- Trading

- Trading

- Markets

- Markets

- Products overview

- Forex

- Commodities

- Metals

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- Platforms

- Platforms

- Platforms

- Platforms

- Platforms overview

- MetaTrader 4

- MetaTrader 5

- Education

- Education

- Education

- Education

- News & analysis

- Education Hub

- Economic calendar

- Help & support

- Help & support

- About

- Trading

- Trading

- Markets

- Markets

- Products overview

- Forex

- Commodities

- Metals

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- Platforms

- Platforms

- Platforms

- Platforms

- Platforms overview

- MetaTrader 4

- MetaTrader 5

- Education

- Education

- Education

- Education

- News & analysis

- Education Hub

- Economic calendar

- Help & support

- Help & support

- About

- Home

- News & Analysis

- Economic Updates

- Tesla delivers in Q2

- 1 Month +5.00%

- 3 Month -23.89%

- Year-to-date -29.63%

- 1 Year +13.49%

- Credit Suisse $1000

- Barclays $380

- Morgan Stanley $1150

- Truist Securities $1000

- Wells Fargo $820

- JP Morgan $385

- Deutsche Bank $1125

- Mizuho $1150

News & AnalysisTesla Inc. (TSLA) announced its latest financial results after the market close on Wall Street on Wednesday.

World’s largest automaker reported solid results for Q2 of 2022.

Revenue reported at $16.934 billion vs. $16.539 billion expected.

Earnings per share also exceeded Wall Street expectations at $2.27 per share vs. $1.81 per share estimate.

Tesla produced over 258k vehicles in the second quarter and delivered over 254k vehicles, despite supply chain challenges and factory shutdowns.

June was the highest vehicle production month in company’s 19 year history.

”We continued to make significant progress across the business during the second quarter of 2022. Though we faced certain challenges, including limited production and shutdowns in Shanghai for the majority of the quarter, we achieved an operating margin among the highest in the industry of 14.6%, positive free cash flow of $621M and ended the quarter with the highest vehicle production month in our history.”

”New factories in Berlin-Brandenburg and Austin continued to ramp in Q2. Gigafactory Berlin-Brandenburg reached an important milestone of over 1,000 cars produced in a single week while achieving positive gross margin during the quarter. From our Austin factory, the first vehicles with Tesla-made 4680 cells and structural battery packs were delivered to our U.S. customers. We are continuing to invest in capacity expansion of our factories to maximize production.”

”The Energy business made meaningful progress in Q2 as well, achieving higher volumes with stronger unit economics. This resulted in an overall record gross profit. Customer interest in our storage products remains strong and well above our production rate.”

”With each of the Fremont and Shanghai factories achieving their highest-ever production months and new factory growth, we are focused on a record-breaking second half of 2022,” Tesla said in a statement to shareholders.

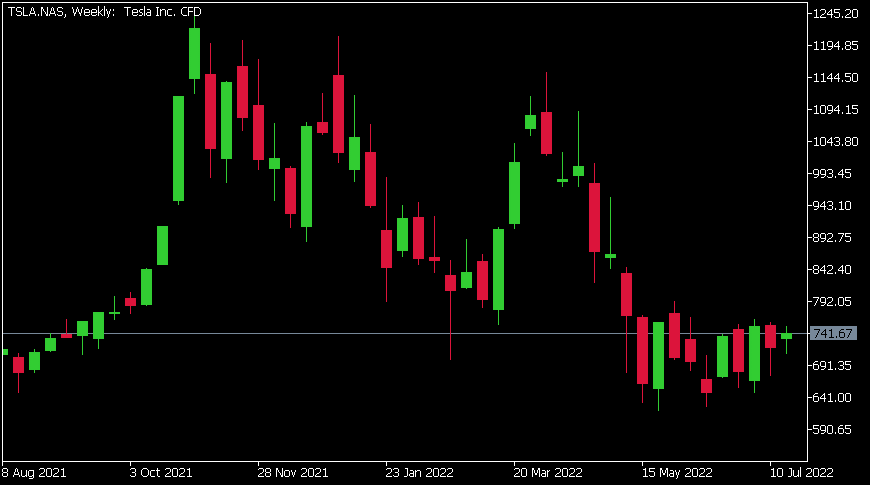

Tesla Inc. (TSLA) chart

Share price was little changed at the end of the trading day on Thursday, up by 0.80% at $741.67 per share.

Here is how the stock has performed in the past year:

Tesla price targets

Tesla Inc. is the 6th largest company in the world with a market cap of $772.06 billion.

You can trade Tesla Inc. (TSLA) and many other stocks from the NYSE, NASDAQ, HKEX and the ASX with GO Markets as a Share CFD.

Sources: Tesla Inc., TradingView, MetaTrader 5, Benzinga, CompaniesMarketCap

The information provided is of general nature only and does not take into account your personal objectives, financial situations or needs. Before acting on any information provided, you should consider whether the information is suitable for you and your personal circumstances and if necessary, seek appropriate professional advice. All opinions, conclusions, forecasts or recommendations are reasonably held at the time of compilation but are subject to change without notice. Past performance is not an indication of future performance. Go Markets Pty Ltd, ABN 85 081 864 039, AFSL 254963 is a CFD issuer, and trading carries significant risks and is not suitable for everyone. You do not own or have any interest in the rights to the underlying assets. You should consider the appropriateness by reviewing our TMD, FSG, PDS and other CFD legal documents to ensure you understand the risks before you invest in CFDs. These documents are available here.

#Economy #Economics #Finance #MarketsNext Article

Is the AUDUSD ready to reverse?

Recent History The USD has been on a tear in recent months as volatile market conditions have sent the currency rocketing. Inflationary pressures and recession fears have seen investors turn to the USD whilst at the same time taking off risk from the AUD. The AUD's drop has also been further is largely due to a decrease in the price of commodities...

July 21, 2022Read More >Previous Article

Short Term Break Out on the S&P500

The S&P 500 has been battered and bruised in one of the worst first half of the years in history. However, there are some signs that it may be tur...

July 21, 2022Read More >Please share your location to continue.

Check our help guide for more info.

- Trading