- Trading

- Trading

- Markets

- Markets

- Products overview

- Forex

- Commodities

- Metals

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- Platforms

- Platforms

- Platforms

- Platforms

- Platforms overview

- MetaTrader 4

- MetaTrader 5

- Education

- Education

- Education

- Education

- News & analysis

- Education Hub

- Economic calendar

- Help & support

- Help & support

- About

- Trading

- Trading

- Markets

- Markets

- Products overview

- Forex

- Commodities

- Metals

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- Platforms

- Platforms

- Platforms

- Platforms

- Platforms overview

- MetaTrader 4

- MetaTrader 5

- Education

- Education

- Education

- Education

- News & analysis

- Education Hub

- Economic calendar

- Help & support

- Help & support

- About

- Home

- News & Analysis

- Economic Updates

- The ‘R’ Word

News & AnalysisIn recent weeks fears of a recession have gripped the market. With record high inflation levels and growth slowing down, is the perfect storm about to hit or will the markets be spared? Recessions are when there is negative growth for two consecutive quarters across the economy. Recession has often hit at times with high global uncertainty including, Covid -19 and after WW2.

A Difficult Choice

At the same time the Russian and Ukraine war broke out and the world was recovering from Covid-19 inflation was growing at a record pace. The potential for out-of-control inflation caused central banks to have to choose between slowing down inflation and allowing for the risk of a recession or allowing for inflation to grow at an alarming rate. At this stage most of the central banks have chosen the former as the lesser of the two evils.

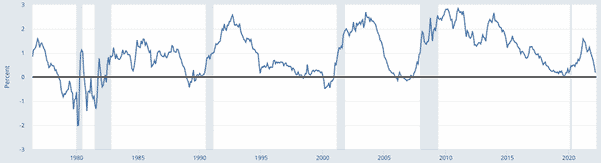

Flattening Yield Curve/Inverted yield curve

The yield curve of bonds with similar risk can be helpful to indicate the possibility of an incoming recession. As a general rule, yield curves slope upward reflecting the fact that holders of longer term debt have taken on more risk. There are really two different measures that can be used. The common measure being used at the moment is the difference between the 2-year and the 10 year bond yields. This may indicate a recession is coming. The view behind this is that in the longer term future, central banks will have to reduce interest rates to stimulate the economy.

When Jerome Powell was asked about the potential for an inverted yield curve his response was “We’re not worried about that right now. We’re worried about bringing inflation down to 2%.

As we can see the difference between the yields is reducing to the point of zero and almost inverting.

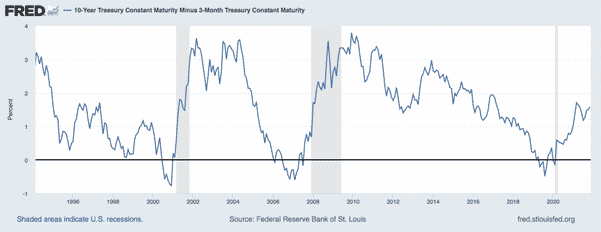

However another approach uses the 90 day treasury bills and compares the yield to the 10 year bond.

This graph shows that the market has not seen the difference between these bonds invert or look close doing to do so. According to one analyst, the overwhelming federal research shows a clearer link between the 90 day treasury bills and 10 year bonds as predicting recessions.

How a recession would affect Australia?

Australia is a commodity rich economy. A slowdown in growth essentially mean less money will be spent on infrastructure growth which is largely what mining companies need to be profitable. With many of the largest companies on the ASX such as BHP and Rio Tinto being mining ad commodity based, a reduction in prices for commodities would be a challenge. As indicated in recent days the price of Oil, Gold, Gas, and other resources have fallen hard. Similarly, with Covid-19 still proving to be an issue especially in China any expectation of a lockdown may exaggerate the sell off. A recession in the USA does not guarantee that one would follow in Australia. For one, the Australian economy is not as reliant on growth or technology based companies. It is much more settled and less volatile.

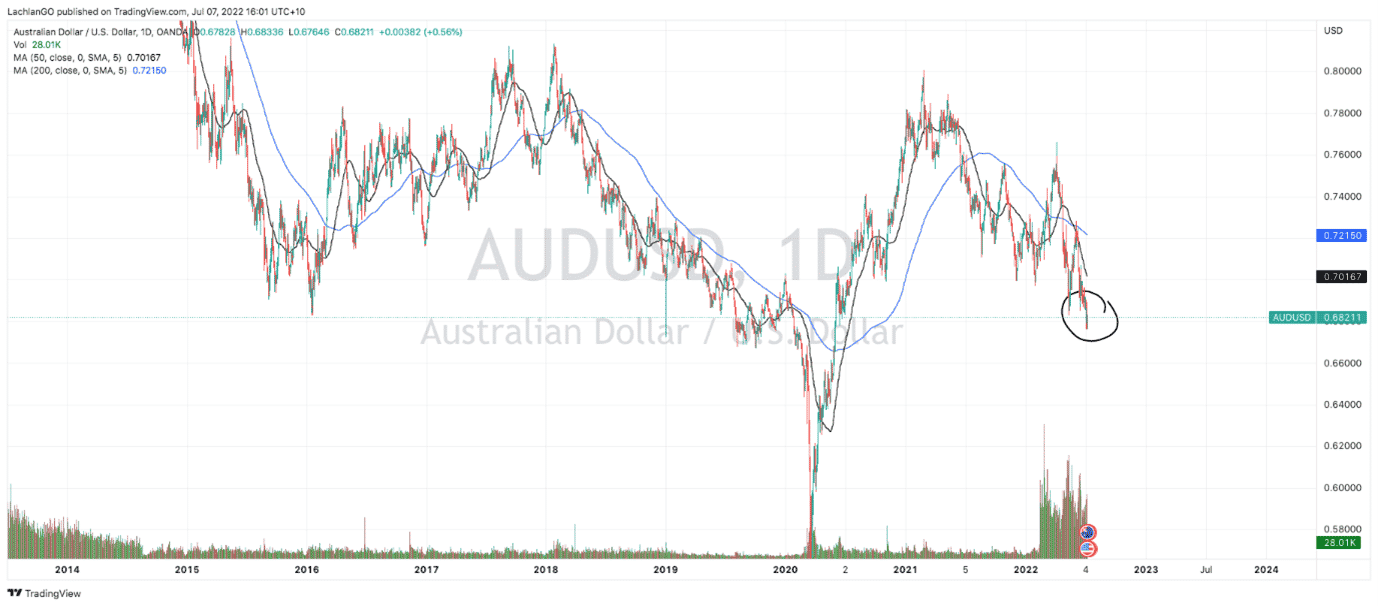

Recession fears may also reduce the strength of the Australian Dollar and increase the value of the US dollar. In fact, in recent days/weeks the AUD has fallen to 2 year lows against the USD. From a practical sense this means if Australian companies are operating in other countries particularly ones with stronger currencies becomes more costly. On the other hands the price of their exports becomes more competitive on the global market.

The next few weeks and days will provide a clearer picture and where the market is heading, however it remains volatile and unpredictable.

The information provided is of general nature only and does not take into account your personal objectives, financial situations or needs. Before acting on any information provided, you should consider whether the information is suitable for you and your personal circumstances and if necessary, seek appropriate professional advice. All opinions, conclusions, forecasts or recommendations are reasonably held at the time of compilation but are subject to change without notice. Past performance is not an indication of future performance. Go Markets Pty Ltd, ABN 85 081 864 039, AFSL 254963 is a CFD issuer, and trading carries significant risks and is not suitable for everyone. You do not own or have any interest in the rights to the underlying assets. You should consider the appropriateness by reviewing our TMD, FSG, PDS and other CFD legal documents to ensure you understand the risks before you invest in CFDs. These documents are available here.

#Economy #Economics #Finance #MarketsNext Article

Market Update – The week ahead

Equity Indices saw some positive price action over the last week. The US continued to rally, albeit with a sense of unsurety. The S&P 500 finished Friday in a flat session as it saw close to a 4% rise for the week. The NASDAQ and the Dow Jones both followed similar patterns as the market determines its next course of action. From a technical pe...

July 11, 2022Read More >Previous Article

How to ‘Trade the News’

‘Trading the news’, is a phrase that is often said, but to new traders it can be a confusing statement without much context. What does it mean to ...

July 6, 2022Read More >Please share your location to continue.

Check our help guide for more info.

- Trading