- Trading

- Trading

- Markets

- Markets

- Products overview

- Forex

- Commodities

- Metals

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- Platforms

- Platforms

- Platforms

- Platforms

- Platforms overview

- MetaTrader 4

- MetaTrader 5

- Education

- Education

- Education

- Education

- News & analysis

- Education Hub

- Economic calendar

- Help & support

- Help & support

- About

- Trading

- Trading

- Markets

- Markets

- Products overview

- Forex

- Commodities

- Metals

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- Platforms

- Platforms

- Platforms

- Platforms

- Platforms overview

- MetaTrader 4

- MetaTrader 5

- Education

- Education

- Education

- Education

- News & analysis

- Education Hub

- Economic calendar

- Help & support

- Help & support

- About

- Home

- News & Analysis

- Economic Updates

- The Week Ahead – Central banks, inflation and corporate earnings set to take centre stage.

- Home

- News & Analysis

- Economic Updates

- The Week Ahead – Central banks, inflation and corporate earnings set to take centre stage.

News & AnalysisNews & Analysis

News & AnalysisNews & AnalysisThe Week Ahead – Central banks, inflation and corporate earnings set to take centre stage.

24 October 2022 By Lachlan MeakinGlobal markets are in for a busy last week of October, with inflation, growth and Central bank rate decisions set to be released from multiple countries.

We’re also in the midst of US reporting season, last week solid earning helped propel US Indices to a very big up week, the Dow Jones rising over 5%. With all this going on. another volatile week looks to be ahead with large swings almost a given.

USA, Inflation and GDP figures headline

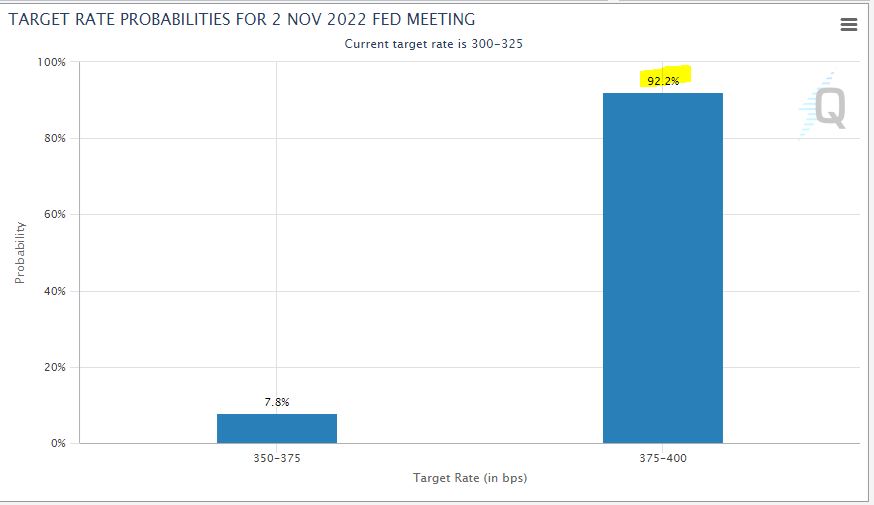

There are some important numbers out of the US this week, as important as they are, they are unlikely to change the market’s forecast for a Fed 75bp interest rate hike on 2 November. With Fed funds futures pricing in a 92% chance of a 75bp hike, it would take some huge surprises to wind back those odds.

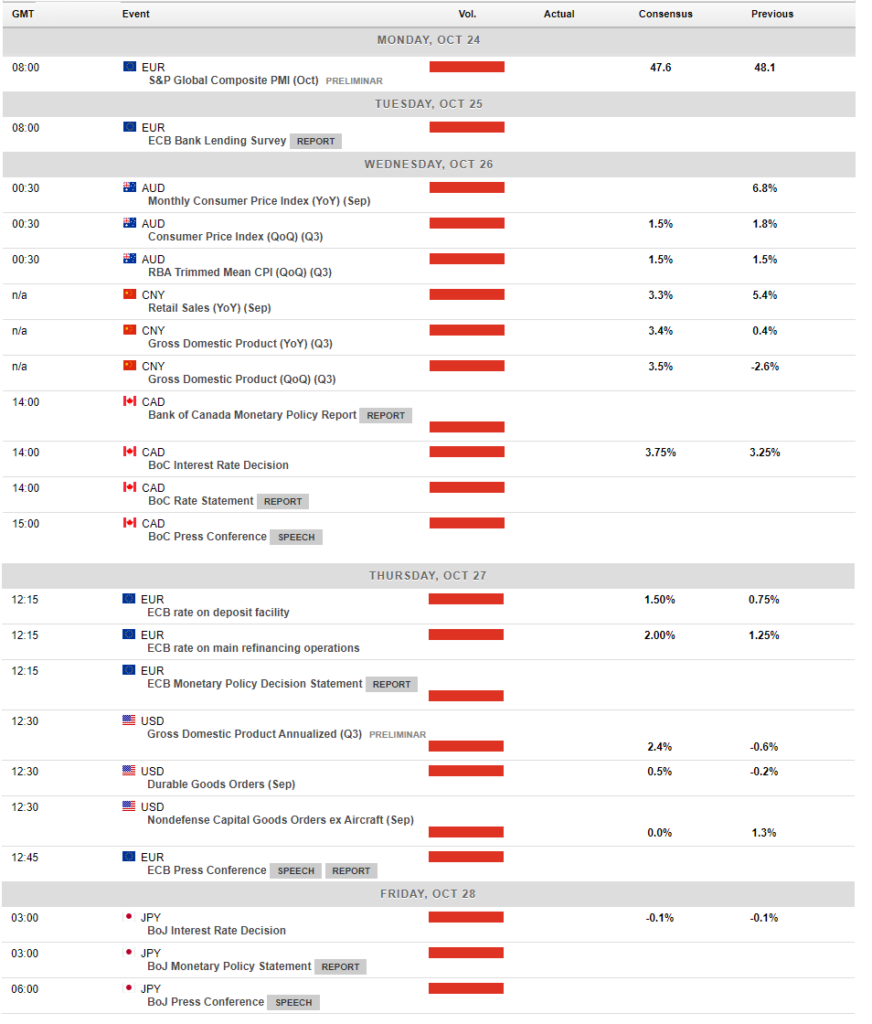

Thursdays 3Q GDP is likely to show positive growth after the “technical” recession experienced in the first half of the year. While on Friday the Fed’s favoured measure of inflation, the Core PCE Price Index. This is expected to broadly match the recent core CPI figure which came in hot. With the economy growing and inflation heading in the wrong direction it is looking likely the Fed will stay the course of aggressive rate hiking for now.

Eurozone, another 75bp hike looks like a done deal.

Amid ongoing inflation concerns, it looks like the hawks are in ascendance at the ECB, markets are pricing in another 75bp hike from Thursdays ECB Monetary policy meeting. With a 75bp hike seemingly a given, traders will be eyeing more open issues such as clues to quantitative tightening and the terminal interest rate coming out of the accompanying statement. The reaction of the Euro will likely depend on these clues, more so than the actual rate hike.

Canada, could the BoC surprise to the upside?

Thursdays Bank of Canada rate statement is one that could actually surprise the market, currently the market is expecting a 50bp hike, but with strong Job creation, consumer activity holding up and the recent upside surprise in inflation, a 75bp hike is definitely a possibility.

Australia, Q3 inflation figures

On Wednesday Australia is set to release Q3 CPI figures where another elevated reading is expected. This figure will take on extra importance as it is hoped to show a moderation in inflation from Q2, which would fit the “inflation has peaked” narrative. I suspect me may see an upside surprise to this figure in line with overseas peers who have yet to see this “peak”. An elevated reading would put the pressure back on the RBA and their recent slower pace of tightening. Rate markets are currently pricing in a 97% chance of a 25bp hike on Melbourne Cup day, a blowout CPI could see a repricing towards a 50bp hike and some volatility in AUD.

Chart to watch

In FX markets, the pair to watch this week will be the USDJPY. With Japanese authorities intervening to strengthen the Yen at seemingly regular intervals, some good trading opportunities have presented themselves, either going with the Bank of Japan, or fading the spikes as they retrace.

Economic Calendar

Along with the scheduled economic release below we have continued corporate earnings out of the US. With tech Microsoft (MSFT), Alphabet (GOOGL), Meta Platforms (FB), Apple (AAPL), and Amazon (AMZN) all set to report this week.

The information provided is of general nature only and does not take into account your personal objectives, financial situations or needs. Before acting on any information provided, you should consider whether the information is suitable for you and your personal circumstances and if necessary, seek appropriate professional advice. All opinions, conclusions, forecasts or recommendations are reasonably held at the time of compilation but are subject to change without notice. Past performance is not an indication of future performance. Go Markets Pty Ltd, ABN 85 081 864 039, AFSL 254963 is a CFD issuer, and trading carries significant risks and is not suitable for everyone. You do not own or have any interest in the rights to the underlying assets. You should consider the appropriateness by reviewing our TMD, FSG, PDS and other CFD legal documents to ensure you understand the risks before you invest in CFDs. These documents are available here.

#Economy #Economics #Finance #MarketsNext Article

US stocks rip higher again, China falters and Yen-tervention fails

Another day, another push higher in US equities as the market mood remains buoyant during what has so far been a good earnings season, with much more to come. Services and manufacturing PMI figures out of the UK, EU and US all came in weaker than expected and well in contraction territory, in the equity market theme is “Bad news is good news” (...

October 25, 2022Read More >Previous Article

China’s slow growth a worry for Australia?

China, Australia’s savior during the 2009 Global Financial Crisis may not provide the same security in what may be an impending recession. This does...

October 21, 2022Read More >Please share your location to continue.

Check our help guide for more info.

- Trading