- Trading

- Trading

- Markets

- Markets

- Products overview

- Forex

- Commodities

- Metals

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- Platforms

- Platforms

- Platforms

- Platforms

- Platforms overview

- MetaTrader 4

- MetaTrader 5

- Education

- Education

- Education

- Education

- News & analysis

- Education Hub

- Economic calendar

- Help & support

- Help & support

- About

- Trading

- Trading

- Markets

- Markets

- Products overview

- Forex

- Commodities

- Metals

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- Platforms

- Platforms

- Platforms

- Platforms

- Platforms overview

- MetaTrader 4

- MetaTrader 5

- Education

- Education

- Education

- Education

- News & analysis

- Education Hub

- Economic calendar

- Help & support

- Help & support

- About

- Home

- News & Analysis

- Economic Updates

- US equities rise ahead of Midterm results in choppy session as Crypto craters

- Home

- News & Analysis

- Economic Updates

- US equities rise ahead of Midterm results in choppy session as Crypto craters

News & AnalysisNews & Analysis

News & AnalysisNews & AnalysisUS equities rise ahead of Midterm results in choppy session as Crypto craters

9 November 2022 By Lachlan MeakinUS equities got off to flying start with reports of possible peace talks between Russia and Ukraine and a softening in the rate environment saw solid gains across the major indices for the first half of the session. Chaos in the Crypto market then hit dragging down stocks before a bounce off technical levels saw the Dow Jones still finish up over 1%.

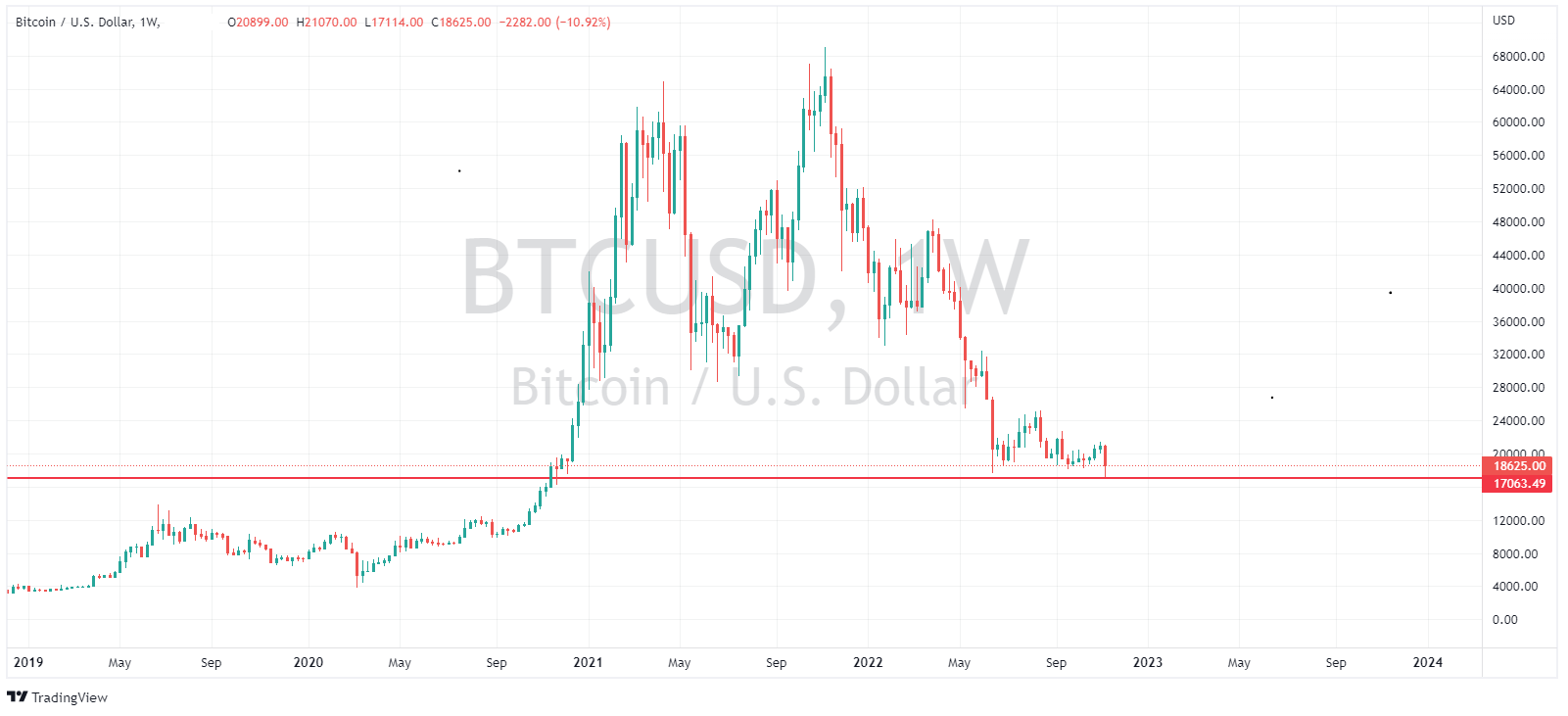

Crypto markets were routed as founder of FTX crypto exchange Sam Bankman-Fried conceded it had liquidity problems amid a flood of withdrawals. As a result Binance has agreed to acquire the world’s largest crypto exchange but not before an interesting Twitter spat between the Binance CEO “CZ” and FTX founder and CEO Sam Bankman-Fried. Bitcoin crashed below 2022 lows down to lows not seen since November 2020

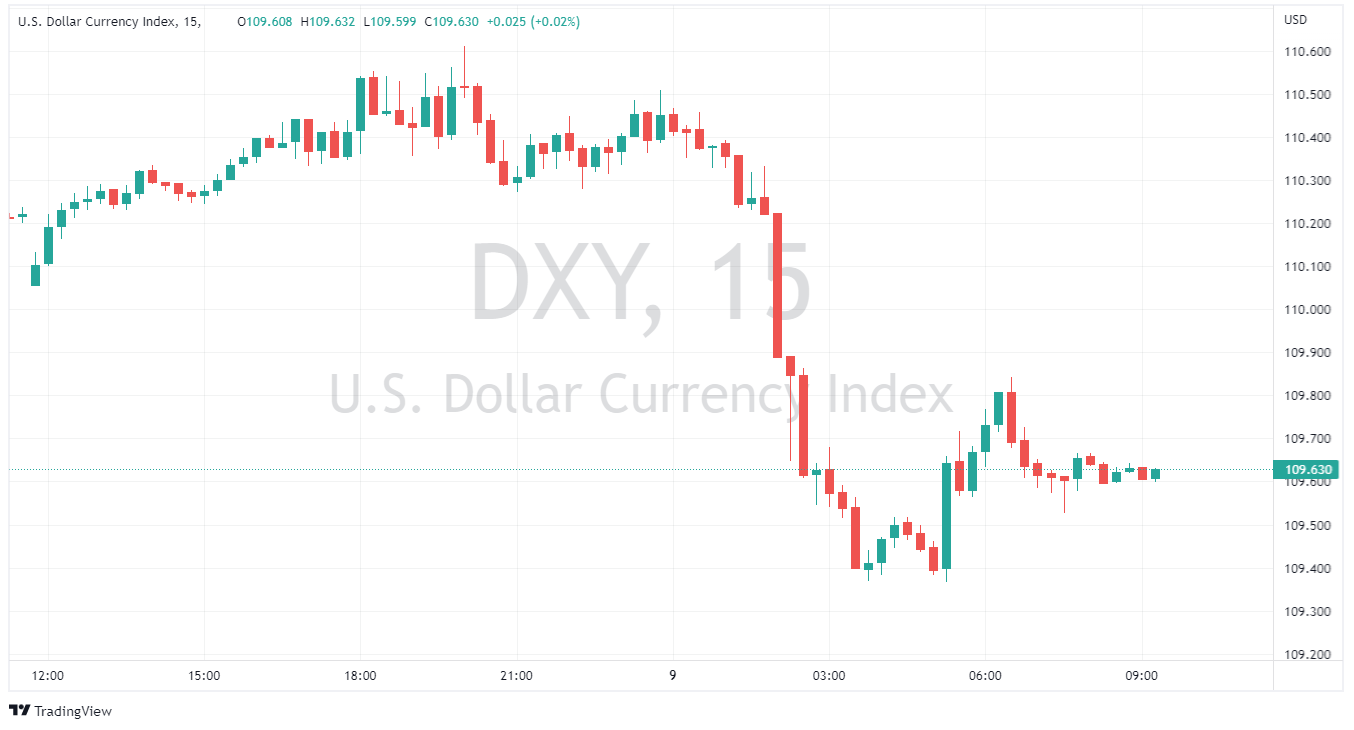

The US Dollar index tumbled to 7 week lows, dropping below 110 and seeing EURUSD get back above parity, the Euro was helped by hawkish comments from ECB members de Guindos and Nagel, both who commented that the ECB should not let up in its inflation fight.

Dollar weakness and an uncertain risk environment saw gold spike up to over 1700 USD per ounce setting 5-week highs.

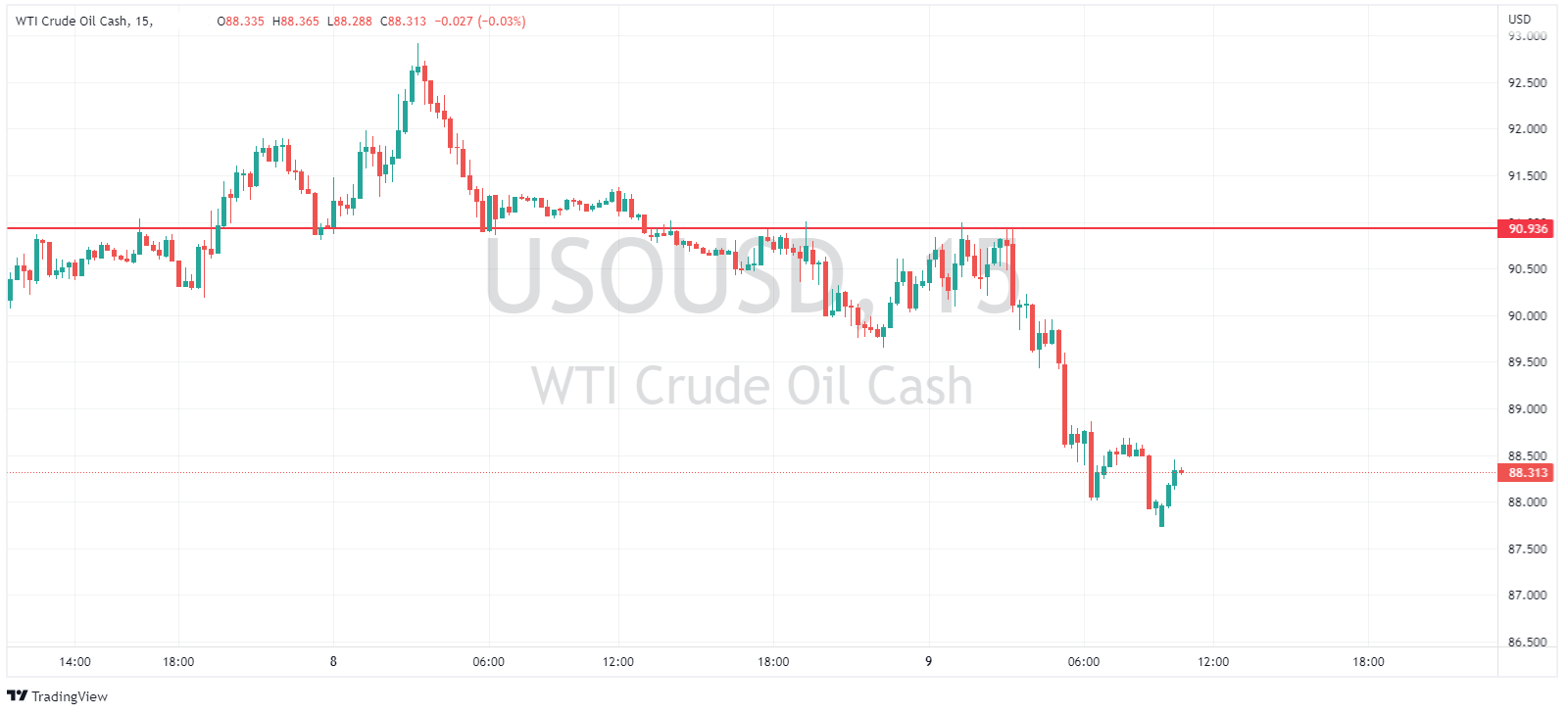

Crude oil plunged along with cryptos , down 3% for the session after stalling at the major resistance just below $91 as China Covid woes and comments from Omans energy minister who sees oil prices falling after the winter season weighed on the price.

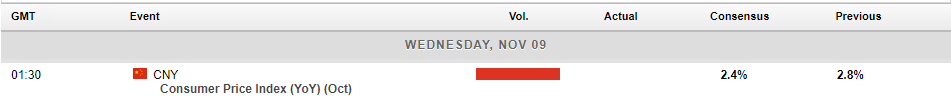

Todays calendar is very light, with the only tier 1 scheduled release being Chinese CPI, US Midterm results filtering through will be the premier risk event for the next day or two.

The information provided is of general nature only and does not take into account your personal objectives, financial situations or needs. Before acting on any information provided, you should consider whether the information is suitable for you and your personal circumstances and if necessary, seek appropriate professional advice. All opinions, conclusions, forecasts or recommendations are reasonably held at the time of compilation but are subject to change without notice. Past performance is not an indication of future performance. Go Markets Pty Ltd, ABN 85 081 864 039, AFSL 254963 is a CFD issuer, and trading carries significant risks and is not suitable for everyone. You do not own or have any interest in the rights to the underlying assets. You should consider the appropriateness by reviewing our TMD, FSG, PDS and other CFD legal documents to ensure you understand the risks before you invest in CFDs. These documents are available here.

#Economy #Economics #Finance #MarketsNext Article

Crypto Crashes as exchange, FTX, faces liquidity crisis.

Bitcoin has dropped dramatically over the last 24 hours to its lowest level for the year after fears were sparked that major player FTX faced a liquidity crisis. In the last two years cryptocurrency has become available to large institutions and funds which has increased the overall size of the market. However, at the same time it has made it vulne...

November 9, 2022Read More >Previous Article

Disney falls short of expectations – the stock tumbles in the after-hours

The Walt Disney Company (NYSE: DIS) reported the latest financial results for the fourth quarter and fiscal year ended October 1, 2022, after the clos...

November 9, 2022Read More >Please share your location to continue.

Check our help guide for more info.

- Trading