- Trading

- Trading

- Markets

- Markets

- Products overview

- Forex

- Commodities

- Metals

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- Platforms

- Platforms

- Platforms

- Platforms

- Platforms overview

- MetaTrader 4

- MetaTrader 5

- Education

- Education

- Education

- Education

- News & analysis

- Education Hub

- Economic calendar

- Help & support

- Help & support

- About

- Trading

- Trading

- Markets

- Markets

- Products overview

- Forex

- Commodities

- Metals

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- Platforms

- Platforms

- Platforms

- Platforms

- Platforms overview

- MetaTrader 4

- MetaTrader 5

- Education

- Education

- Education

- Education

- News & analysis

- Education Hub

- Economic calendar

- Help & support

- Help & support

- About

- Home

- News & Analysis

- Economic Updates

- The Week Ahead – Central banks in focus, can the ECB or BOJ surprise?

- Home

- News & Analysis

- Economic Updates

- The Week Ahead – Central banks in focus, can the ECB or BOJ surprise?

News & AnalysisNews & Analysis

News & AnalysisNews & AnalysisThe Week Ahead – Central banks in focus, can the ECB or BOJ surprise?

18 July 2022 By Lachlan MeakinFriday’s session saw a big rally in US equities as rate markets pared back some the pricing in of a 100bp hike at the next FOMC meeting after the red hot CPI figures on Wednesday.

Fed hawks Waller and Bullard both hinted they favour a 75bp hike, and with the Fed blackout meeting now in effect until the meeting on July 27, this looks like a done deal, taking some of the uncertainty out of play, driving equities to erase the loss of the previous four sessions.

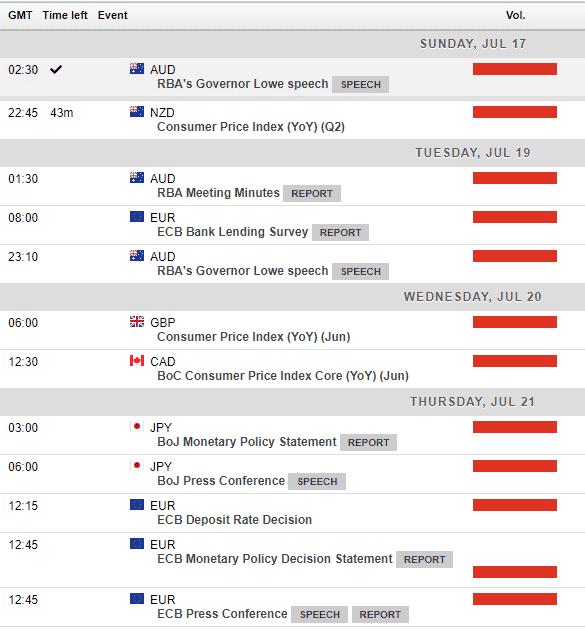

The week ahead will again be greatly influenced by central bank releases, the obvious big one being the ECB on Thursday where the first hike in 11 years is expected. The ECB has been slow to the party with the snail like pace of their normalisation process as compared to their central bank peers in other developed nations has seen the Euro drop to its lowest level against the USD in over 20 years.

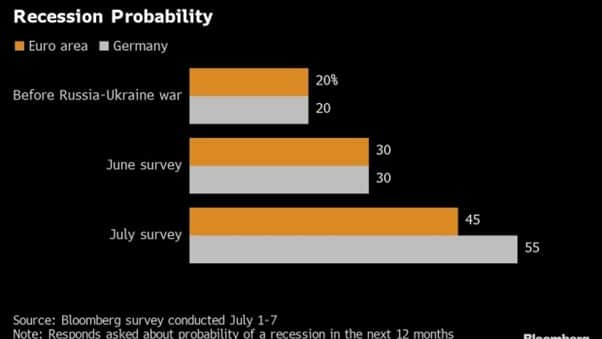

Don’t forget to expect the unexpected though, a hike of 25bp has been telegraphed with another 25bps to come in September, but with fast deteriorating economic conditions seeing recession fears grow, the hawks may push for a faster move higher before things get worse, with markets pricing in a small chance this week’s hike could be sized up to 50bp.

Source: Bloomberg

The Reserve Bank of Australia release the minutes from the last policy meeting, these minutes have taken on renewed importance in recent times as traders try to decipher any hints as to the next move by the RBA. The key points to look for after the RBA surprised the market with a 50bp hike will be, is 50bp the new 25 going forward? Or even larger increases possible? The bond markets are currently pricing in a close to 100% chance of a 50bp hike at the next meeting, they even briefly started to price in a bigger cut just after the blockbuster employment report last week, so these minutes will be closely watched.

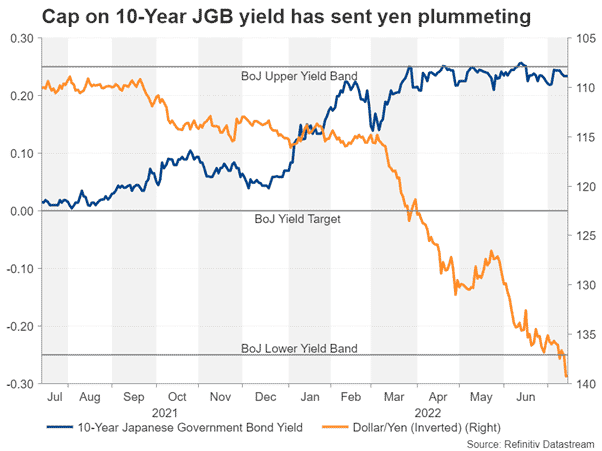

The Bank of Japan meet on Thursday where a backdrop of a recent pick-up in Covid cases and a weaker than expected consumption recovery has most analysts seeing the BOJ stand pat and continue the policies that have seen the JPY battered recently. Though with the weak Yen being front and centre and bond vigilantes testing the commitment of their yield curve control (0.25% upper band) it’s not impossible me may see a surprise out of the BOJ.

With cost of living being the hot topic recently, it will also be worth keeping an eye on the plethora of inflation figures out this week as well, with the UK, Canada and NZ releasing CPI figures that could see some volatility in their respective currencies.

The information provided is of general nature only and does not take into account your personal objectives, financial situations or needs. Before acting on any information provided, you should consider whether the information is suitable for you and your personal circumstances and if necessary, seek appropriate professional advice. All opinions, conclusions, forecasts or recommendations are reasonably held at the time of compilation but are subject to change without notice. Past performance is not an indication of future performance. Go Markets Pty Ltd, ABN 85 081 864 039, AFSL 254963 is a CFD issuer, and trading carries significant risks and is not suitable for everyone. You do not own or have any interest in the rights to the underlying assets. You should consider the appropriateness by reviewing our TMD, FSG, PDS and other CFD legal documents to ensure you understand the risks before you invest in CFDs. These documents are available here.

#Economy #Economics #Finance #MarketsNext Article

Wells Fargo Q2 results are here

Wells Fargo & Co. (WFC) announced its Q2 financial results before the opening bell on Wall Street on Friday. The US financial services company missed analyst expectations for the quarter. Revenue was reported at $17.028 billion for Q2 vs. $17.479 billion expected. Earnings per share at $0.74 per share vs. $0.80 per share estimated. ''W...

July 18, 2022Read More >Previous Article

ANZ set to acquire Suncorp in mega acquisition

Big 4 bank ANZ is set to takeover Suncorp in a massive buyout. The agreement stipulates that the buyout is only for the banking side of the business w...

July 18, 2022Read More >Please share your location to continue.

Check our help guide for more info.

- Trading