- Trading

- Trading

- Markets

- Markets

- Products overview

- Forex

- Commodities

- Metals

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- Platforms

- Platforms

- Platforms

- Platforms

- Platforms overview

- MetaTrader 4

- MetaTrader 5

- Education

- Education

- Education

- Education

- News & analysis

- Education Hub

- Economic calendar

- Help & support

- Help & support

- About

- Trading

- Trading

- Markets

- Markets

- Products overview

- Forex

- Commodities

- Metals

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- Platforms

- Platforms

- Platforms

- Platforms

- Platforms overview

- MetaTrader 4

- MetaTrader 5

- Education

- Education

- Education

- Education

- News & analysis

- Education Hub

- Economic calendar

- Help & support

- Help & support

- About

- Home

- News & Analysis

- Economic Updates

- Up next: the Bank of Canada rate decision

News & AnalysisOne of the must-watch economic events this week will be the Bank of Canada interest rate decision. The rate decision is due to be announced at 15:00 PM London time on Wednesday.

Why is the announcement important?

A bank interest rate is the rate at which a country’s central bank lends money to local banks. The interest rate is charged by the nation’s central or federal bank on loan advances to control the money supply in the economy and the banking sector. The Bank of Canada has an inflation target of 1% to 3%. The interest rates are changed accordingly to meet the target. The decision to increase, decrease, or maintain the interest rate has a significant impact on financial markets, so it’s one of the most closely watched economic events in the calendar.

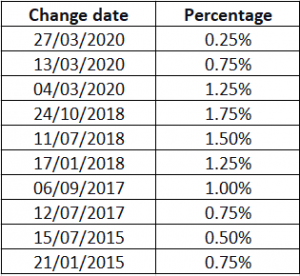

Bank of Canada interest rate changes since 2015

Expectations

In January, we saw the Bank of Canada leave its interest rate unchanged at 0.25%.

It’s expected that the same will happen this month, according to the analysts. In fact, following January’s rate decision the Bank of Canada signalled that rates may remain unchanged until 2023.

”In view of the weakness of near-term growth and the protracted nature of the recovery, the Canadian economy will continue to require extraordinary monetary policy support. The Governing Council will hold the policy interest rate at the effective lower bound until economic slack is absorbed so that the 2 percent inflation target is sustainably achieved. In our projection, this does not happen until into 2023”, the bank’s website statement read.

With interest rates likely to remain unchanged, all eyes will be on the statement following the rate announcement, where we may see further comments from the bank about the future outlook for the economy.

You can keep up to date with economic announcements and events by clicking here for our GO Markets Economic Calendar.

The information provided is of general nature only and does not take into account your personal objectives, financial situations or needs. Before acting on any information provided, you should consider whether the information is suitable for you and your personal circumstances and if necessary, seek appropriate professional advice. All opinions, conclusions, forecasts or recommendations are reasonably held at the time of compilation but are subject to change without notice. Past performance is not an indication of future performance. Go Markets Pty Ltd, ABN 85 081 864 039, AFSL 254963 is a CFD issuer, and trading carries significant risks and is not suitable for everyone. You do not own or have any interest in the rights to the underlying assets. You should consider the appropriateness by reviewing our TMD, FSG, PDS and other CFD legal documents to ensure you understand the risks before you invest in CFDs. These documents are available here.

#Economy #Economics #Finance #MarketsNext Article

Dow Jones rally Q1 2021

2021 has been a profitable year for stocks in the Dow Jones Index. Since the turn of the year, the Dow has seen what appears to be a roaring rally with no end in sight, fuelled by a return of investor confidence and a stimulus package aiming to revitalise a stagnant U.S economy. In the first quarter of 2021, we've seen an increase of over 30...

March 17, 2021Read More >Previous Article

DOW hits all time highs, Nikkei back to bubble era prices and Bitcoin’s wild ride.

Going into the month’s last day of trading, Global markets have performed well despite a sell off this week. Continued hopes that we’re on a pat...

February 26, 2021Read More >Please share your location to continue.

Check our help guide for more info.

- Trading