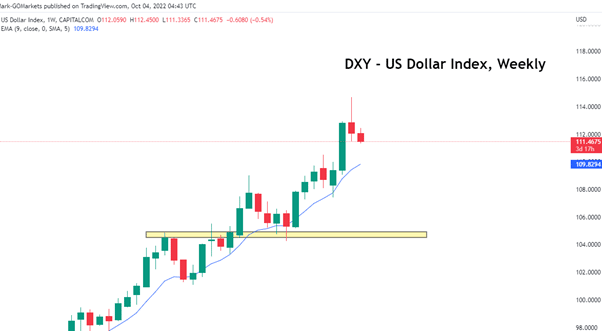

Breaking down the movements of the uptrend, generally the higher highs create a floor for the pullback. For example:

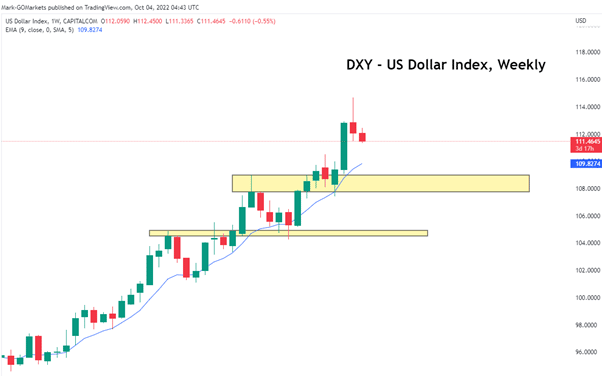

Taking this into consideration, if the US Dollar continues to retrace back to the 9 EMA, the last higher high can be used as a base level for the potential floor, or the end of the retracement:

The range is between $108.45 to $109 as the potential target for the US Dollar.

The information provided is of general nature only and does not take into account your personal objectives, financial situations or needs. Before acting on any information provided, you should consider whether the information is suitable for you and your personal circumstances and if necessary, seek appropriate professional advice. All opinions, conclusions, forecasts or recommendations are reasonably held at the time of compilation but are subject to change without notice. Past performance is not an indication of future performance. Go Markets Pty Ltd, ABN 85 081 864 039, AFSL 254963 is a CFD issuer, and trading carries significant risks and is not suitable for everyone. You do not own or have any interest in the rights to the underlying assets. You should consider the appropriateness by reviewing our TMD, FSG, PDS and other CFD legal documents to ensure you understand the risks before you invest in CFDs. These documents are available here.

#Economy #Economics #Finance #MarketsNext Article

GO Markets Announced as Kooyong Classic 2023 Partner

FRITZ, CILIC JOIN ALCARAZ AND DE MINAUR AT CARE A2+ KOOYONG CLASSIC GO MARKETS ANNOUNCED AS NEW PARTNER Top-ranked American Taylor Fritz and former US Open Champion Marin Cilic are the latest headline acts for the Care A2+ Kooyong Classic in 2023, with Australian-owned online brokerage, GO Markets also announced as a new tournament partner. Fr...

October 7, 2022Read More >Previous Article

US stocks dump and pump as strong data cools Fed-pivot hopes

US equities declined after a record two day winning streak, a volatile and choppy session ultimately ending with the S&P500 down 7.65 points (0.2%...

October 6, 2022Read More >Please share your location to continue.

Check our help guide for more info.

- Trading