- Trading

- Trading

- Markets

- Markets

- Products overview

- Forex

- Commodities

- Metals

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- Platforms

- Platforms

- Platforms

- Platforms

- Platforms overview

- MetaTrader 4

- MetaTrader 5

- Education

- Education

- Education

- Education

- News & analysis

- Education Hub

- Economic calendar

- Help & support

- Help & support

- About

- Trading

- Trading

- Markets

- Markets

- Products overview

- Forex

- Commodities

- Metals

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- Platforms

- Platforms

- Platforms

- Platforms

- Platforms overview

- MetaTrader 4

- MetaTrader 5

- Education

- Education

- Education

- Education

- News & analysis

- Education Hub

- Economic calendar

- Help & support

- Help & support

- About

- Home

- News & Analysis

- Economic Updates

- The Week Ahead – US employment and inflation figures take centre stage

- Home

- News & Analysis

- Economic Updates

- The Week Ahead – US employment and inflation figures take centre stage

News & AnalysisNews & Analysis

News & AnalysisNews & AnalysisThe Week Ahead – US employment and inflation figures take centre stage

28 November 2022 By Lachlan MeakinAfter coming off a fairly quiet, US holiday shortened week, traders will have a plethora of scheduled news to digest as the market continues to swing from risk-on to risk-off as it tries to predict what the Federal Reserves next moves will be.

Equity markets drifted up, the US dollar drifted down as a resilient US economy and a dovish Fed minutes saw market trading risk-on. This “loosening” of financial conditions will no doubt make the Fed unhappy as they battle to control inflation, so it wouldn’t be a surprise to see the Fed language become more aggressive over the coming week with three officials scheduled to speak.

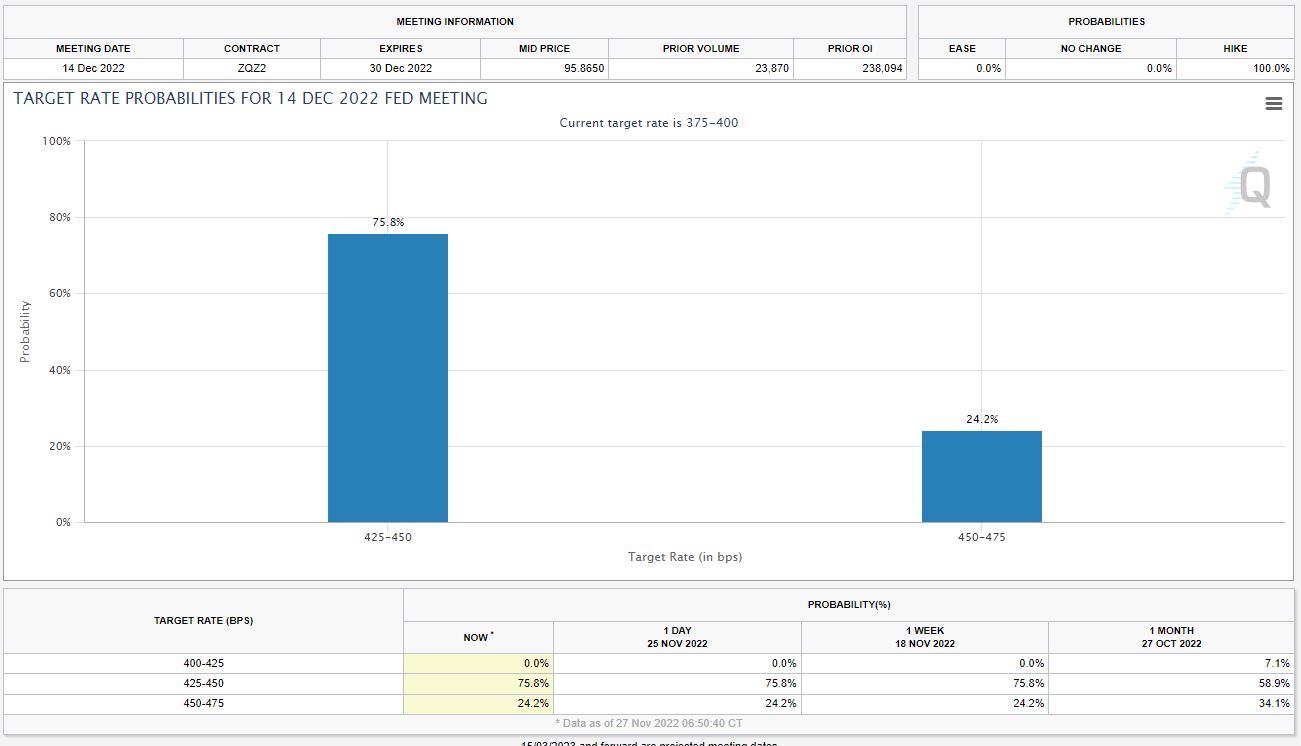

With the market pricing in a 50bp hike from the Fed in a couple of weeks at 75% (25% for a 75bp hike) and terminal rate expectations fluctuating on any Fed speak or major figure we will probably see a fair bit of volatility in US equity and global FX markets as liquidity returns and markets reprice on any perceived clues.

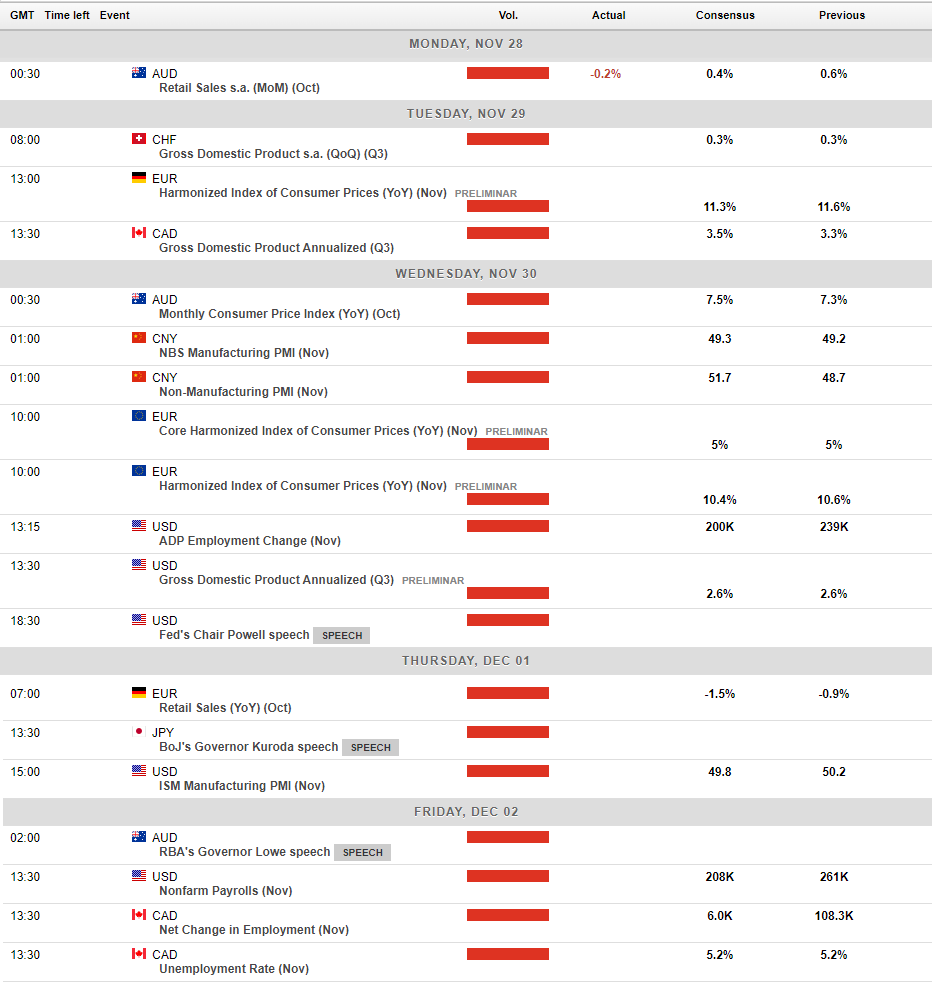

The main risk events out of the US are the Feds preferred Core PCE inflation figure released on Thursday and the always closely watched Non-Farm Payrolls, released on Friday. Both of these play right into the Fed’s mandates of employment and inflation, figures outside expectation will see some extreme volatility in FX and equity markets.

Jerome Powell is also scheduled to speak on Wednesday, this originally wasn’t planned and was only a recent addition to the economic calendar which suggests it could be an interesting one.

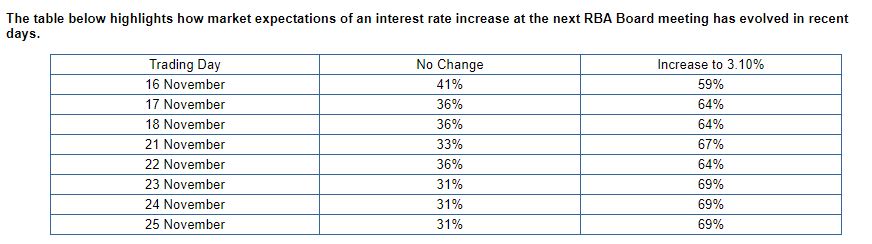

For AUD and ASX 200 traders, Australia’s first newly created monthly CPI figure will be released on Wednesday (previously this figure was only released quarterly) This combined with a speech from Governor Lowe on Friday could see rates markets re-price with an RBA decision next week. With a 25bp hike at 69% chance at the moment, either of these events could see that change and some volatility in Aussie markets.

This week’s calendar below:

The information provided is of general nature only and does not take into account your personal objectives, financial situations or needs. Before acting on any information provided, you should consider whether the information is suitable for you and your personal circumstances and if necessary, seek appropriate professional advice. All opinions, conclusions, forecasts or recommendations are reasonably held at the time of compilation but are subject to change without notice. Past performance is not an indication of future performance. Go Markets Pty Ltd, ABN 85 081 864 039, AFSL 254963 is a CFD issuer, and trading carries significant risks and is not suitable for everyone. You do not own or have any interest in the rights to the underlying assets. You should consider the appropriateness by reviewing our TMD, FSG, PDS and other CFD legal documents to ensure you understand the risks before you invest in CFDs. These documents are available here.

#Economy #Economics #Finance #MarketsNext Article

Phillip Lowe apologises to the Australian Public over missed forecasts

Phillip Lowe, governor of the Reserve Bank of Australia, (RBA) has issued an apology to the Australian public in his most recent statement. Lowe specifically apologised for providing guidance in 2020 and 2021 that the official cash would only rise in 2024. Instead, rate rises began earlier this year and rises have occurred in 7 straight months. Dur...

November 28, 2022Read More >Previous Article

Possible high return Swing Trade on USDCHF

The USDCHF has just reached a significant support zone providing a potential entry for a low-risk high return trade. In recent weeks the USD has an ag...

November 25, 2022Read More >Please share your location to continue.

Check our help guide for more info.

- Trading