- Trading

- Trading

- Markets

- Markets

- Products overview

- Forex

- Commodities

- Metals

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- Platforms

- Platforms

- Platforms

- Platforms

- Platforms overview

- MetaTrader 4

- MetaTrader 5

- Education

- Education

- Education

- Education

- News & analysis

- Education Hub

- Economic calendar

- Help & support

- Help & support

- About

- Trading

- Trading

- Markets

- Markets

- Products overview

- Forex

- Commodities

- Metals

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- Platforms

- Platforms

- Platforms

- Platforms

- Platforms overview

- MetaTrader 4

- MetaTrader 5

- Education

- Education

- Education

- Education

- News & analysis

- Education Hub

- Economic calendar

- Help & support

- Help & support

- About

- Home

- News & Analysis

- Economic Updates

- US equities decline amid global inflationary headwinds as yields and the Dollar jump.

- Home

- News & Analysis

- Economic Updates

- US equities decline amid global inflationary headwinds as yields and the Dollar jump.

News & AnalysisNews & Analysis

News & AnalysisNews & AnalysisUS equities decline amid global inflationary headwinds as yields and the Dollar jump.

20 October 2022 By Lachlan MeakinUS stocks broke a two-day winning streak with the major indexes finishing moderately lower as global inflation fears lingered after both Canada and the UK CPI figures came in hot, showing signs that the inflation peak may not yet be in.

With risk aversion back (for the day at least) Bonds were sold off (Price down, yields up) with the US 10 year yield soaring back above 4.00%, it’s highest since June 2008. Higher US rates also saw the USD surging, with the Dollar Index topping 113

CHF and JPY were the underperformers as rising US rates, increasing already large rate differentials with these two low yielding currencies. The USDJPY is within touching distance of the psychological 150 mark as traders continue to test the Bank of Japan, almost daring them to repeat their September and likely earlier in October interventions.

One market bucking the risk off narrative was oil with US crude bouncing off support and rallying over 2% after an unexpected draw in crude stocks, despite an announcement from the White House that 15 million barrels would be sold from the SPR.

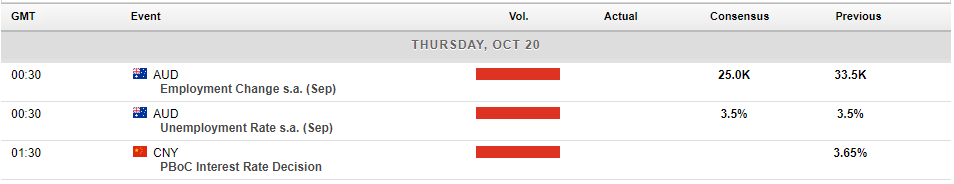

In today’s economic announcements the Employment report out of Australia will be closely watched for clues as to the RBA’s next move after their “dovish” hike at the last meeting. With rate markets fully pricing in a 25bp hike at their November meeting, a strong report could see odds jump for a return to a 50bp hike and see FX and equity markets re-price accordingly.

The information provided is of general nature only and does not take into account your personal objectives, financial situations or needs. Before acting on any information provided, you should consider whether the information is suitable for you and your personal circumstances and if necessary, seek appropriate professional advice. All opinions, conclusions, forecasts or recommendations are reasonably held at the time of compilation but are subject to change without notice. Past performance is not an indication of future performance. Go Markets Pty Ltd, ABN 85 081 864 039, AFSL 254963 is a CFD issuer, and trading carries significant risks and is not suitable for everyone. You do not own or have any interest in the rights to the underlying assets. You should consider the appropriateness by reviewing our TMD, FSG, PDS and other CFD legal documents to ensure you understand the risks before you invest in CFDs. These documents are available here.

#Economy #Economics #Finance #MarketsNext Article

China’s slow growth a worry for Australia?

China, Australia’s savior during the 2009 Global Financial Crisis may not provide the same security in what may be an impending recession. This does not bode well for the Australian economy which so far has performed relatively well in the recent volatile market conditions. The ASX which has been resilient in the global sell off, on the back of i...

October 21, 2022Read More >Previous Article

Is Credit Suisse running out of Credit?

This year has not been kind to the domestic and global economy. The financial woes keep rolling in, this time an old issue has rear its head with one ...

October 20, 2022Read More >Please share your location to continue.

Check our help guide for more info.

- Trading