- Trading

- Trading

- Markets

- Markets

- Products overview

- Forex

- Commodities

- Metals

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- Platforms

- Platforms

- Platforms

- Platforms

- Platforms overview

- MetaTrader 4

- MetaTrader 5

- Education

- Education

- Education

- Education

- News & analysis

- Education Hub

- Economic calendar

- Help & support

- Help & support

- About

- Trading

- Trading

- Markets

- Markets

- Products overview

- Forex

- Commodities

- Metals

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- Platforms

- Platforms

- Platforms

- Platforms

- Platforms overview

- MetaTrader 4

- MetaTrader 5

- Education

- Education

- Education

- Education

- News & analysis

- Education Hub

- Economic calendar

- Help & support

- Help & support

- About

- Home

- News & Analysis

- Economic Updates

- Telstra, TLS Dividend and Price Action

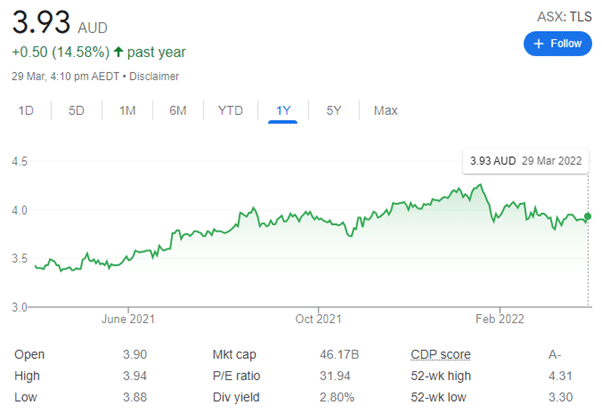

- Telstra’s share price is advancing after management provided details of the company’s restructure

- The plan will see shareholders swap their shares for new Telstra Group shares

- The restructure will make Telstra more transparent and make it easier to divest other assets

News & Analysis

Telstra Corporation Limited is an Australian telecommunications company which builds and operates telecommunications networks and markets voice, mobile, internet access, pay television and other products and services. It is a member of the S&P/ASX 20 and Australia’s largest telecommunications company by market share.

Key points

The Telstra Corporation Ltd (ASX: TLS) share price is making early gains after management outlined details of its restructure to unlock “additional value to shareholders”.

Under the plan, shareholders in the country’s largest telco will swap their shares in Telstra Corporation for Telstra Group Limited.

The 5% lift in Telstra’s fiscal 2022 first-half underlying EBITDA to AUD 3,495 million masked a stellar showing from mobile. The key division delivered a 25% jump in EBITDA to AUD 1,957 million, with margin surging by 860 basis points year on year to 41.8%. This is almost back to the halcyon days of 2016-17, despite first-time absorption of infrastructure cost allocations, which dampened margins by around 400 basis points.

Upcoming Dividend

Below is the upcoming trade, Ex-Dividend Date and Dividend Pay Date for Telstra.

ASX Code Company Name Ex Dividend

DateDividend Pay

DateAmount

¢Franking

%TLS Telstra 02 Mar 2022 01 Apr 2022 8.00 100.00 The impact of COVID-19 on Telstra demonstrates the relative resilience of its earnings and the strength of its balance sheet, although the impact on high-margin roaming revenue was notable. The cost-out program is back on track, with management in February 2021 increasing the T22 cost-out target by the end of fiscal 2022 to AUD 2.7 billion from AU.

The Telstra share price is currently up 0.9% to $3.905 in morning trade. For comparison, the S&P/ASX 200 Index (ASX: XJO) is up 0.76%.

You can trade Telstra, TLS in several ways; you can buy into the shares and build a portfolio here or you can trade the share as a CFD by opening an account here.

Sources: The Motley Fool, www.morningstar.com.au/Stocks/UpcomingDividends, Telstra.

The information provided is of general nature only and does not take into account your personal objectives, financial situations or needs. Before acting on any information provided, you should consider whether the information is suitable for you and your personal circumstances and if necessary, seek appropriate professional advice. All opinions, conclusions, forecasts or recommendations are reasonably held at the time of compilation but are subject to change without notice. Past performance is not an indication of future performance. Go Markets Pty Ltd, ABN 85 081 864 039, AFSL 254963 is a CFD issuer, and trading carries significant risks and is not suitable for everyone. You do not own or have any interest in the rights to the underlying assets. You should consider the appropriateness by reviewing our TMD, FSG, PDS and other CFD legal documents to ensure you understand the risks before you invest in CFDs. These documents are available here.

#Economy #Economics #Finance #MarketsNext Article

JB Hi-Fi may have just successfully weathered the pandemic

JB Hi-Fi is an Australian/New Zealand consumer electronics, Home Appliances and Technology retailer. The company operates 316 stores across Australia and New Zealand. JB Hi-Fi appears to be still going strong despite the general retail disruptions brought on by COVID-19. Based on the uncertain nature of the pandemic, they are having issues with ...

March 31, 2022Read More >Previous Article

Dividends and who’s paying them in April?

A dividend is a distribution of profits by a corporation to its shareholders. When a corporation earns a profit or surplus, it is able to pay a propor...

March 29, 2022Read More >Please share your location to continue.

Check our help guide for more info.

- Trading