- Trading

- Trading

- Markets

- Markets

- Products overview

- Forex

- Commodities

- Metals

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- Platforms

- Platforms

- Platforms

- Platforms

- Platforms overview

- MetaTrader 4

- MetaTrader 5

- Education

- Education

- Education

- Education

- News & analysis

- Education Hub

- Economic calendar

- Help & support

- Help & support

- About

- Trading

- Trading

- Markets

- Markets

- Products overview

- Forex

- Commodities

- Metals

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- Platforms

- Platforms

- Platforms

- Platforms

- Platforms overview

- MetaTrader 4

- MetaTrader 5

- Education

- Education

- Education

- Education

- News & analysis

- Education Hub

- Economic calendar

- Help & support

- Help & support

- About

- Home

- News & Analysis

- Economic Updates

- Ukraine Conflict Causes Moves To Safety

- Gold and precious metals

- Government bonds

- US Dollar

- Swiss Franc

- Japanese Yen

- Defensive Stocks

- Tangible Commodities (Oil, Agriculture, Land)

News & AnalysisAs geopolitical tensions continue to escalate in Ukraine following news of a full-scale Russian invasion, we are starting to see evidence of fear and heightened uncertainty enter financial markets across the globe. The driving force of instability is the unknown impact of these latest events in Europe and the potential economic, political, and social implications of Russia’s actions on a global scale.

Russian Market Collapse

Already, we have witnessed a 45% collapse in the Russian stock market, the Moscow Exchange MOEX, hitting record lows against the US Dollar. While indeed a shock move, it’s hardly surprising considering the numerous fiscal sanctions about to be implemented by member countries of NATO. It signals a massive flight to safety, but where are these funds perhaps likely to flow?

Safe-Haven Assets

A quick recap in safe-haven assets suggests the most likely candidate for money flows during times of mass geopolitical tension are the following:

While this list doesn’t exhaust all the possibilities, it suggests assets that are in a broader sense less risky to hold and historically have performed better at maintaining a store of value. Some may refer to these assets as a hedge against the overall market.

When Putin Announced War

If we take a look at the current market activity shortly following the announcement made by Russian President Vladimir Putin, gold jumped 3% to a multi-month high of $1974 a troy ounce. Furthermore, the US Dollar Index (DXY) continues to print new 2022 highs around $97.60, and global oil prices have breached $100 per barrel for the first time since July 2014. All this movement suggests a large-scale move into perceived safe-haven assets is underway.

Isn’t Crypto A Store Of Value?

One asset class not mentioned above is Bitcoin and cryptocurrencies in general. Some may argue that Bitcoin, like gold, can be viewed as a store of value and a potential hedge against a market downturn. However, while there could be a case for digital value in the future, at the moment, the market still views cryptocurrencies as high risk and an extremely speculative asset class. We see key evidence of this sentiment as the crisis in Ukraine unfolds, with Bitcoin plummeting as much as 7.9%, creating a low of $34,324, while the crypto market managed to wipe up to $150 billion in the last 24 hours alone, according to data from Coinmarketcap.

Trading Opportunities

While cryptocurrencies may not present a viable trading opportunity for trading safe-haven sentiment, a couple of others are worth considering in the short term.

Dollar Demand Hurts Aussie

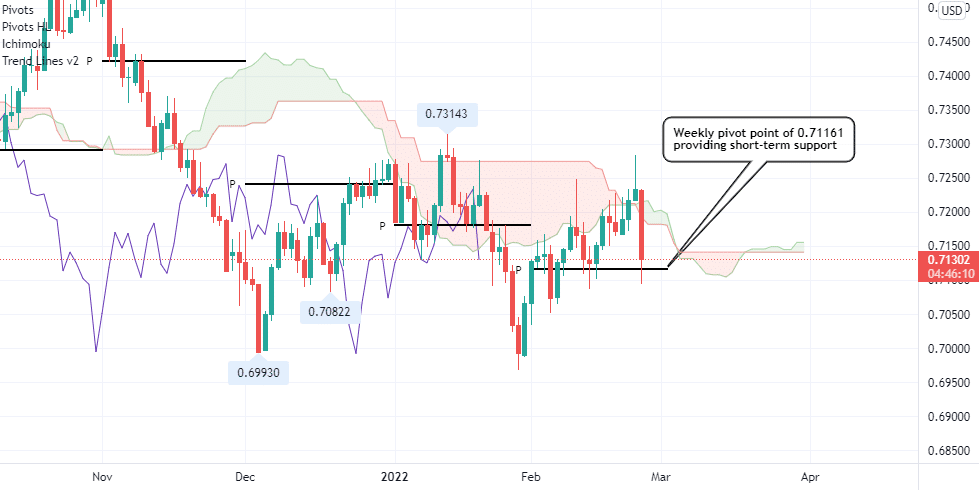

The AUDUSD pair on the daily chart has continued a downward trend for the past several months, and current events could trigger further pain for Aussie longs as the demand for the US Dollar begins to ramp up further.

As we look at the chart above, the latest price action has produced a bearish engulfing candle and pulled price action well below the Ichimoku cloud once again. In addition, the longer-term span line (purple) is also below the cloud creating an overall bearish outlook. It appears the only element providing immediate support for the pair is the weekly pivot level at 0.71161. Should we see a further bearish sell-off, the Aussie could target recent lows of 0.70822 and 0.69930, respectively.

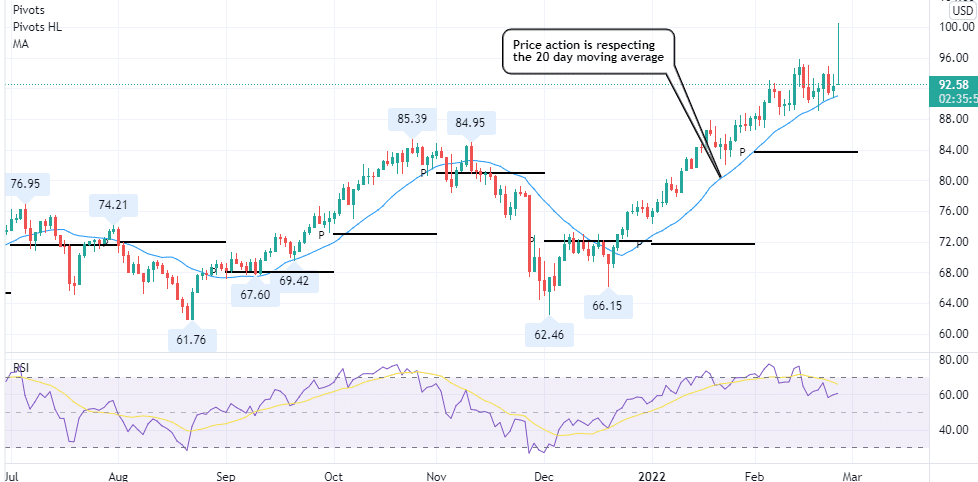

Crude Oil Looking Slippery

Another chart to watch is the Crude Oil on the daily time frame. Despite the push to over $100 earlier today, the latest candle suggests the market is keen to suppress moves at those higher levels, and sellers are providing plenty of resistance. So while the longer-term outlook remains bullish, finding support at the 20-day moving average (blue line), we may see the price consolidate lower towards $91.00 for the time being. There is also a slight bearish divergence on the RSI indicator suggesting short-term pressure to the downside. A lot will depend on how things progress in Ukraine.

Finally, whatever happens in the coming days and weeks, hopefully, world leaders will find a peaceful resolution. But, in the meantime, be mindful of additional risks caused by increased volatility within the markets – trade sensibly.

The information provided is of general nature only and does not take into account your personal objectives, financial situations or needs. Before acting on any information provided, you should consider whether the information is suitable for you and your personal circumstances and if necessary, seek appropriate professional advice. All opinions, conclusions, forecasts or recommendations are reasonably held at the time of compilation but are subject to change without notice. Past performance is not an indication of future performance. Go Markets Pty Ltd, ABN 85 081 864 039, AFSL 254963 is a CFD issuer, and trading carries significant risks and is not suitable for everyone. You do not own or have any interest in the rights to the underlying assets. You should consider the appropriateness by reviewing our TMD, FSG, PDS and other CFD legal documents to ensure you understand the risks before you invest in CFDs. These documents are available here.

#Economy #Economics #Finance #MarketsNext Article

Below expectations – Beyond Meat falls short in Q4

Beyond Meat Inc. reported their latest financial results for Q4 2021 after the closing bell on Wall Street today. The US plant-based meat substitute producer company fell short of analyst expectations for the last quarter, sending the stock price lower in the after-market hours. The company reported revenue of $100.678 million in Q4 (decrease...

February 25, 2022Read More >Previous Article

eBay beats Wall Street estimates in Q4

US e-commerce company eBay Inc. reported its Q4 2021 financial results after the closing bell on Wall Street on Wednesday. The company reported rev...

February 24, 2022Read More >Please share your location to continue.

Check our help guide for more info.

- Trading