- Trading

- Trading

- Markets

- Markets

- Products overview

- Forex

- Commodities

- Metals

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- Platforms

- Platforms

- Platforms

- Platforms

- Platforms overview

- MetaTrader 4

- MetaTrader 5

- Education

- Education

- Education

- Education

- News & analysis

- Education Hub

- Economic calendar

- Help & support

- Help & support

- About

- Trading

- Trading

- Markets

- Markets

- Products overview

- Forex

- Commodities

- Metals

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- Platforms

- Platforms

- Platforms

- Platforms

- Platforms overview

- MetaTrader 4

- MetaTrader 5

- Education

- Education

- Education

- Education

- News & analysis

- Education Hub

- Economic calendar

- Help & support

- Help & support

- About

- Home

- News & Analysis

- Economic Updates

- US equities rally on softer PPI figure though upside capped on hawkish Fed rhetoric and geopolitics

- Home

- News & Analysis

- Economic Updates

- US equities rally on softer PPI figure though upside capped on hawkish Fed rhetoric and geopolitics

News & AnalysisNews & Analysis

News & AnalysisNews & AnalysisUS equities rally on softer PPI figure though upside capped on hawkish Fed rhetoric and geopolitics

16 November 2022 By Lachlan MeakinUS markets rallied in a choppy session after a softer Producer inflation figure mirrored the Consumer inflation figure from last week, giving investors optimism that US inflation may have peaked. Gains were tempered though with Fed voting members Barr and Harker both made hawkish comments regarding the Feds fight against inflation and reports of a Russian missile striking Poland.

The Dow Jones eked out a small gain of +0.17% while lower bond yields propelled the more risk-on Nasdaq to a decent gain of 1.5%

In FX markets the US dollar descent continued as the market’s view that inflation and the Fed’s peak tightening is now behind us. The USDJPY pushed below 139 to hit lows not seen since August, though buyers were found at the July high resistance level which now looks to have switched to an important support level and one worth watching as to the next move in this pair.

Cryptos tried to extend their modest rebound from Monday’s steep drop, with Bitcoin briefly rising above $17K before the Russian missile news sent it back down to session lows. it is quite clear that any news – both positive and negative – sends digital tokens tumbling testing the conviction of the HODLers.

In commodities, Crypto falling out of favour seems to be Golds gain as an alternative store of value to fiat currencies. From trading in the mid 1600’s only 2 weeks ago, XAUUSD continued it’s steep through the 1700’s and possibly on the way to testing the major resistance level at 1806.

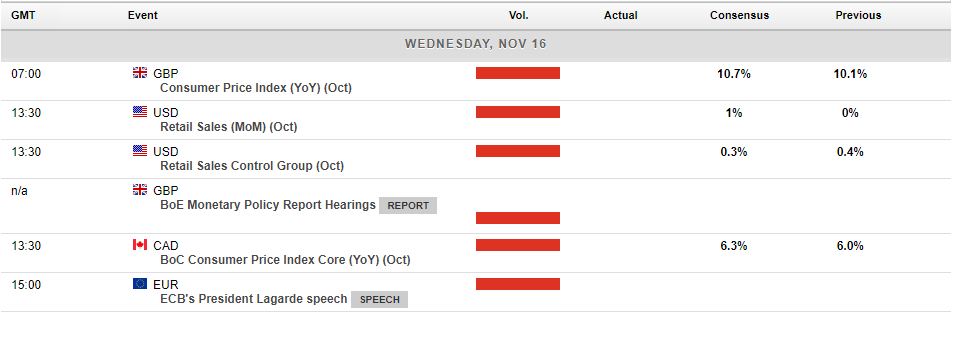

Today’s Economic announcements:

The information provided is of general nature only and does not take into account your personal objectives, financial situations or needs. Before acting on any information provided, you should consider whether the information is suitable for you and your personal circumstances and if necessary, seek appropriate professional advice. All opinions, conclusions, forecasts or recommendations are reasonably held at the time of compilation but are subject to change without notice. Past performance is not an indication of future performance. Go Markets Pty Ltd, ABN 85 081 864 039, AFSL 254963 is a CFD issuer, and trading carries significant risks and is not suitable for everyone. You do not own or have any interest in the rights to the underlying assets. You should consider the appropriateness by reviewing our TMD, FSG, PDS and other CFD legal documents to ensure you understand the risks before you invest in CFDs. These documents are available here.

#Economy #Economics #Finance #MarketsNext Article

Bitcoin ready for its next leg down?

Bitcoin has seen its price plummet after a volatile week largely due to the collapse of Cryptocurrency exchange, FTX. The price of the Bitcoin has fallen to levels not seen since November 2020. The price is now showing signs that it may be in a short-term consolidation before it may sell off again. The downward move may be amplified, especially if ...

November 16, 2022Read More >Previous Article

Walmart posts better-than-expected Q3 results – shares move higher

Walmart Inc. (NYSE: WMT) announced its latest financial results before the market open in the US on Tuesday. World’s largest supermarket chain re...

November 16, 2022Read More >Please share your location to continue.

Check our help guide for more info.

- Trading