- Trading

- Trading

- Markets

- Markets

- Products overview

- Forex

- Commodities

- Metals

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- Platforms

- Platforms

- Platforms

- Platforms

- Platforms overview

- MetaTrader 4

- MetaTrader 5

- Education

- Education

- Education

- Education

- News & analysis

- Education Hub

- Economic calendar

- Help & support

- Help & support

- About

- Trading

- Trading

- Markets

- Markets

- Products overview

- Forex

- Commodities

- Metals

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- Platforms

- Platforms

- Platforms

- Platforms

- Platforms overview

- MetaTrader 4

- MetaTrader 5

- Education

- Education

- Education

- Education

- News & analysis

- Education Hub

- Economic calendar

- Help & support

- Help & support

- About

- Home

- News & Analysis

- Economic Updates

- The week ahead – Central banks, NFP star in a busy calendar, will bad news be good news?

- Home

- News & Analysis

- Economic Updates

- The week ahead – Central banks, NFP star in a busy calendar, will bad news be good news?

News & AnalysisNews & Analysis

News & AnalysisNews & AnalysisThe week ahead – Central banks, NFP star in a busy calendar, will bad news be good news?

1 August 2022 By Lachlan MeakinMarket sentiment continued to improve in the past week with equity markets rallying as traders pared back on bets on the extent of the Federal Reserves rate hike path. Corporate earnings also buoyed the markets with the likes of Amazon and Apple having bumper gains on Friday after their results were released.

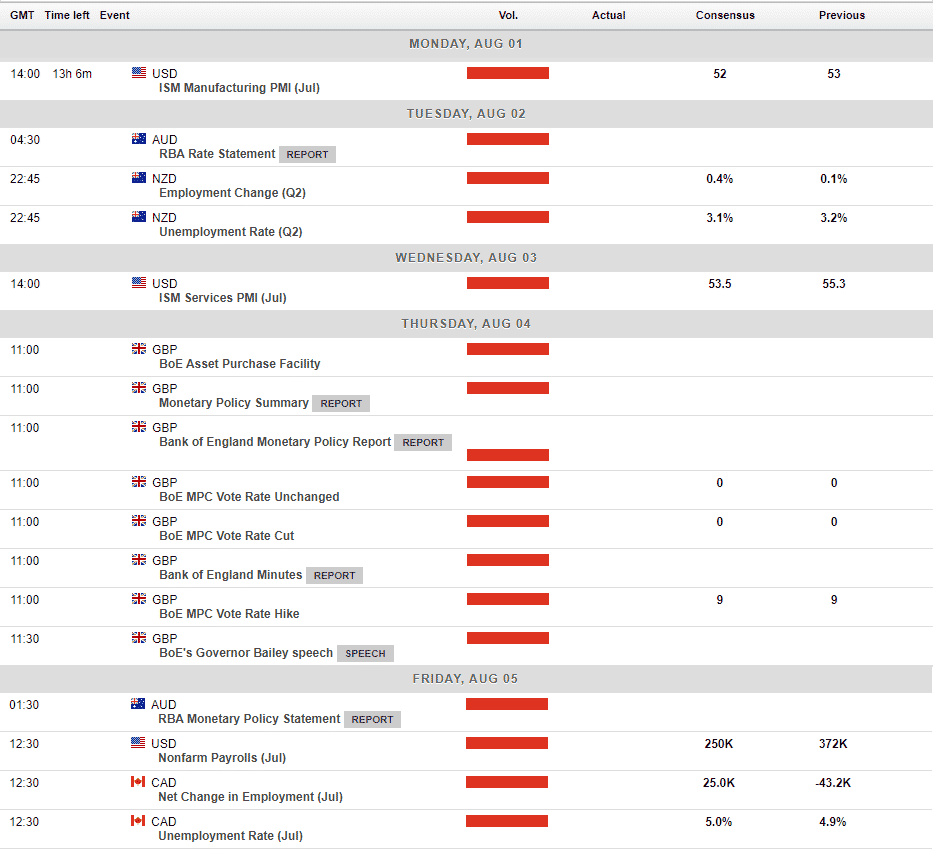

Looking ahead, a very busy calendar awaits which will no doubt test the new found optimism and risk-on theme of the markets recent action.

The AUD saw a steep rise last week testing it’s major resistance at 0.70, mostly on USD weakness but also helped along by the improvement in risk sentiment which seems to be it’s main driver recently. The RBA policy meeting on Tuesday will no doubt be the driver of its short-term price action where they are expected to hike rates 50bp. As of this morning 40bp is priced in to the futures market, so a 50bp hike should see a short term rally in the AUD, though with most of the hike priced in the rally would be expected to be fairly muted and short lived , a lot will depend on the accompanying statement for any sustained move. Fridays quarterly RBA Monetary Policy Statement will also be closely watched for any clues to future RBA policy directions.

Sticking with the Central bank theme is the Bank of England’s Monetary Policy meeting on Thursday. The BoE is widely tipped to raise rates by 50bp, with the markets close to fully pricing in such a move. The big question is with the Bank’s window for further rate hikes is gradually closing due to worsening economic conditions, will they be able to keep up with the fairly aggressive hiking schedule the markets have been pricing in? With the sterling being incredibly weak recently Bank may be reluctant to signal a forthcoming pivot in policy in the accompanying forecast.

A big week in US data with Manufacturing and Service PMI’s earlier in the week topped off by the always important NFP employment report on Friday which are all expected to show a slowing down of the economy as recent rate hikes start to bite. With the Fed signalling in its July meeting that future rate decisions would be “data dependant” and decided meeting to meeting, we could see the “bad news is good news” effect if we see misses, with traders taking that as a sign the Fed is less likely to hike as aggressively, seeing risk assets rally and further decline in the USD.

The information provided is of general nature only and does not take into account your personal objectives, financial situations or needs. Before acting on any information provided, you should consider whether the information is suitable for you and your personal circumstances and if necessary, seek appropriate professional advice. All opinions, conclusions, forecasts or recommendations are reasonably held at the time of compilation but are subject to change without notice. Past performance is not an indication of future performance. Go Markets Pty Ltd, ABN 85 081 864 039, AFSL 254963 is a CFD issuer, and trading carries significant risks and is not suitable for everyone. You do not own or have any interest in the rights to the underlying assets. You should consider the appropriateness by reviewing our TMD, FSG, PDS and other CFD legal documents to ensure you understand the risks before you invest in CFDs. These documents are available here.

#Economy #Economics #Finance #MarketsNext Article

RBA preview – likely 50bp hike incoming

Todays RBA policy meeting is expected by most analysts to result in a 50bp hike as the bank tries to play catch up and get on top of elevated inflation figures. The slightly lower Q2 CPI figures released last week has seen futures markets price out what was earlier feared could be a 75bp supersized move, a 50bp hike would see the ban...

August 2, 2022Read More >Previous Article

ExxonMobil exceeds analyst estimates for Q2 – the stock gains

ExxonMobil Corporation (XOM) reported its second quarter financial results before the opening bell on Wall Street on Friday. The oil and gas giant ...

August 1, 2022Read More >Please share your location to continue.

Check our help guide for more info.

- Trading