- Trading

- Trading

- Markets

- Markets

- Products overview

- Forex

- Commodities

- Metals

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- Platforms

- Platforms

- Platforms

- Platforms

- Platforms overview

- MetaTrader 4

- MetaTrader 5

- Education

- Education

- Education

- Education

- News & analysis

- Education Hub

- Economic calendar

- Help & support

- Help & support

- About

- Trading

- Trading

- Markets

- Markets

- Products overview

- Forex

- Commodities

- Metals

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- Platforms

- Platforms

- Platforms

- Platforms

- Platforms overview

- MetaTrader 4

- MetaTrader 5

- Education

- Education

- Education

- Education

- News & analysis

- Education Hub

- Economic calendar

- Help & support

- Help & support

- About

- Home

- News & Analysis

- Economic Updates

- US Indices hit three-month highs on solid Walmart earnings, meme stocks pump and dump

- Home

- News & Analysis

- Economic Updates

- US Indices hit three-month highs on solid Walmart earnings, meme stocks pump and dump

News & AnalysisNews & Analysis

News & AnalysisNews & AnalysisUS Indices hit three-month highs on solid Walmart earnings, meme stocks pump and dump

17 August 2022 By Lachlan MeakinUS got off to a flying start in Tuesdays session after retail giant Walmart (WMT.NYSE) reported much better results and forward guidance than the recently lowered expectations of analysts, sending the stock soaring over 5%, and dragging the whole consumer discretionary sector with it.

See Analyst Klavs Walters Walmart report for an in depth view of Walmart earnings

Same late session weakness was seen with the Dow and S&P 500 drifting lower, but managing to end with gains, while the Nasdaq finished the session moderately lower.

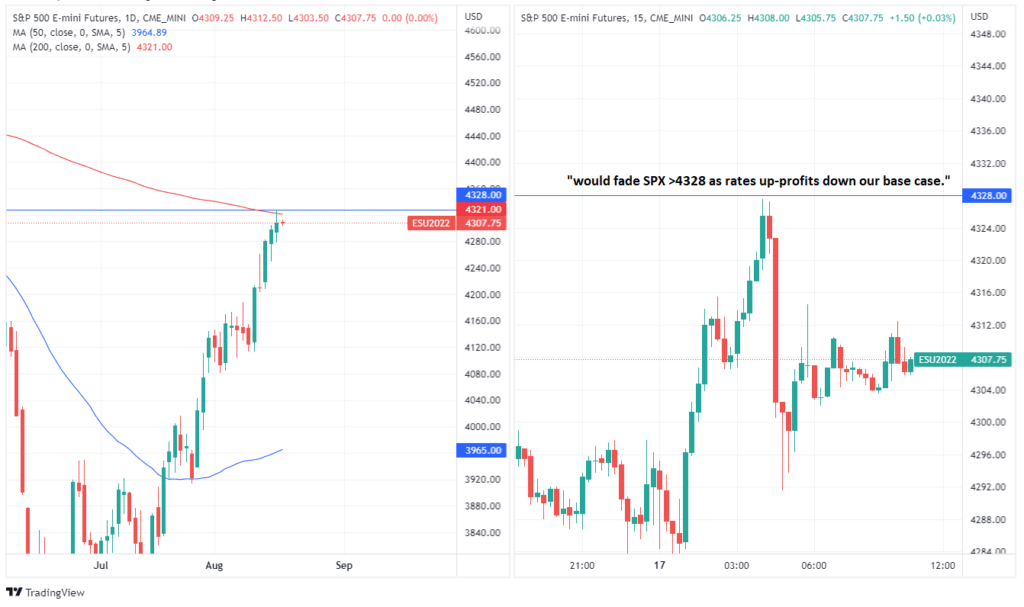

Technically, the S&P price action was interesting with the 200 day moving average acting as strong resistance and hitting a high of 4327.5, just under the 4328 level that one of Wall Street most accurate strategists Michael Hartnett of Bank of America recently said that he “would fade SPX >4328 as rates up-profits down our base case.”

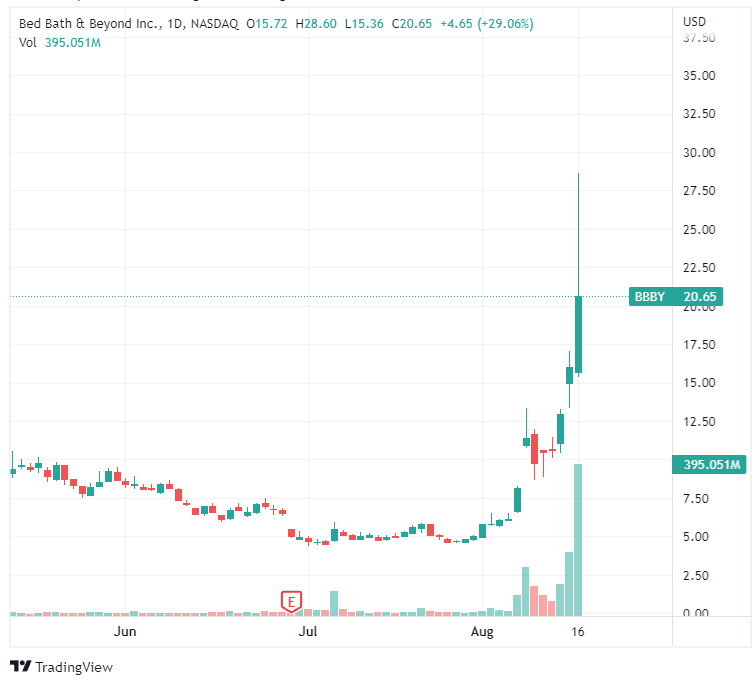

Meme stocks had a roller coaster of a session, chief among them was under pressure retailer Bed Bath and Beyond (BBBY.NAS) exploding 75% higher at one stage before dumping on frenzied profit taking, but still managing to finish the session 29% higher.

Crude Oil had a volatile session after an early bounce on the back of lessened recession fears on the back of strong corporate earnings, quickly turned around with Oil tumbling to its lowest level since January. Speculation of an “imminent” Iranian nuclear deal coupled with more fears about China’s waning oil demand weighed on the price of oil with both Brent and WTI finishing down around 3% for the session

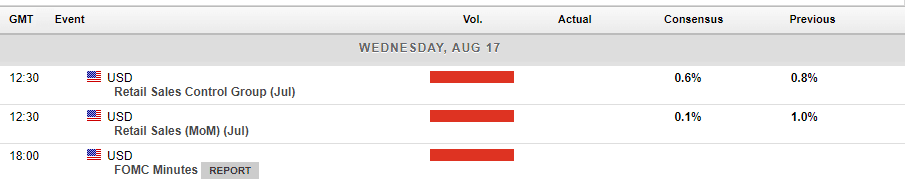

In FX market a very quiet session was had with most FX pairs finishing mostly flat for the session, the US economy continues to send mixed signals with disappointing manufacturing figures offset by robust industrial production figures with a backdrop of a CPI slowdown and strong employment figures making it difficult for traders to take a position on the Federal Reserves next move. Todays FOMC minutes will take on even more importance as any clues to the Feds plans should see traders readjusting FX exposure, expect some volatility in the USD at 2pm EST (6pm GMT, 4am AEST)

The information provided is of general nature only and does not take into account your personal objectives, financial situations or needs. Before acting on any information provided, you should consider whether the information is suitable for you and your personal circumstances and if necessary, seek appropriate professional advice. All opinions, conclusions, forecasts or recommendations are reasonably held at the time of compilation but are subject to change without notice. Past performance is not an indication of future performance. Go Markets Pty Ltd, ABN 85 081 864 039, AFSL 254963 is a CFD issuer, and trading carries significant risks and is not suitable for everyone. You do not own or have any interest in the rights to the underlying assets. You should consider the appropriateness by reviewing our TMD, FSG, PDS and other CFD legal documents to ensure you understand the risks before you invest in CFDs. These documents are available here.

#Economy #Economics #Finance #MarketsNext Article

Target falls short in Q2 – the stock is down

Target Corporation (TGT) reported its second quarter earnings results before the opening bell on Wall Street on Wednesday. The US retailer reported revenue of $26.037 billion (up 3.5% year-over-year), which was slightly above analyst estimate of $26.032 billion. Earnings per share reported at $0.39 per share (down 89.2% year-over-year) vs. $0...

August 18, 2022Read More >Previous Article

Walmart tops expectations for Q2 – the stock is up

Walmart tops expectations for Q2 – the stock is up Walmart Inc. (WMT) announced its Q2 financial results before the market open on Wall Street on...

August 17, 2022Read More >Please share your location to continue.

Check our help guide for more info.

- Trading