- Trading

- Trading

- Markets

- Markets

- Products overview

- Forex

- Commodities

- Metals

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- Platforms

- Platforms

- Platforms

- Platforms

- Platforms overview

- MetaTrader 4

- MetaTrader 5

- Education

- Education

- Education

- Education

- News & analysis

- Education Hub

- Economic calendar

- Help & support

- Help & support

- About

- Trading

- Trading

- Markets

- Markets

- Products overview

- Forex

- Commodities

- Metals

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- Platforms

- Platforms

- Platforms

- Platforms

- Platforms overview

- MetaTrader 4

- MetaTrader 5

- Education

- Education

- Education

- Education

- News & analysis

- Education Hub

- Economic calendar

- Help & support

- Help & support

- About

- Home

- News & Analysis

- Economic Updates

- US Dollar analysis – a technical perspective

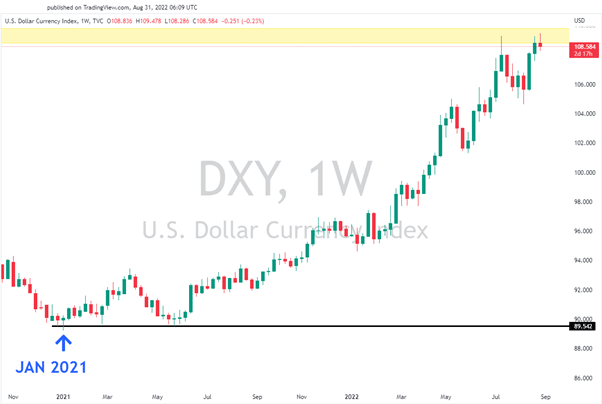

News & AnalysisThe US Dollar Index has been on a bull run since January 2021, we can see a consistent uptrend, making higher highs breaking above and beyond the $103 dollar mark, which it hasn’t been above since December of 2002.

Looking at the monthly timeframe for the US Dollar Index, we can see around January of 2021 was the beginning of the double bottom reversal pattern. Now if we take a look at the pattern that’s currently forming at the top of the highlighted zone, can we see the similarities?

The yellow highlighted zone between $108.7 to $109.8 was taken from a major resistance from September 2002, where the price significantly dropped from in the past. Which was the last time that the US Dollar was sitting at the current price.

If previously in the past the US Dollar was pushed down at this major resistance, there is a high probability that it could happen again. Pairing the major resistance with the double top pattern that’s forming, we could expect the end of an uptrend for the US Dollar.

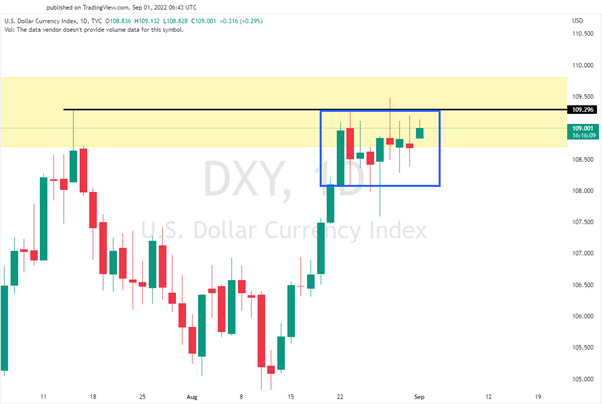

On a daily timeframe, the US dollar has been moving sideways, consolidating for a total of 8 days.

Struggling to break above the previous high, this can be seen as buyers losing control of the markets, and sellers could be coming in. A Break below the consolidation zone could confirm the beginning of the downtrend.

This could be helpful when looking at pairs that have a strong negative correlation with the US Dollar Index.

However, if the price pushes above and continues to rally, we can see the price potentially head up to $120.

The information provided is of general nature only and does not take into account your personal objectives, financial situations or needs. Before acting on any information provided, you should consider whether the information is suitable for you and your personal circumstances and if necessary, seek appropriate professional advice. All opinions, conclusions, forecasts or recommendations are reasonably held at the time of compilation but are subject to change without notice. Past performance is not an indication of future performance. Go Markets Pty Ltd, ABN 85 081 864 039, AFSL 254963 is a CFD issuer, and trading carries significant risks and is not suitable for everyone. You do not own or have any interest in the rights to the underlying assets. You should consider the appropriateness by reviewing our TMD, FSG, PDS and other CFD legal documents to ensure you understand the risks before you invest in CFDs. These documents are available here.

#Economy #Economics #Finance #MarketsNext Article

Bitcoin/USD – Technical Analysis

After Bitcoin reached its all time highs around $69,000USD per coin in November of 2021, it’s been downhill ever since. Currently sitting at roughly $20,080USD, it has dropped over 70% of its value in less than a year. Let’s break this down from a technical viewpoint, keeping it very simple with only a few lines. Not much else is needed....

September 2, 2022Read More >Previous Article

US equities extend losses into month end on weak US job data and hot EZ inflation

All major US indices were down for a fourth straight session as hawkish rhetoric from Central bankers and persistent inflation continues to keep the m...

September 1, 2022Read More >Please share your location to continue.

Check our help guide for more info.

- Trading