- Trading

- Trading

- Markets

- Markets

- Products overview

- Forex

- Commodities

- Metals

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- Platforms

- Platforms

- Platforms

- Platforms

- Platforms overview

- MetaTrader 4

- MetaTrader 5

- Education

- Education

- Education

- Education

- News & analysis

- Education Hub

- Economic calendar

- Help & support

- Help & support

- About

- Trading

- Trading

- Markets

- Markets

- Products overview

- Forex

- Commodities

- Metals

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- Platforms

- Platforms

- Platforms

- Platforms

- Platforms overview

- MetaTrader 4

- MetaTrader 5

- Education

- Education

- Education

- Education

- News & analysis

- Education Hub

- Economic calendar

- Help & support

- Help & support

- About

- Home

- News & Analysis

- Economic Updates

- US equities under pressure as Tech tumbles to worst losing streak in 6 years

- Home

- News & Analysis

- Economic Updates

- US equities under pressure as Tech tumbles to worst losing streak in 6 years

News & AnalysisNews & Analysis

News & AnalysisNews & AnalysisUS equities under pressure as Tech tumbles to worst losing streak in 6 years

7 September 2022 By Lachlan MeakinUS equities returned from the Labor day holiday continuing from the selling pressures last week in anticipation of hawkish central bank policies and an ongoing energy crunch in Europe.

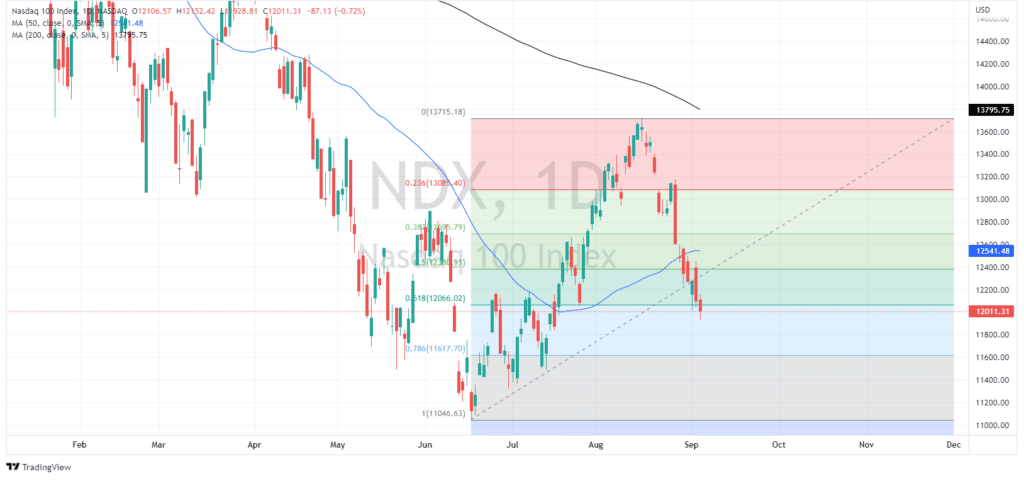

Tech was particularly hard hit as risk off remains the market narrative, the Nasdaq had its 7th straight down day, it’s longest losing streak since 2016. The Nasdaq 100 is now down over 12% from the high of the bear rally in mid-August, and has blown through the important technical levels of the 50 day MA and 61.8% Fib retracement of that rally.

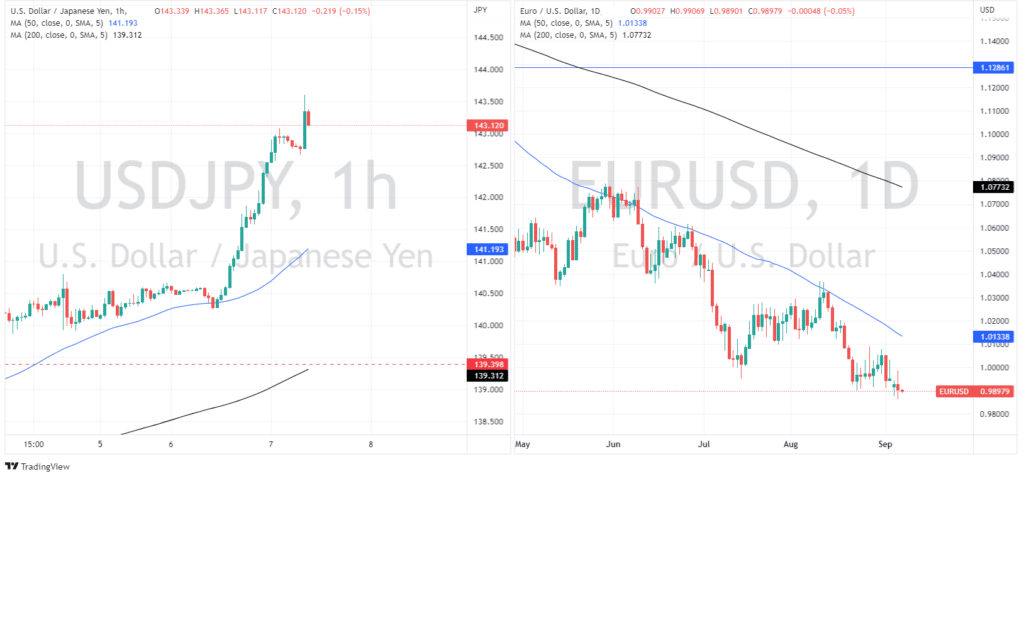

Tech wasn’t the only big mover as traders looked to take risk off the table, Bond yields also surged with the US 10-year surging around 13bp as investors priced in a more hawkish Federal reserve. This saw the USD outperform on a combination of a flight to safety and hawkish yield re-pricing saw the EURUSD break below 0.99 and the USDJPY rocket past 143 as yield differentials saw outflows from EUR and JPY to the USD.

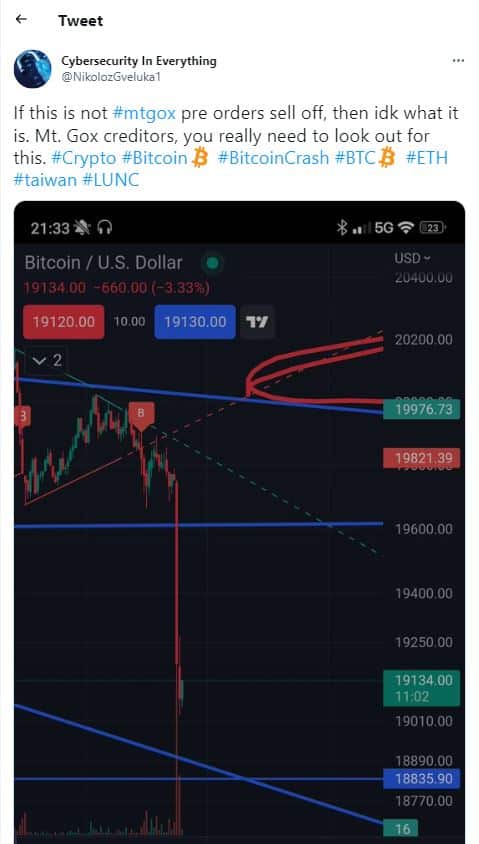

Bitcoin was hammered lower, breaking the support level of 19500 that held in August and testing the lows of July. This on the back of the tech route and unconfirmed reports this may be initial dump of MtGox holdings that were seized by US and Japanese authorities previously.

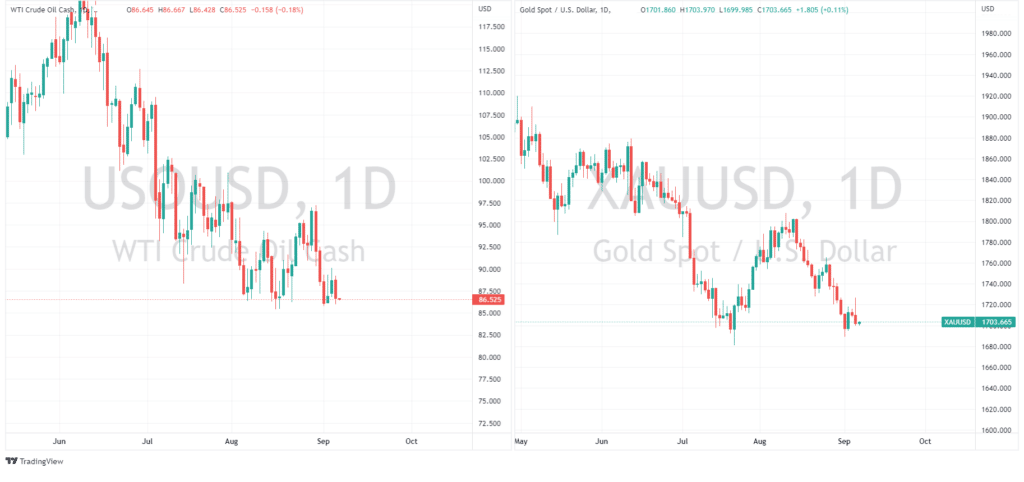

Gold fell back with USD strength and rising yields seeing it testing its 1700 support level, Oil also dropped , giving back most of Fridays OPEC+ production cut rally, USD strength and growth concerns being a major headwind.

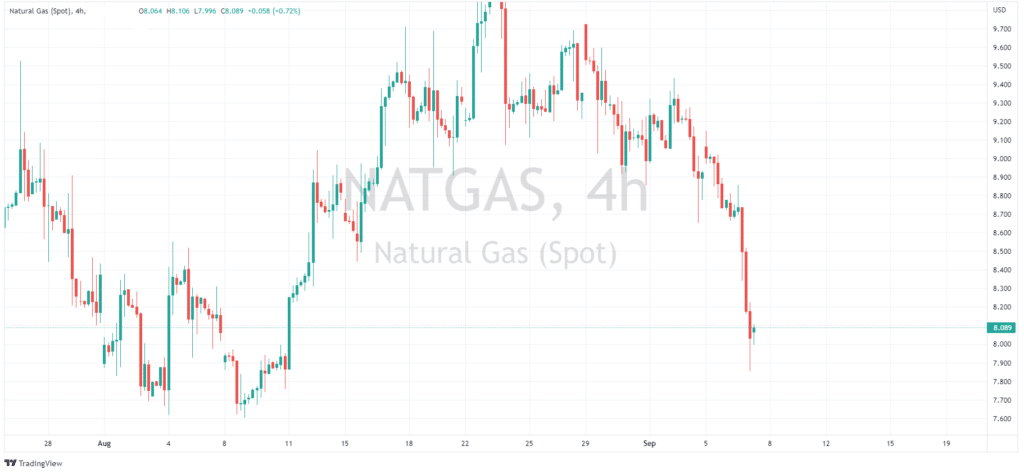

The big mover in commodities overnight though was US Natural gas which plunged over 7% , hitting a four-week low, as soaring output coupled with lower demand forecasts hit prices.

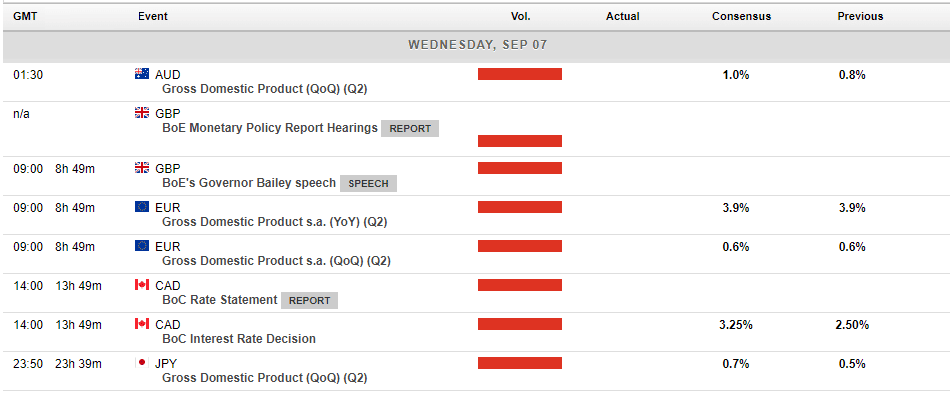

In today’s economic announcements, Australian GDP for Q2 is set to be released at 11:30 AEST where an increase of 0.9% is expected. After yesterdays fairly middle of the road RBA policy statement a reading inline with the forecast would be the most likely outcome and probably won’t see much movement in AUD or Aussie equities.

Later in the day, the Bank of Canada will be releasing their rate statement where a hike of 75bp is expected after Julys supersized 100bp hike surprised the markets.

The information provided is of general nature only and does not take into account your personal objectives, financial situations or needs. Before acting on any information provided, you should consider whether the information is suitable for you and your personal circumstances and if necessary, seek appropriate professional advice. All opinions, conclusions, forecasts or recommendations are reasonably held at the time of compilation but are subject to change without notice. Past performance is not an indication of future performance. Go Markets Pty Ltd, ABN 85 081 864 039, AFSL 254963 is a CFD issuer, and trading carries significant risks and is not suitable for everyone. You do not own or have any interest in the rights to the underlying assets. You should consider the appropriateness by reviewing our TMD, FSG, PDS and other CFD legal documents to ensure you understand the risks before you invest in CFDs. These documents are available here.

#Economy #Economics #Finance #MarketsNext Article

NIO Q2 results have arrived

NIO Q2 results have arrived NIO Inc. (NIO) reported its unaudited second quarter financial results on Wednesday. The Chinese electric vehicle maker reported revenue of $1.538 billion for the quarter, beating analyst estimate of $1.458 billion. Loss per share reported at -$0.20 per share vs. -$0.16 loss per share expected. William Bin Li...

September 8, 2022Read More >Previous Article

Market Recap – A look at the markets after the Labor Day Weekend U.S.

You may already be aware that our financial markets here in Australia and around the world are so closely intertwined that any event, decision or ...

September 7, 2022Read More >Please share your location to continue.

Check our help guide for more info.

- Trading