- Trading

- Trading

- Markets

- Markets

- Products overview

- Forex

- Commodities

- Metals

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- Platforms

- Platforms

- Platforms

- Platforms

- Platforms overview

- MetaTrader 4

- MetaTrader 5

- Education

- Education

- Education

- Education

- News & analysis

- Education Hub

- Economic calendar

- Help & support

- Help & support

- About

- Trading

- Trading

- Markets

- Markets

- Products overview

- Forex

- Commodities

- Metals

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- Platforms

- Platforms

- Platforms

- Platforms

- Platforms overview

- MetaTrader 4

- MetaTrader 5

- Education

- Education

- Education

- Education

- News & analysis

- Education Hub

- Economic calendar

- Help & support

- Help & support

- About

- Home

- News & Analysis

- Economic Updates

- The “Aussie’s” outlook amid Diplomatic tensions with China

- Home

- News & Analysis

- Economic Updates

- The “Aussie’s” outlook amid Diplomatic tensions with China

News & AnalysisNews & Analysis

News & AnalysisNews & AnalysisThe Aussie dollar is on the rise again after the tumble taken after China decided to halt economic dialogues. Apart from becoming a commodity currency pair, Australia offers investors visibility into the health of China’s economy since China is Australia’s largest export client. If Australia’s exports to China are growing, it is fair to assume that China’s economic development is ramping up. A healthy Chinese economy bodes well for the rest of the world and Australia, potentially increasing the Australian dollar exchange rate as demand for Australian commodities increases.

The Australian dollar’s decline after Beijing’s announcement faded a rally in its major commodity exports and demonstrates how trade disputes have a more substantial impact on the currency’s movements. Iron ore, Australia’s largest export is on track to set a new high, although other commodities such as copper and oil also increased in value as indicators of global demand. However, the Aussie has risen to nearly 80 cents against the USD since the initial announcement. It could even be argued that it is poised to rise above it.

First of all, traditionally, a weaker Aussie dollar goes in tandem with a boosted economy, which increases competitiveness in the export markets. However, Australia is in a unique situation where its exports are witnessing unprecedented demand regardless of the Aussie rate. It is also worth remembering that China has an actual demand for Australian commodities such as iron ore, which needs fulfillment, notwithstanding any Chinese diplomatic bravado.

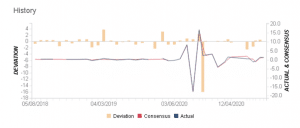

Rising internal inflation could put bullish pressure on the interest rate, even though the month-to-month retail sales came to a tad short of consensus. The close association between retail sales and inflation is one of the primary factors retail sales data will shift markets. High inflation figures often follow retail revenue figures that are high. Similar to how increasing inflation exerts upward pressure on interest rates, higher retail sales figures do the same. In the absence of confounding variables, traders regard higher prices as instantly bullish for a currency.

Australian Retail Sales Consensus vs Actual

Source: gomarkets.com

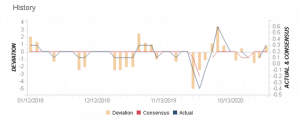

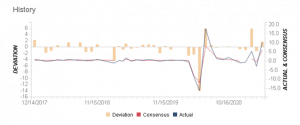

On the US side of the equation, we have several significant announcements this week, some of which would suggest inflationary pressure, such as consumer price indices and increasing consumer confidence. Nevertheless, mixed retail sales readings could deter a rate hike, lest the Fed wants to risk a gratuitous deflationary period.

US Consumer Price Index Ex Food & Energy – Month on month

Source: gomarkets.com

US Retail Sales – Month on month

Source: gomarkets.com

The information provided is of general nature only and does not take into account your personal objectives, financial situations or needs. Before acting on any information provided, you should consider whether the information is suitable for you and your personal circumstances and if necessary, seek appropriate professional advice. All opinions, conclusions, forecasts or recommendations are reasonably held at the time of compilation but are subject to change without notice. Past performance is not an indication of future performance. Go Markets Pty Ltd, ABN 85 081 864 039, AFSL 254963 is a CFD issuer, and trading carries significant risks and is not suitable for everyone. You do not own or have any interest in the rights to the underlying assets. You should consider the appropriateness by reviewing our TMD, FSG, PDS and other CFD legal documents to ensure you understand the risks before you invest in CFDs. These documents are available here.

#Economy #Economics #Finance #MarketsNext Article

Gold and equities rally as Cryptos crash and Dollar dips

After dipping early in the month as inflation fears resurfaced, markets bounced back to broadly rally, with US and Australian equity markets touching on all-time highs. Global Equities Major world indices rallied strongly in May. Gains were seen across the US, EU/UK, and Asia/pacific as central banks struck a mostly dovish tone and economic rec...

May 31, 2021Read More >Previous Article

Bond yields stabilise as US dollar dumps, equity markets hit all-time highs

April was a bumper month for world markets as major equity indexes across all regions rallied strongly. US markets smashed through all-time highs on s...

April 30, 2021Read More >Please share your location to continue.

Check our help guide for more info.

- Trading