- Trading

- Trading

- Markets

- Markets

- Products overview

- Forex

- Commodities

- Metals

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- Platforms

- Platforms

- Platforms

- Platforms

- Platforms overview

- MetaTrader 4

- MetaTrader 5

- Education

- Education

- Education

- Education

- News & analysis

- Education Hub

- Economic calendar

- Help & support

- Help & support

- About

- Trading

- Trading

- Markets

- Markets

- Products overview

- Forex

- Commodities

- Metals

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- Platforms

- Platforms

- Platforms

- Platforms

- Platforms overview

- MetaTrader 4

- MetaTrader 5

- Education

- Education

- Education

- Education

- News & analysis

- Education Hub

- Economic calendar

- Help & support

- Help & support

- About

- Home

- News & Analysis

- Economic Updates

- United Kingdom – Snap General Elections 2017

News & AnalysisUnited Kingdom – Snap General Elections 2017

2017 is now expected to be an even bigger year for the United Kingdom – On the 18th April, British Prime Minister Theresa May made the shock call for a snap general election to be held on the 8th June, 2017. This is contrary to what she has previously said on numerous occasions. In fact, on the 30th June last year as she stood for the Conservative leadership, she claimed ‘There should be no general election until 2020. There should be a normal autumn statement held in the normal way, at the normal time, and no emergency budget’. This is an announcement that was not anticipated by the markets especially with the Brexit talks fast approaching.

» How did the markets react?

Before Theresa May’s announcement about the snap general election, the Pound was trading around the level of 1.2563 against the US Dollar but post announcement we saw the Pound strengthening against the US Dollar and moving to its highest level since October 2016. With the general elections and the start of the Brexit negations coming up in June, we can expect even more uncertainty for the Pound in the months to come.

Forex – GPBUSD

Click to enlarge

Source: GO Markets MT4

As for the FTSE 100 index, it had the biggest one day drop since the Brexit vote back in June 2016 and had more than £45 billion wiped off after Theresa May’s announcement.

FTSE 100 index fell 2.4% (180.09 points) and ended the day at 7147.5 and it marked the biggest one day percentage drop for the FTSE 100 index since June 2016, when it fell 3.1%.Index – FTSE100

Click to enlarge

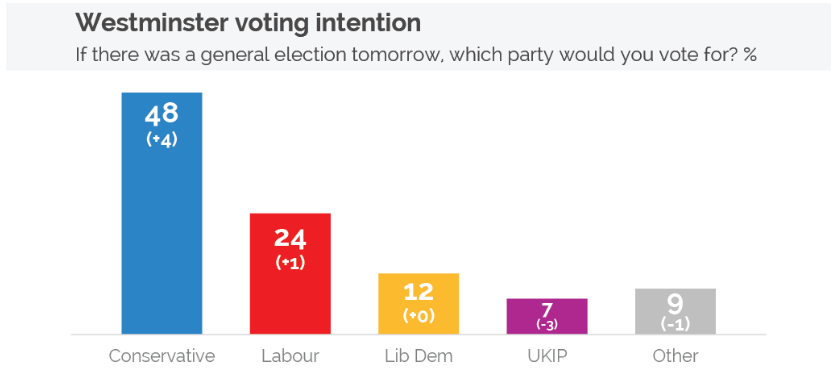

Source: GO Markets MT4» What are the latest polls saying?

Click to enlarge

Source: YouGov» What happens next?

It has only been a few days since the general elections were announced but most parties have already started their election campaigns. We are expecting the parties to launch their manifestos in the next coming weeks and then we will have a clear idea of what each party is proposing as part of campaign.

Looking at the polls from YouGov now, it would be a big surprise if the Conservative party did not win the elections on 8th June but the launch of the manifestos could potentially change that. It worth keeping up with the announcements in the coming weeks to see how the election campaigns will unfold for each party.

The new President of the European Parliament visited Theresa May on 20th April and advised that the UK’s snap election will not affect the Brexit negotiation timetable of two-year exit deal negotiation followed by a three-year transition phase with negotiations expected to begin in June, just after the UK elections.– By Klavs Valters

The information provided is of general nature only and does not take into account your personal objectives, financial situations or needs. Before acting on any information provided, you should consider whether the information is suitable for you and your personal circumstances and if necessary, seek appropriate professional advice. All opinions, conclusions, forecasts or recommendations are reasonably held at the time of compilation but are subject to change without notice. Past performance is not an indication of future performance. Go Markets Pty Ltd, ABN 85 081 864 039, AFSL 254963 is a CFD issuer, and trading carries significant risks and is not suitable for everyone. You do not own or have any interest in the rights to the underlying assets. You should consider the appropriateness by reviewing our TMD, FSG, PDS and other CFD legal documents to ensure you understand the risks before you invest in CFDs. These documents are available here.

#Economy #Economics #Finance #MarketsNext Article

French Elections – The final round

French Elections -The final around Marine Le Pen, a lawyer, politician and recently the former president of the National Front is facing a young independent centrist untainted by old politics. Almost a year after forming his party, markets were positively surprised when Macron managed to outcast 2 major political parties that have governed France f...

May 5, 2017Read More >Previous Article

Post Inauguration – approaching 100 days

Post Inauguration – approaching 100 days Back in November 2016, the people of America went to cast their vote for their 45th President. There were t...

April 19, 2017Read More >Please share your location to continue.

Check our help guide for more info.

- Trading