- Trading

- Trading

- Markets

- Markets

- Products overview

- Forex

- Commodities

- Metals

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- Platforms

- Platforms

- Platforms

- Platforms

- Platforms overview

- MetaTrader 4

- MetaTrader 5

- Education

- Education

- Education

- Education

- News & analysis

- Education Hub

- Economic calendar

- Help & support

- Help & support

- About

- Trading

- Trading

- Markets

- Markets

- Products overview

- Forex

- Commodities

- Metals

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- Platforms

- Platforms

- Platforms

- Platforms

- Platforms overview

- MetaTrader 4

- MetaTrader 5

- Education

- Education

- Education

- Education

- News & analysis

- Education Hub

- Economic calendar

- Help & support

- Help & support

- About

- Home

- News & Analysis

- Economic Updates

- The week ahead – Big US data in the spotlight as the markets still dance to the Feds tune.

- Home

- News & Analysis

- Economic Updates

- The week ahead – Big US data in the spotlight as the markets still dance to the Feds tune.

News & AnalysisNews & Analysis

News & AnalysisNews & AnalysisThe week ahead – Big US data in the spotlight as the markets still dance to the Feds tune.

10 October 2022 By Lachlan MeakinThe first week of Q4 proved to be a volatile one in global markets. US equities got off the best start to a quarter since 2009 (Best start of Q4 since 2002) on Fed pivot hopes, only to decline sharply in the second half of the week as those hopes faded on the back of a blockbuster Non-Farm employment report before the market opened on Friday.

NFP figures came in at 263k job created, beating the expectation of 248k, but the big surprise was the jobless rate sharply dropping to 3.5%, when it was forecast to remain steady at 3.7%. This saw the Fed pivot odds evaporate and stocks dump while the USD pumped as bond markets repriced to reflect the expectation of a more hawkish Federal reserve.

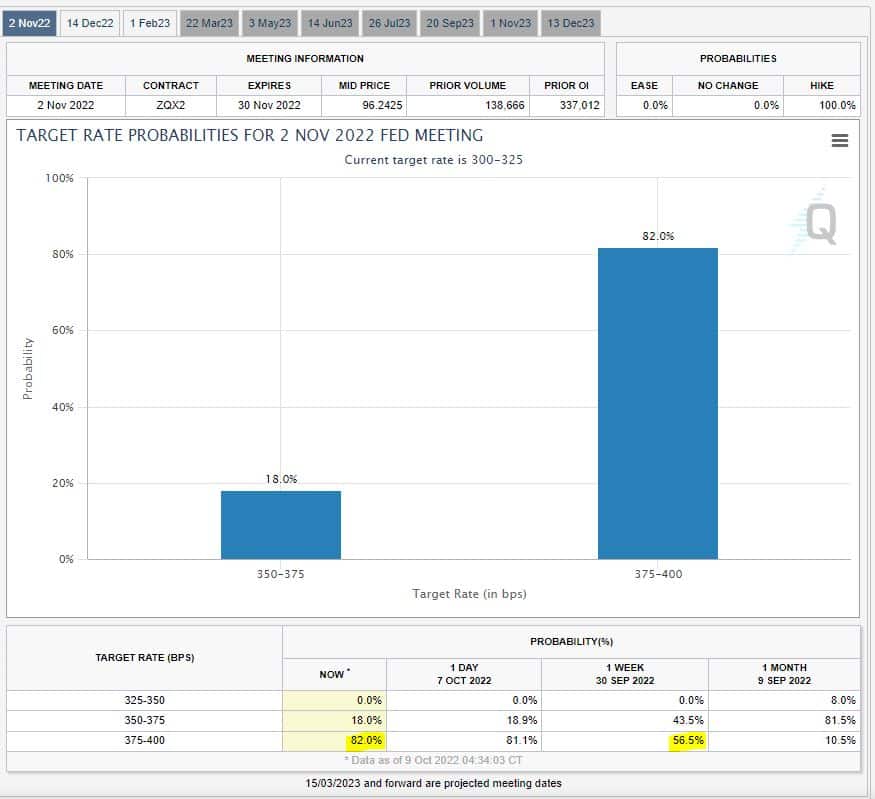

The probability of a 75bp hike at the Feds November meeting jumped to 82% based on Fed funds futures, a sharp increase from the start of the week where a 56.5% probability was priced in.

The week ahead is set to be more of the same as risk assets are looking at another volatile week with some major US figures that are bound to move the needle on the Fed Pivot/No pivot gauge.

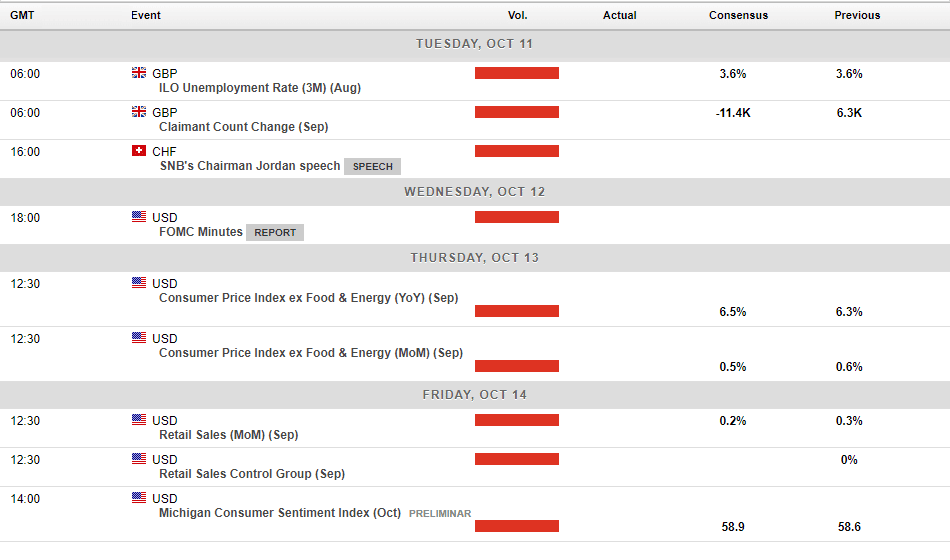

The main US data report to watch this week will be consumer price inflation (CPI) figure released on Thursday, whilst the headline figure is expected to moderate, (thanks mostly to lowered Gasoline prices) the core inflation component is proving far stickier and set to continue rising at pace should cement expectations for a fourth consecutive 75bp interest rate increase from the Federal Reserve on 2 November.

Retail sales figures, the September FOMC meeting minutes, PPI and Consumer confidence reports round out the week. All of these figures could be seen as swaying market expectations of a data dependant Fed’s future actions and we should see some volatility in US and Global equity markets on these.

Coming off an extremely volatile period for the Pound, some important UK figures will also be watched as the Bank of England weighs up a monster 100bp hike at their next meeting. Employment figures released on Tuesday, followed by Governor Bailey speaking and GDP figures being released on Wednesday have the potential to see some volatility in GBP and to a lesser extent the FTSE 100.

Markets ,and the board members themselves, seem to be split between a 100 or 75bp move in November. A lot will depend on the Pounds price action and high impact news such as we’re seeing this week, as to the BoE’s direction.

The information provided is of general nature only and does not take into account your personal objectives, financial situations or needs. Before acting on any information provided, you should consider whether the information is suitable for you and your personal circumstances and if necessary, seek appropriate professional advice. All opinions, conclusions, forecasts or recommendations are reasonably held at the time of compilation but are subject to change without notice. Past performance is not an indication of future performance. Go Markets Pty Ltd, ABN 85 081 864 039, AFSL 254963 is a CFD issuer, and trading carries significant risks and is not suitable for everyone. You do not own or have any interest in the rights to the underlying assets. You should consider the appropriateness by reviewing our TMD, FSG, PDS and other CFD legal documents to ensure you understand the risks before you invest in CFDs. These documents are available here.

#Economy #Economics #Finance #MarketsNext Article

How to practically implement Long-Short strategies into your trading

Long and Short trading and investing strategies are often seen as advanced strategies only used for large hedge funds and large banks. However, retail traders can learn valuable lessons and ideas from this type of trading strategy that is usually reserved for institutional players. What is a long-short strategy? A long-short strategy as...

October 10, 2022Read More >Previous Article

Gold Price rises to monthly High, but will it last?

Gold has finally seen some respite in its price after it fell to 12-month lows. With slowing growth forecasts being a key reason as to the drop in pri...

October 7, 2022Read More >Please share your location to continue.

Check our help guide for more info.

- Trading