- Trading

- Trading

- Markets

- Markets

- Products overview

- Forex

- Commodities

- Metals

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- Platforms

- Platforms

- Platforms

- Platforms

- Platforms overview

- MetaTrader 4

- MetaTrader 5

- Education

- Education

- Education

- Education

- News & analysis

- Education Hub

- Economic calendar

- Help & support

- Help & support

- About

- Trading

- Trading

- Markets

- Markets

- Products overview

- Forex

- Commodities

- Metals

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- Platforms

- Platforms

- Platforms

- Platforms

- Platforms overview

- MetaTrader 4

- MetaTrader 5

- Education

- Education

- Education

- Education

- News & analysis

- Education Hub

- Economic calendar

- Help & support

- Help & support

- About

- Home

- News & Analysis

- Economic Updates

- Uber earnings have arrived

News & AnalysisUber Technologies Inc. (UBER) reported their third-quarter earnings after the closing bell on Thursday.

The company reported revenue of $4.8 billion (up by 72% year-over-year) vs. $4.4 billion expected by the analysts on Wall Street. Loss per share was above analyst predictions at $1.33 per share vs. $0.33 loss per share expected.

Gross bookings reached an all-time high of $23.1 billion, up 57% year-over-year.

Uber reported a net loss of $2.4 billion in the third-quarter mainly due to a decline in the value of its investments.

CEO, Dara Khosrowshahi commented on the latest results: ”Our early and decisive investments in driver growth are still paying dividends, with drivers steadily returning to the platform, leading to further improvement in the consumer experience.”

”This is especially important as Mobility reignites. Mobility Gross Bookings are up 18 percent over just the last two months and this Halloween weekend surpassed 2019 levels.”

”While we recognize it’s just a step, reaching total-company Adjusted EBITDA profitability is an important milestone for Uber,” said Nelson Chai, CFO.

”Not only did our Mobility business recover to pre-COVID margins this quarter, our core restaurant delivery business was profitable on an Adjusted EBITDA basis for the first time as well, bringing the full Delivery segment close to breakeven.”

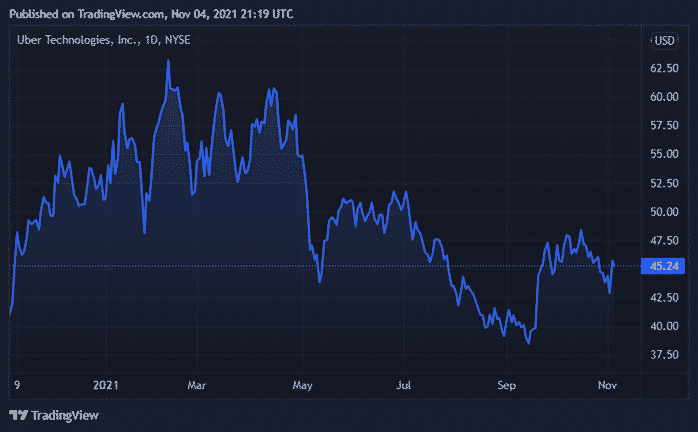

Uber chart (1Y)

Share price of Uber trading 1.75% higher in the after-hour trading after ending the trading day on Thursday at $45.24 per share. The stock is up by 10.44% in the past year.

Uber is the 183rd largest company in the world with a total market cap of $ $87.72 billion.

You can trade Uber Technologies Inc. (UBER) and many other stocks from the NYSE, NASDAQ, HKEX and the ASX with GO Markets as a Share CFD. Click here for more information. Trading Derivatives carries a high level of risk.

Sources: Uber, Refinitiv, TradingView, CompaniesMarketCap

The information provided is of general nature only and does not take into account your personal objectives, financial situations or needs. Before acting on any information provided, you should consider whether the information is suitable for you and your personal circumstances and if necessary, seek appropriate professional advice. All opinions, conclusions, forecasts or recommendations are reasonably held at the time of compilation but are subject to change without notice. Past performance is not an indication of future performance. Go Markets Pty Ltd, ABN 85 081 864 039, AFSL 254963 is a CFD issuer, and trading carries significant risks and is not suitable for everyone. You do not own or have any interest in the rights to the underlying assets. You should consider the appropriateness by reviewing our TMD, FSG, PDS and other CFD legal documents to ensure you understand the risks before you invest in CFDs. These documents are available here.

#Economy #Economics #Finance #MarketsNext Article

Moderna doesn’t get the boost – Q3 earnings fall short

Moderna (MRNA) reported their Q3 financial results before the opening bell on Thursday. The pharmaceutical company posted disappointing results below Wall Street analyst expectations. The company reported total revenue of $4.97 billion vs. $6.21 billion expected. Earnings per share at $7.70 a share vs. $9.05 a share expected. It also downgrad...

November 5, 2021Read More >Previous Article

Q3 results give Pfizer a boost

Pfizer posted their third-quarter financial results before the opening bell on Tuesday. The pharmaceutical giant beat Wall Street estimates. Pfizer...

November 3, 2021Read More >Please share your location to continue.

Check our help guide for more info.

- Trading