- Trading

- Trading

- Markets

- Markets

- Products overview

- Forex

- Commodities

- Metals

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- Platforms

- Platforms

- Platforms

- Platforms

- Platforms overview

- MetaTrader 4

- MetaTrader 5

- Education

- Education

- Education

- Education

- News & analysis

- Education Hub

- Economic calendar

- Help & support

- Help & support

- About

- Trading

- Trading

- Markets

- Markets

- Products overview

- Forex

- Commodities

- Metals

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- Platforms

- Platforms

- Platforms

- Platforms

- Platforms overview

- MetaTrader 4

- MetaTrader 5

- Education

- Education

- Education

- Education

- News & analysis

- Education Hub

- Economic calendar

- Help & support

- Help & support

- About

- Home

- News & Analysis

- Articles

- Economic Updates

- The week ahead – SNB, Federal Reserve and BoE rate decisions

- Home

- News & Analysis

- Articles

- Economic Updates

- The week ahead – SNB, Federal Reserve and BoE rate decisions

News & AnalysisNews & Analysis

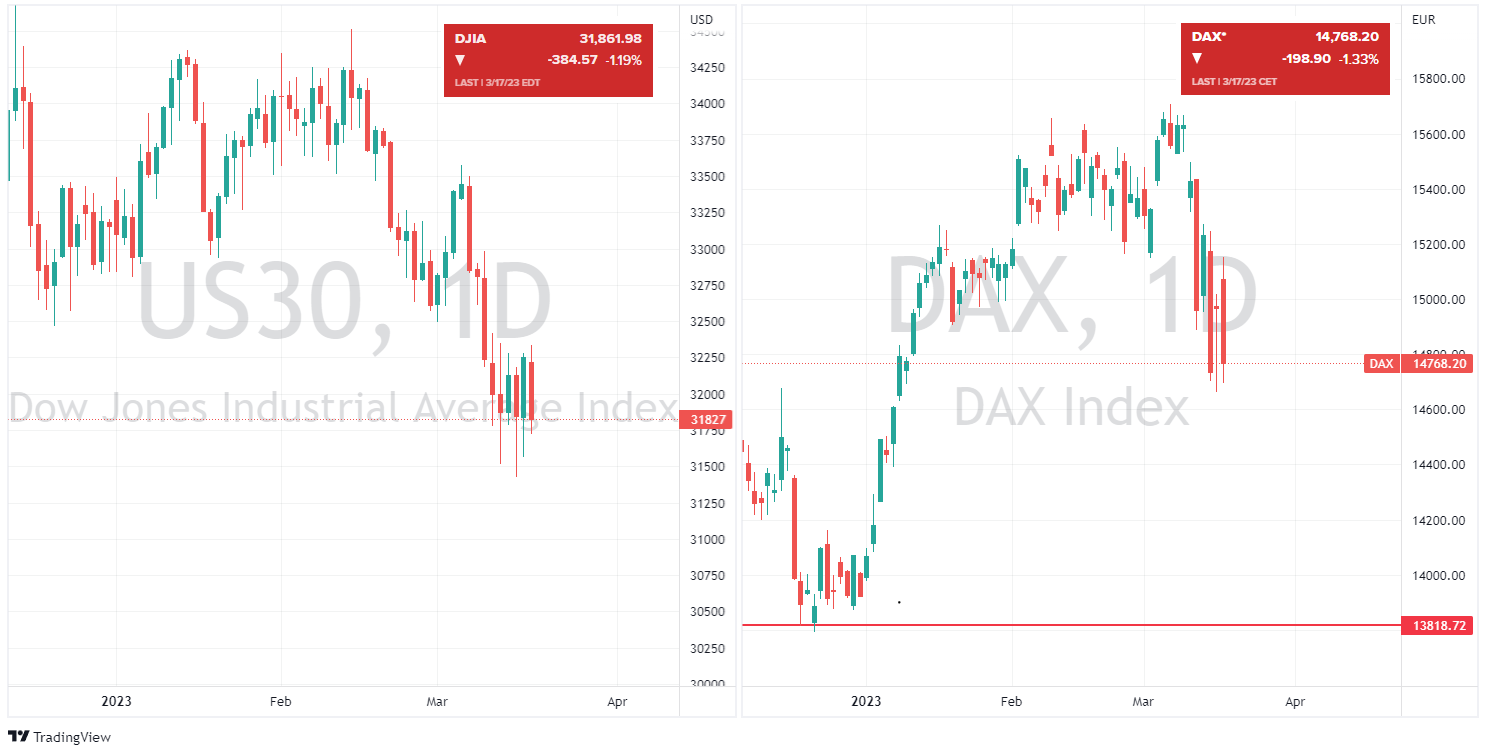

News & AnalysisNews & AnalysisUS and European markets dropped steeply on Friday as investors remained shaken by the fallout of bank collapses in the US and the issues at Credit Suisse ahead of a pivotal week in Central Bank policy meetings.

Over weekend a SNB brokered deal a deal was announced that UBS will buy rival Credit Suisse for 3 billion Francs and agreed to assume up to 5 billion in losses in a deal that would see CS shareholders receive 1 UBS share for every 22.48 Credit Suisse shares they own in a bid to restore confidence in the banking sector, whether that soothes investors or not will be the big question at Mondays opening.

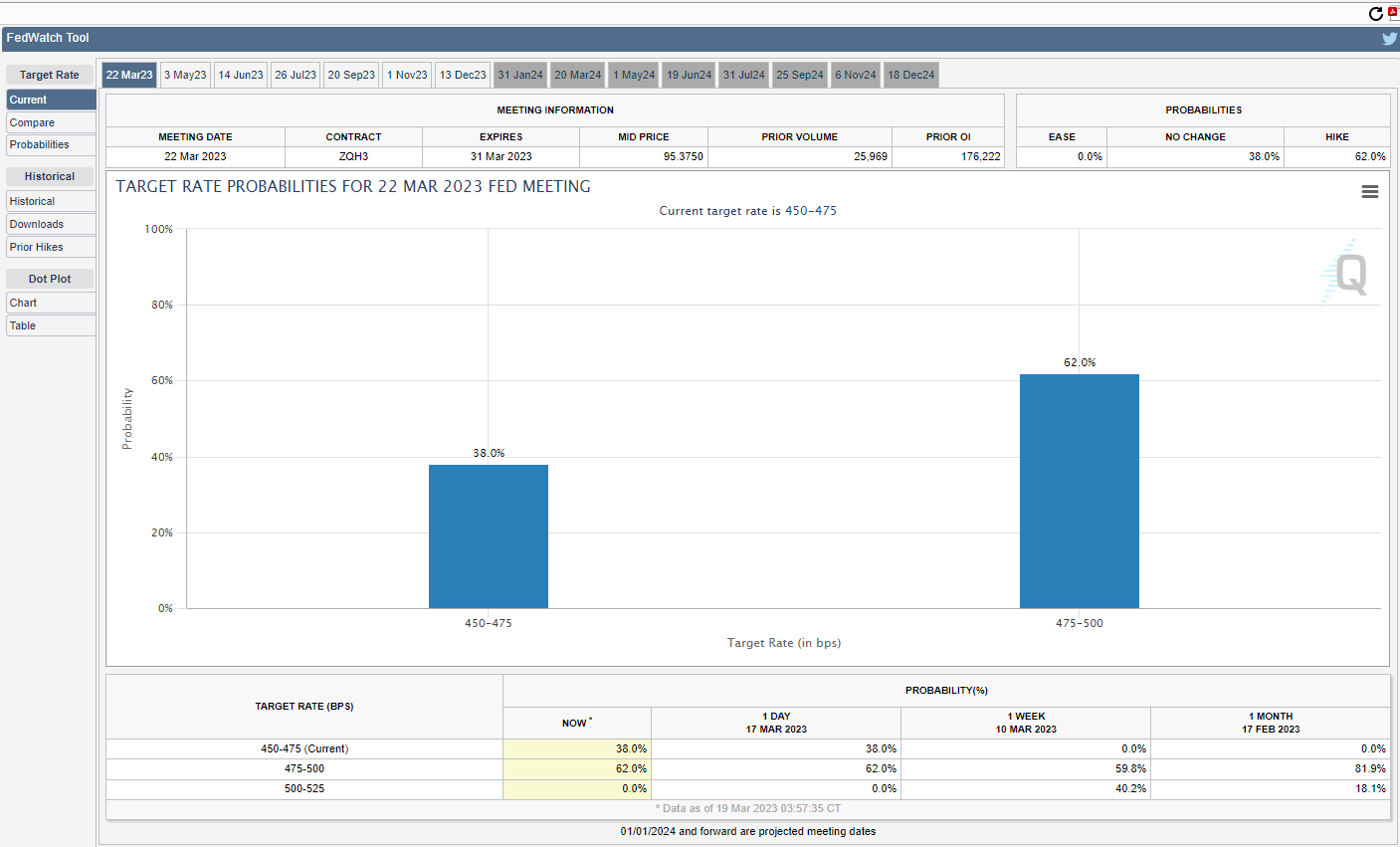

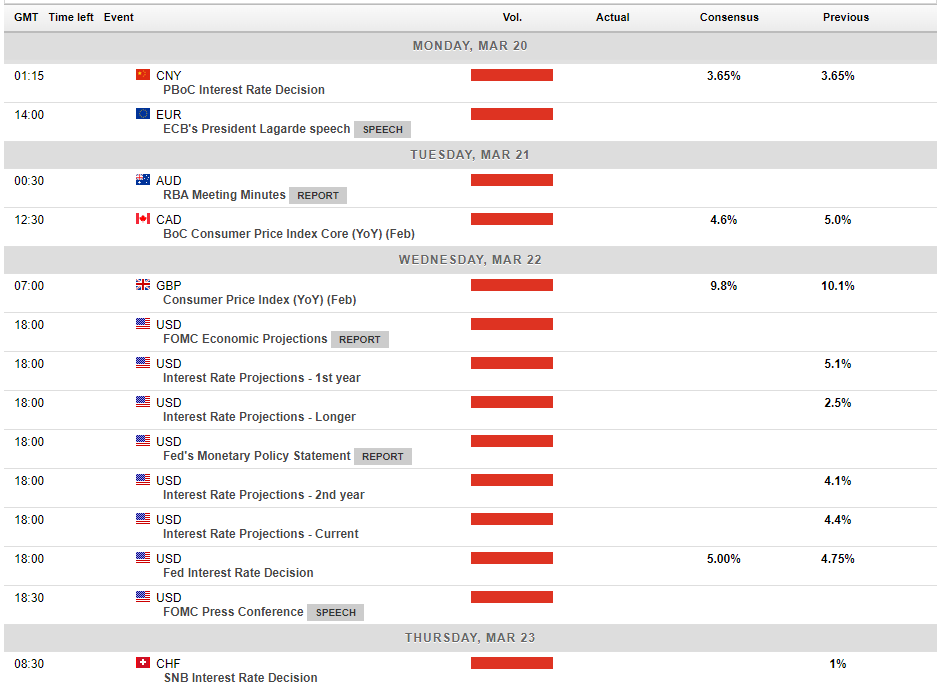

With the background of banking woes, this week’s Central Bank decisions have certainly become more interesting, up until a week ago the market was pricing in a 50 bp hike from the Federal Reserve, the odds now have around 60% for a 25bp hike, 40% for a pause, in my view it is likely the Fed will go for a 25 and moderate their language in the statement somewhat.

Next we’ll have the Bank of England, who’s decision is now on a knife edge with the market split on a 25bp hike or a pause. Since the last decision there has been encouraging data with wage growth finally showing signs of having peaked and recent communication indicates that the bar for pausing is much lower at the BoE than at the ECB or the Fed. it likely will come down to whether stability in financial markets returns before Thursday. Either way, expect the committee to remain heavily divided and some volatility in the GBP.

The SNB is last cab off the rank, inflation continued to rise and exceed expectations in Switzerland, reaching 3.4% in February, with the SNB well behind it’s peers in the rate hiking cycle conditions 50 basis point rate hike at the March meeting A fortnight ago, this was pretty much a done deal, but against a backdrop of Credit Suisse woes this has clearly reduced the chances this will happen, with a 25bp hike or even a pause possible.

A very busy and likely volatile week ahead in all markets.

The information provided is of general nature only and does not take into account your personal objectives, financial situations or needs. Before acting on any information provided, you should consider whether the information is suitable for you and your personal circumstances and if necessary, seek appropriate professional advice. All opinions, conclusions, forecasts or recommendations are reasonably held at the time of compilation but are subject to change without notice. Past performance is not an indication of future performance. Go Markets Pty Ltd, ABN 85 081 864 039, AFSL 254963 is a CFD issuer, and trading carries significant risks and is not suitable for everyone. You do not own or have any interest in the rights to the underlying assets. You should consider the appropriateness by reviewing our TMD, FSG, PDS and other CFD legal documents to ensure you understand the risks before you invest in CFDs. These documents are available here.

#Economy #Economics #Finance #MarketsNext Article

US stocks rally as banking sector fears ease, USD and Gold down, Yields up

US markets rose modestly in Mondays session on a more positive tone in the banking sector following on from the UBS – Swiss government bail out of Credit Suisse over the weekend and hopes US banking regulators would backstop deposits to restore confidence in US mid-sized banks. We saw green across all major indexes, the NASDQ being the lagged ...

March 21, 2023Read More >Previous Article

Bank bailouts see markets bounce, ECB surprises with big hike

Thursdays US session was risk on led by global banking support after SNB gave a lifeline to Credit Suisse while 11 large US banks stepped up to help...

March 17, 2023Read More >Please share your location to continue.

Check our help guide for more info.

- Trading