- Trading

- Trading

- Markets

- Markets

- Products overview

- Forex

- Commodities

- Metals

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- Platforms

- Platforms

- Platforms

- Platforms

- Platforms overview

- MetaTrader 4

- MetaTrader 5

- Education

- Education

- Education

- Education

- News & analysis

- Education Hub

- Economic calendar

- Help & support

- Help & support

- About

- Trading

- Trading

- Markets

- Markets

- Products overview

- Forex

- Commodities

- Metals

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- Platforms

- Platforms

- Platforms

- Platforms

- Platforms overview

- MetaTrader 4

- MetaTrader 5

- Education

- Education

- Education

- Education

- News & analysis

- Education Hub

- Economic calendar

- Help & support

- Help & support

- About

- Home

- News & Analysis

- Economic Updates

- The US equities market at a tipping point after CPI data

- Home

- News & Analysis

- Economic Updates

- The US equities market at a tipping point after CPI data

News & AnalysisNews & Analysis

News & AnalysisNews & AnalysisThe US markets are at a tipping point after CPI figures point to slowing growth and a potential pivot from the Federal reserve. The US released its updated CPI figures overnight as the data pointed to lower inflation and slowing growth. The Federal reserve may be buoyed by this data as it highlights that its interest rate hikes have been working to slow the exceptionally high inflation hitting the country. The question is whether the Fed be satisfied with this level of slowed growth or will they wait for lower growth figures before cutting the rates.

The CPI figures came in rather as expected with m/m CPI being -0.1%, y/y at 6.5% and Core CPI m/m at 0.3%. Again, these figures point to a slowing of inflation and perhaps that recessionary pressures may be starting to take over. It is so far expected that the Federal reserve will raise the official rate by 25 bps at its next meeting in February. The statement and commentary on the decision will likely provide more insight as to how it views the market going forward and the likelihood of sustained or higher interest rate rises.

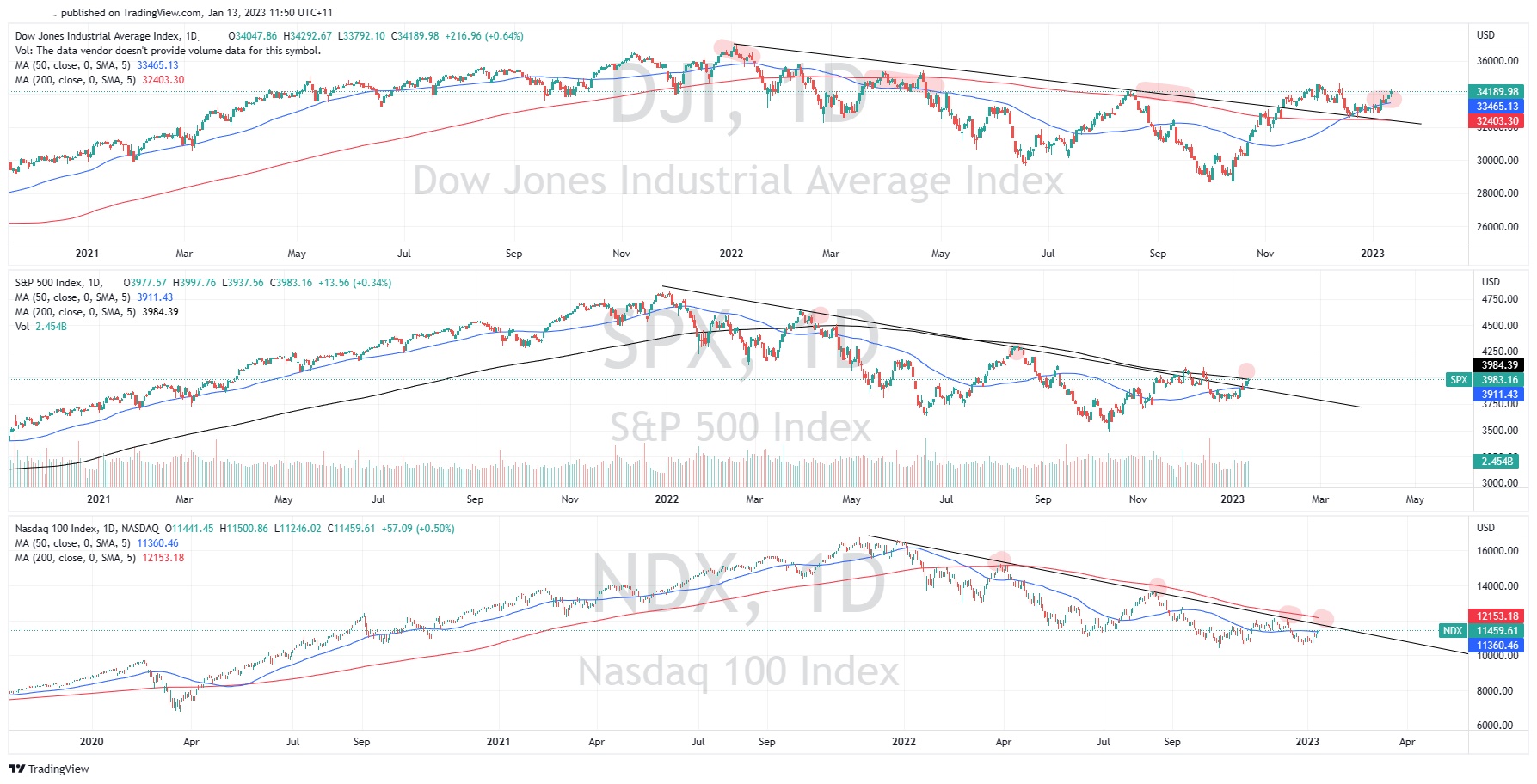

Looking at the US Indices, they are all still in a down trend, with the Dow Jones being the strongest of the three. The tipping point for these indices is whether they fall back down as has been the price action over the last 12 months or if the price will finally begin its reversal. As stated above much will depend on the overall macroeconomic conditions. If the US economy can have a soft landing and gain momentum from China reopening the equities market may begin to reverse. Adding to this is that a weakness in the USD has aided risk on assets such as the Nasdaq and equities more generally. It has also supported the increased price of many commodities which has stabilised the Dow Jones Index. The downside is that if the world does begin to enter a recession and growth continues to stagnate confidence in the market may falter. Ultimately for a reversal to be confirmed significant break out above the 200- and 50-day moving averages would be desirable.

The information provided is of general nature only and does not take into account your personal objectives, financial situations or needs. Before acting on any information provided, you should consider whether the information is suitable for you and your personal circumstances and if necessary, seek appropriate professional advice. All opinions, conclusions, forecasts or recommendations are reasonably held at the time of compilation but are subject to change without notice. Past performance is not an indication of future performance. Go Markets Pty Ltd, ABN 85 081 864 039, AFSL 254963 is a CFD issuer, and trading carries significant risks and is not suitable for everyone. You do not own or have any interest in the rights to the underlying assets. You should consider the appropriateness by reviewing our TMD, FSG, PDS and other CFD legal documents to ensure you understand the risks before you invest in CFDs. These documents are available here.

#Economy #Economics #Finance #MarketsNext Article

Equities remain strong after modest CPI figures

Equities remain strong after modest CPI figures The global equities market remains solid after modest CPI and inflation figures were recorded for the most recent month in the USA. The Dow Jones closed the week 2.00% higher, the S&P500 2.67% and the Nasdaq 4.55% as risk sentiment improved. The country recorded negative m/m growth o...

January 16, 2023Read More >Previous Article

TSMC posts strong Q4 results – the stock is rising

TSMC posts strong Q4 results – the stock is rising Taiwan Semiconductor Manufacturing Company Limited (NYSE: TSM) reported Q4 financial results b...

January 13, 2023Read More >Please share your location to continue.

Check our help guide for more info.

- Trading