- Trading

- Trading

- Markets

- Markets

- Products overview

- Forex

- Commodities

- Metals

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- Platforms

- Platforms

- Platforms

- Platforms

- Platforms overview

- MetaTrader 4

- MetaTrader 5

- Education

- Education

- Education

- Education

- News & analysis

- Education Hub

- Economic calendar

- Help & support

- Help & support

- About

- Trading

- Trading

- Markets

- Markets

- Products overview

- Forex

- Commodities

- Metals

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- Platforms

- Platforms

- Platforms

- Platforms

- Platforms overview

- MetaTrader 4

- MetaTrader 5

- Education

- Education

- Education

- Education

- News & analysis

- Education Hub

- Economic calendar

- Help & support

- Help & support

- About

- Home

- News & Analysis

- Economic Updates

- US equities and bonds drop ahead of key US CPI figure and Rate-hike odds rise

- Home

- News & Analysis

- Economic Updates

- US equities and bonds drop ahead of key US CPI figure and Rate-hike odds rise

News & AnalysisNews & Analysis

News & AnalysisNews & AnalysisUS equities and bonds drop ahead of key US CPI figure and Rate-hike odds rise

10 August 2022 By Lachlan MeakinUS equities markets were jittery on Tuesday as traders await todays closely watched inflation figures out of the US. All major Indices declined with the rate and risk sensitive Nasdaq taking the biggest hit dropping 1.2%, selloffs in heavyweight Tesla (TSLA) and Nvidia (NVDIA) created further pressure for the tech index.

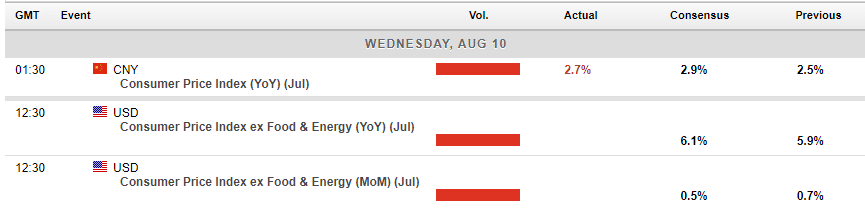

Todays core and headline CPI print will be crucial in gauging near term Fed actions with recent whipsawing in rate expectations driving equity and FX markets. With an around a 60% chance priced in by bond markets of a 75bp hike in September from the Fed, the CPI figures take on extra importance as rate markets will be looking for signs of inflation peaking– and a less aggressive Fed, or Inflation still on an upward trajectory resulting in a more aggressive Fed.

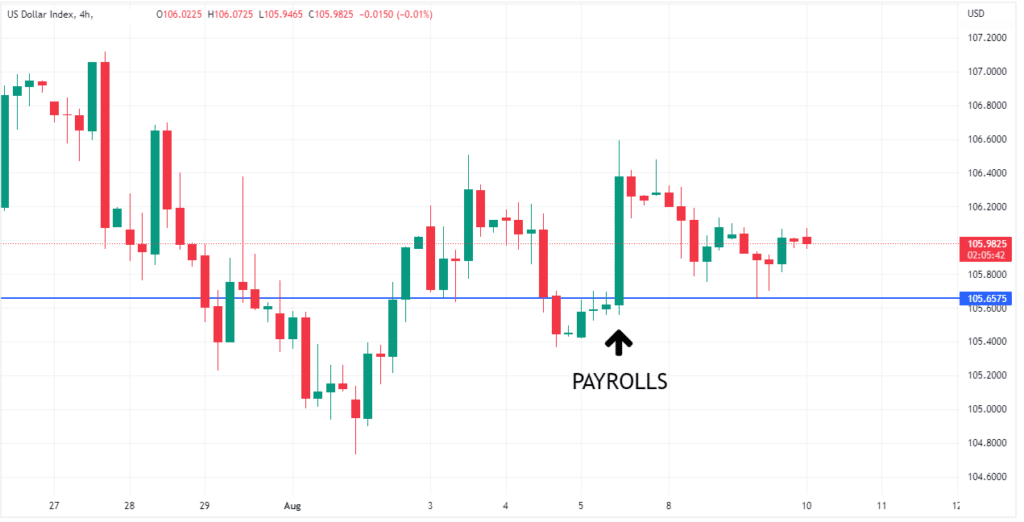

FX markets had a very quiet session, with FX traders seemingly waiting on the sideline until the US CPI figure is released, with the US dollar index ending unchanged after some early weakness (testing down to pre-payrolls levels) was reversed.

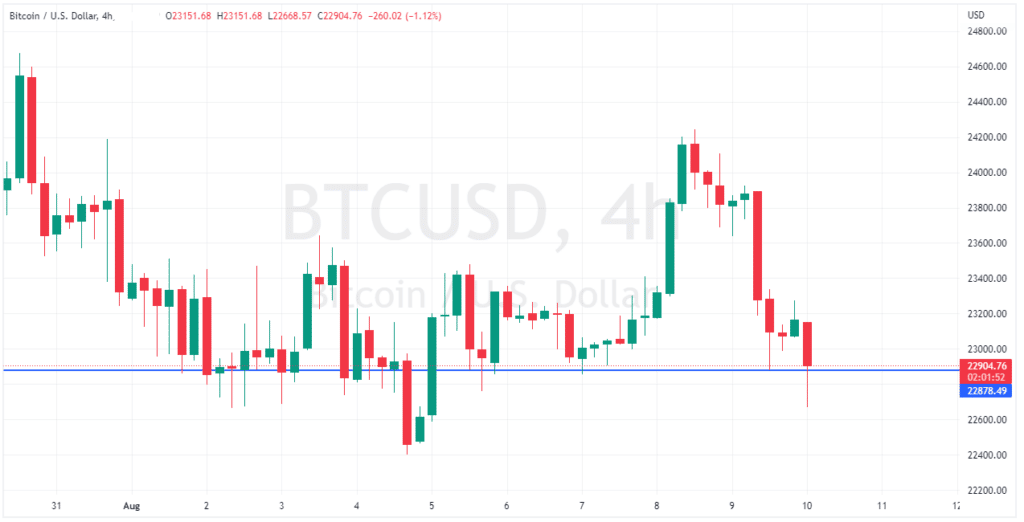

Bitcoin slipped lower on interest rate worries, testing support below $23k

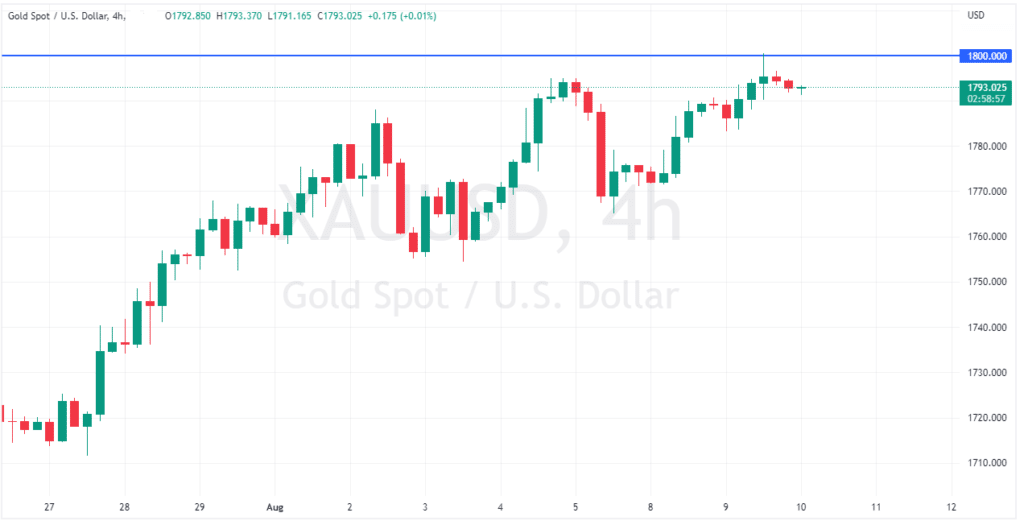

Gold pushed back up to test the 1800 level, before retracing on late session USD strength.

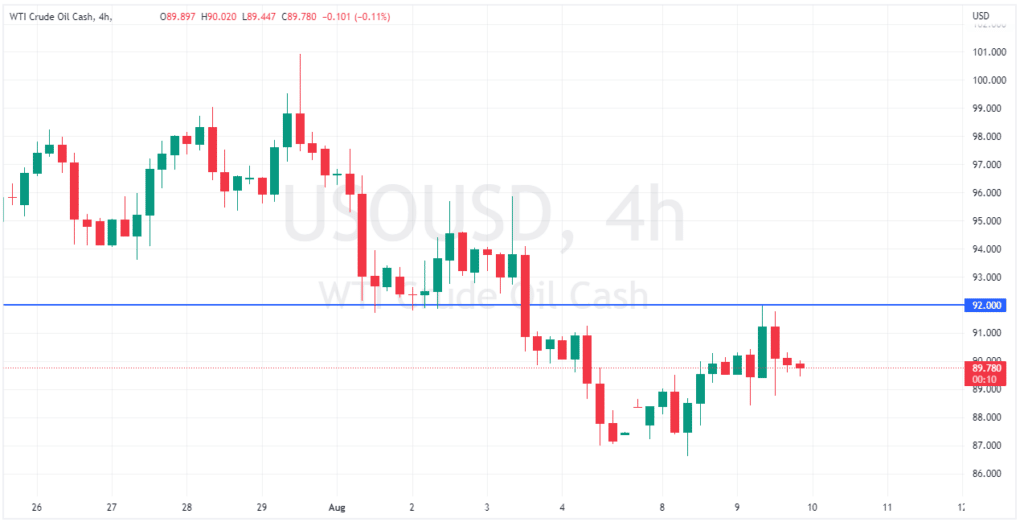

US crude oil tested the $92 resistance level before dipping to finish the session marginally lower. Weighing on the crude price was indications that Russian crude shipments via a major pipeline to Europe may resume in a few days, Also the potential return of Iranian oil to the market.

Tonight’s US CPI figure will be released at 10:30pm AEST (12:30pm GMT)

The information provided is of general nature only and does not take into account your personal objectives, financial situations or needs. Before acting on any information provided, you should consider whether the information is suitable for you and your personal circumstances and if necessary, seek appropriate professional advice. All opinions, conclusions, forecasts or recommendations are reasonably held at the time of compilation but are subject to change without notice. Past performance is not an indication of future performance. Go Markets Pty Ltd, ABN 85 081 864 039, AFSL 254963 is a CFD issuer, and trading carries significant risks and is not suitable for everyone. You do not own or have any interest in the rights to the underlying assets. You should consider the appropriateness by reviewing our TMD, FSG, PDS and other CFD legal documents to ensure you understand the risks before you invest in CFDs. These documents are available here.

#Economy #Economics #Finance #MarketsNext Article

Coinbase reports disappointing results for Q2 – the stock is falling

Coinbase Global Inc. (COIN) released its financial results for Q2 after the market close in the US on Tuesday. The company reported revenue that fell short of Wall Street expectations at $808.325 million for Q2 vs. $873.82 million expected. Coinbase reported a loss per share of -$4.98 per share vs. -$2.47 loss per share expected. ''Q2 was ...

August 10, 2022Read More >Previous Article

Bitcoin showing signs of a reversal.

Bitcoin has seen a large tumble in its share price since it reached its peak of 70,000 USD, however there are signs that the price...

August 9, 2022Read More >Please share your location to continue.

Check our help guide for more info.

- Trading