- Trading

- Trading

- Markets

- Markets

- Products overview

- Forex

- Commodities

- Metals

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- Platforms

- Platforms

- Platforms

- Platforms

- Platforms overview

- MetaTrader 4

- MetaTrader 5

- Education

- Education

- Education

- Education

- News & analysis

- Education Hub

- Economic calendar

- Help & support

- Help & support

- About

- Trading

- Trading

- Markets

- Markets

- Products overview

- Forex

- Commodities

- Metals

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- Platforms

- Platforms

- Platforms

- Platforms

- Platforms overview

- MetaTrader 4

- MetaTrader 5

- Education

- Education

- Education

- Education

- News & analysis

- Education Hub

- Economic calendar

- Help & support

- Help & support

- About

- Home

- News & Analysis

- Economic Updates

- US equities snap five day losing streak, Oil tumbles on recession fears

- Home

- News & Analysis

- Economic Updates

- US equities snap five day losing streak, Oil tumbles on recession fears

News & AnalysisNews & Analysis

News & AnalysisNews & AnalysisUS equities snap five day losing streak, Oil tumbles on recession fears

9 December 2022 By Lachlan MeakinUS equities rose in Thursday’s session in a subdued risk environment ahead that saw traders tiptoeing ahead of next week’s US CPI figures and FOMC meeting.

US indexes broke a five-day losing streak with the Nasdaq advancing 1.1% after having its worst first week of December since 1975 and being the best performer in the session.

It was another relatively quiet day for macro news but recessionary fears were re-ignited somewhat after US continuing unemployment claims jumped to a 10-month high with Bloomberg noting, “claims data is pointing to a recession as continuing claims are above their one-year low by a margin that has always preceded a slump.”

This recession-threatening jobs data saw crude oil crashing after an earlier rip higher on news the Keystone pipeline was shut down due to a leak (halting flows up to 600,000 b/d)

The US dollar drifted lower through the session with USDCAD testing support at 1.3560 before finding some buyers. CAD being helped along by a 50bp Hike from the Bank of Canada on Wednesday.

Bitcoin surged higher from the low of its recent range of 16500 – 17500, on the way to testing the top end which will be a critical level to see if the push higher in cryptos has any legs after recent controversies.

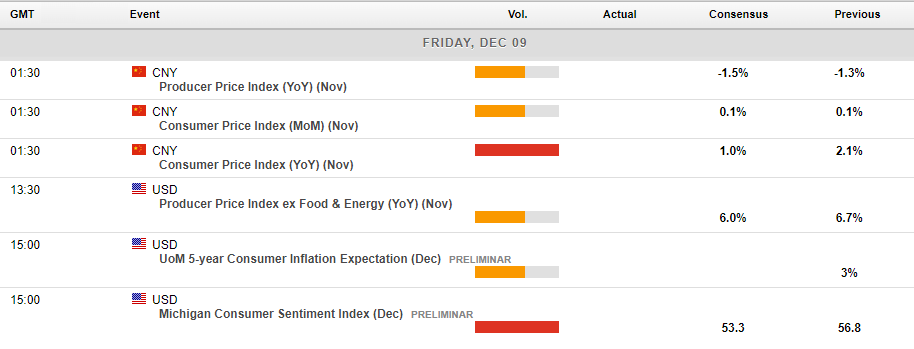

Todays economic calendar is fairly light again with CPI figures out of China expected to show a slight slowdown in inflation, out of the US we have consumer confidence, which may play into the recession them, and PPI figures.

The information provided is of general nature only and does not take into account your personal objectives, financial situations or needs. Before acting on any information provided, you should consider whether the information is suitable for you and your personal circumstances and if necessary, seek appropriate professional advice. All opinions, conclusions, forecasts or recommendations are reasonably held at the time of compilation but are subject to change without notice. Past performance is not an indication of future performance. Go Markets Pty Ltd, ABN 85 081 864 039, AFSL 254963 is a CFD issuer, and trading carries significant risks and is not suitable for everyone. You do not own or have any interest in the rights to the underlying assets. You should consider the appropriateness by reviewing our TMD, FSG, PDS and other CFD legal documents to ensure you understand the risks before you invest in CFDs. These documents are available here.

#Economy #Economics #Finance #MarketsNext Article

Recessionary fears continue to build ahead of cash rate changes

It is expected to be a big week for equity markets with important economic data to come out this week. Central Banks in England, Europe, and the USA all to announce their updated official cash rates. This should hopefully provide some market direction before the end of the year. Last week the market failed to break out through its long term down tr...

December 12, 2022Read More >Previous Article

Oil continues to fall amid news of price cap

The primary reason for the drop in price is the economic slowdown that has become prevalent in the global market. As fears of a recession continue to ...

December 8, 2022Read More >Please share your location to continue.

Check our help guide for more info.

- Trading