- Trading

- Trading

- Markets

- Markets

- Products overview

- Forex

- Commodities

- Metals

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- Platforms

- Platforms

- Platforms

- Platforms

- Platforms overview

- MetaTrader 4

- MetaTrader 5

- Education

- Education

- Education

- Education

- News & analysis

- Education Hub

- Economic calendar

- Help & support

- Help & support

- About

- Trading

- Trading

- Markets

- Markets

- Products overview

- Forex

- Commodities

- Metals

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- Platforms

- Platforms

- Platforms

- Platforms

- Platforms overview

- MetaTrader 4

- MetaTrader 5

- Education

- Education

- Education

- Education

- News & analysis

- Education Hub

- Economic calendar

- Help & support

- Help & support

- About

- Home

- News & Analysis

- Economic Updates

- The week ahead –RBNZ, RBA and FOMC in the spotlight and set to drive the AUD, NZD and USD

- Home

- News & Analysis

- Economic Updates

- The week ahead –RBNZ, RBA and FOMC in the spotlight and set to drive the AUD, NZD and USD

News & AnalysisNews & Analysis

News & AnalysisNews & AnalysisThe week ahead –RBNZ, RBA and FOMC in the spotlight and set to drive the AUD, NZD and USD

15 August 2022 By Lachlan MeakinUS equity markets finished off the week with a blockbuster of a session, pushing all the major indices to a 4th straight week of gains with the growth heavy Russell 2000 (+4.93%) outperforming the “Value” Dow (+2.92%) hammering home that risk on was the overriding narrative of the week.

This was the first time since November 2021 that the broad-based S&P 500 has had 4 weeks of positive returns. Last week’s gains were on the back of a softer CPI figure and a better than expected Consumer sentiment reading cooling inflation and growth concerns and sending Fed rate hike expectations crashing, with the previously expected 75bp hike at Septembers FOMC meeting now being priced in as 50bp.

Source: Zerohedge.com

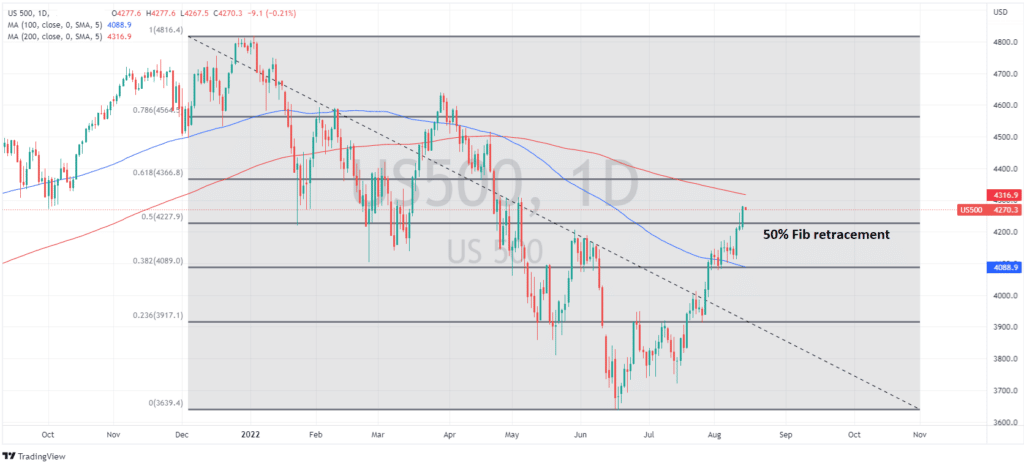

Technically the S&P 500 importantly also crossed and held the 50% Fib retracement from the all time high to bear market lows, this level was closely watched and took on special significance as there has never been a “bear market rally” that bounced back above the 50% fib and then went on to make lower lows.

Though, not all commentators are convinced this is the return of the bull market just yet, notably among them, Michael Burry of the “Big Short” fame.

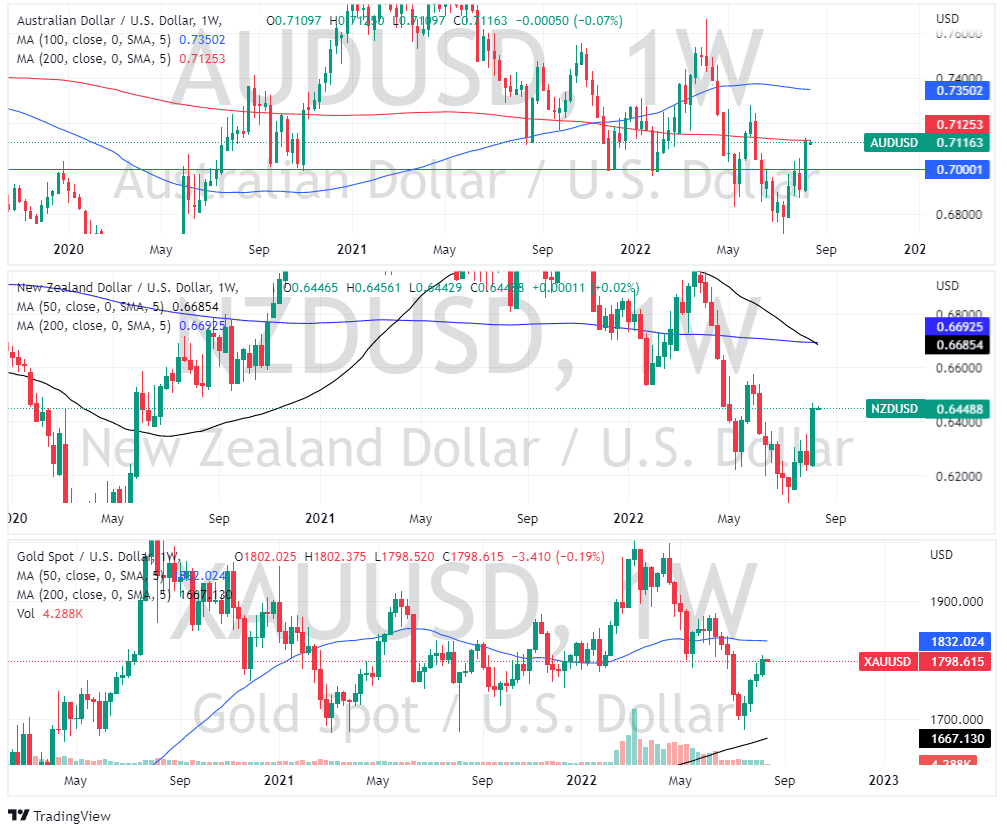

In FX, unsurprisingly the US dollar struggled as risk on returned to the market, with risk sensitive currencies the AUD and NZD outperforming, Gold also saw a boost, mirroring ueqity markets to post a 4th straight up week on lowered rate expectations and a softening of the USD.

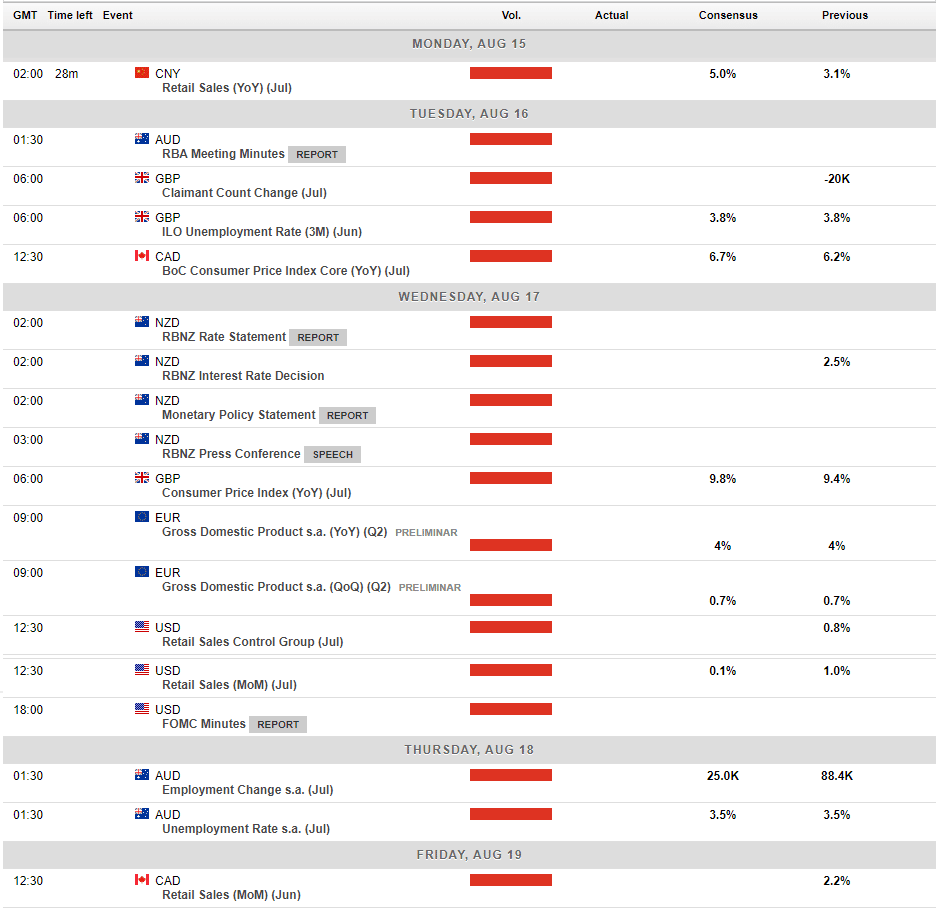

Looking ahead to this week, a busy calendar awaits with important central bank announcements from the RBNZ, RBA and FOMC which should see some volatility in their respective currencies as traders take to decipher clues on future rate movements which are the main driver of FX markets at the moment.

RBA minutes from their last policy meeting are due to be released Tuesday, expect some possible volatility in the AUD on this on any clues as to the RBA’s future tightening cycle.

Wednesday the RBNZ is widely expected to hike rates another 50bp for the 4th meeting in a row pushing the cash rate up to 3% as they try to tame rampant inflation, this hike is mostly priced in, but the accompanying rate projection statement is what will drive the NZD, a 50bp hike would put the RBNZ well ahead of their last projection for this time, so an upward revision on where they see rates going is a definite possibility and should see the NZD well bid it it comes to pass.

Thursday will see the FOMC release their minutes from the July policy meeting where they hiked by 75bp. With the current whipsawing of rate market expectations between a 50bp and 75bp hike at their September meeting, the minutes will be closely watched and could see some rate hike repricing in the rates markets driving FX moves.

The information provided is of general nature only and does not take into account your personal objectives, financial situations or needs. Before acting on any information provided, you should consider whether the information is suitable for you and your personal circumstances and if necessary, seek appropriate professional advice. All opinions, conclusions, forecasts or recommendations are reasonably held at the time of compilation but are subject to change without notice. Past performance is not an indication of future performance. Go Markets Pty Ltd, ABN 85 081 864 039, AFSL 254963 is a CFD issuer, and trading carries significant risks and is not suitable for everyone. You do not own or have any interest in the rights to the underlying assets. You should consider the appropriateness by reviewing our TMD, FSG, PDS and other CFD legal documents to ensure you understand the risks before you invest in CFDs. These documents are available here.

#Economy #Economics #Finance #MarketsNext Article

Li Auto Q2 results are here

Li Auto Inc. (LI) reported its unaudited second quarter financial results on Monday. The Chinese automaker fell short of analyst estimates for the quarter. World’s 16th largest automaker reported revenue of $1.207 billion vs. $1.416 billion expected. The company reported a loss per share of -$0.04 for the quarter vs. -$0.02 loss per share e...

August 16, 2022Read More >Previous Article

USDJPY provides potential trade after holding a key Fibonacci level

The USDJPY has been in an extremely strong upward trend since September 2021. This pair's recent price action has also been charactarised by relativel...

August 12, 2022Read More >Please share your location to continue.

Check our help guide for more info.

- Trading