- Trading

- Trading

- Markets

- Markets

- Products overview

- Forex

- Commodities

- Metals

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- Platforms

- Platforms

- Platforms

- Platforms

- Platforms overview

- MetaTrader 4

- MetaTrader 5

- Education

- Education

- Education

- Education

- News & analysis

- Education Hub

- Economic calendar

- Help & support

- Help & support

- About

- Trading

- Trading

- Markets

- Markets

- Products overview

- Forex

- Commodities

- Metals

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- Platforms

- Platforms

- Platforms

- Platforms

- Platforms overview

- MetaTrader 4

- MetaTrader 5

- Education

- Education

- Education

- Education

- News & analysis

- Education Hub

- Economic calendar

- Help & support

- Help & support

- About

- Home

- News & Analysis

- Economic Updates

- The Agriculture Industry is running hot

News & AnalysisThe Agriculture sectors and companies that operate within it have seen a nice surge in recent months and have been booming in the wake of supply chain crunches stemming from the Russia and Ukraine conflict. The Agriculture sector includes companies that are involved in producing crops and maintaining and harvesting cattle and livestock. A dramatic drop in crops that would usually be planted by farmers in the country has occurred. In addition, Ukraine has been a strong source of supply for crops for North Africa. Reports are that up to a third of the usually planted crops will be disrupted due to the conflict.

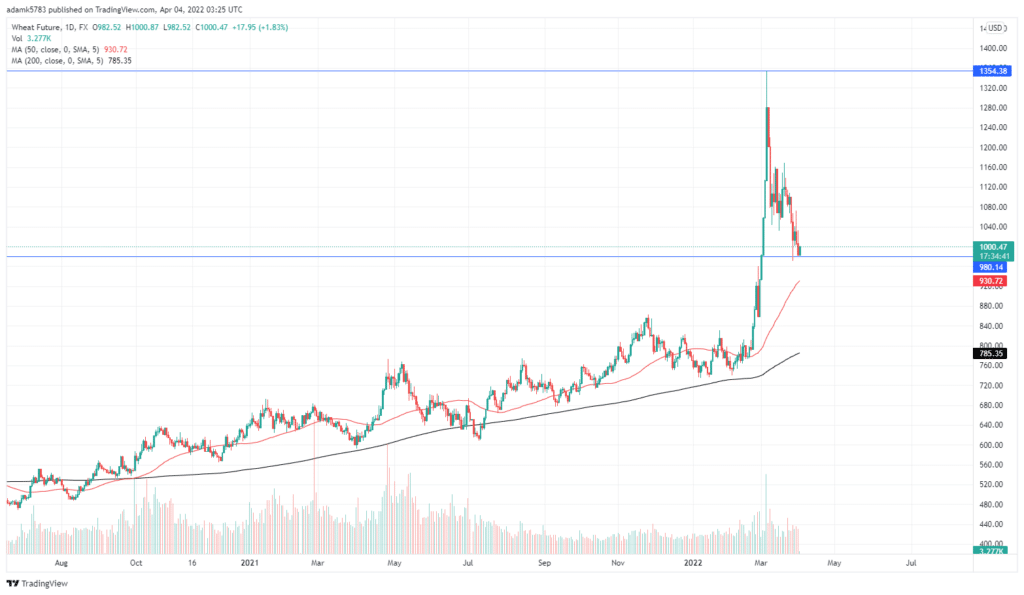

In response, there has been a great deal of pressure on the supply. The price of some of these crops skyrocketed. For instance, wheat went on a massive run because of the conflict. Russia and Ukraine are both major producers of wheat and the conflict put major stress on their ability to supply the market.

The price of wheat peaked at over $1350 a bushel during the height of the conflict although the price has now retraced quite significantly from those highs dropping almost 30%. However, the price is still up 15% from its initial move upward.

Australia’s role

Australia has a very large agricultural sector, and it is one of the largest industries on the ASX. Some of the well-known companies in the ASX top 200 that are in the sector are

ELD, GNC, IPL. NUF, SHV, A2M, and CGC.

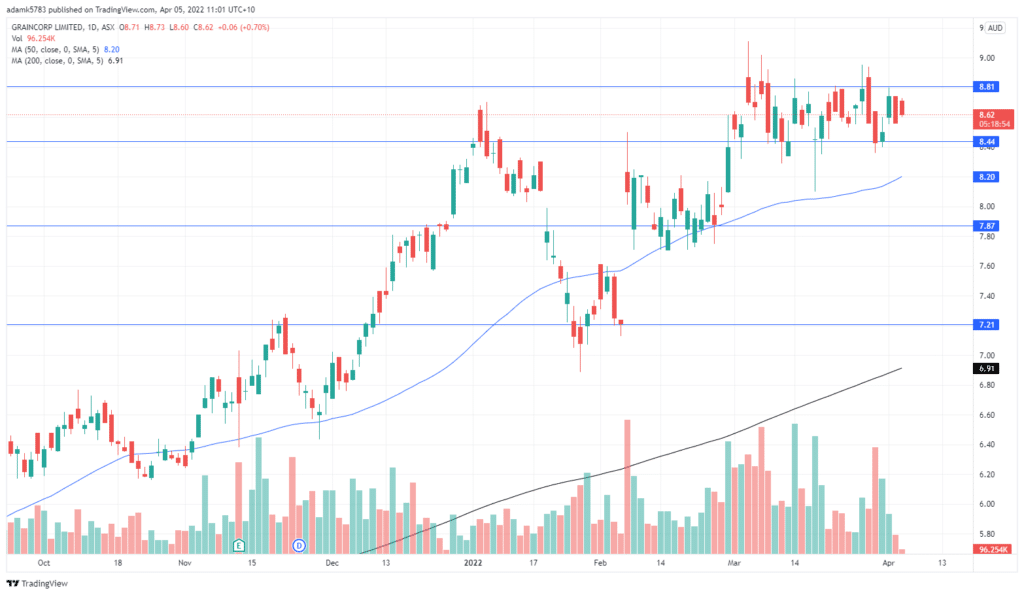

One of these companies, GrainCorp, (GNC) owns the largest grain storage and handling network on the East Coast of Australia. GNC has seen very steady growth in the previous 12 months. Nufarm, (NUF) is another big player in the space as it provides seeds and herbicides to more than 100 countries including many in Europe. The sector along with other harder commodities was able to provide the XJO with a lot of strength during the volatility that ensued from the conflict.

As seen below, the chart shows the price has been in a strong upward trend and has now reached a period of tight consolidation. Both the 50 Period and 200-period moving averages are in a steady and persistent upward trend. Importantly there is also significant space between the two averages. The 50 period MA has seen a slight uptick as it pushes higher. This emphasises that buyers currently hold the upper hand. A push above resistance may see a decently sized break out towards $10.00.

The agriculture sector and other soft commodities that follow alongside it may continue to provide trading opportunities as the conflict in Ukraine continues or as inflationary pressure continues to build.

The information provided is of general nature only and does not take into account your personal objectives, financial situations or needs. Before acting on any information provided, you should consider whether the information is suitable for you and your personal circumstances and if necessary, seek appropriate professional advice. All opinions, conclusions, forecasts or recommendations are reasonably held at the time of compilation but are subject to change without notice. Past performance is not an indication of future performance. Go Markets Pty Ltd, ABN 85 081 864 039, AFSL 254963 is a CFD issuer, and trading carries significant risks and is not suitable for everyone. You do not own or have any interest in the rights to the underlying assets. You should consider the appropriateness by reviewing our TMD, FSG, PDS and other CFD legal documents to ensure you understand the risks before you invest in CFDs. These documents are available here.

#Economy #Economics #Finance #MarketsNext Article

Earnings Season Explained & 2022 Performance thus far

ASX-listed companies must report their financial results to shareholders at least twice a year, within two months of the end of their balance sheet date. As most companies have balance sheet dates of 30 June, the main reporting season takes place in August when many companies release their full-year results. Half-year results generally are rel...

April 7, 2022Read More >Previous Article

Electric cars, space travel… and Twitter – Elon Musk becomes the largest shareholder

On 25th March, Elon Musk asked his 80.6 million followers on Twitter whether ''free speech is essential to a functioning democracy'' and if people ''b...

April 6, 2022Read More >Please share your location to continue.

Check our help guide for more info.

- Trading