- Trading

- Trading

- Markets

- Markets

- Products overview

- Forex

- Commodities

- Metals

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- Platforms

- Platforms

- Platforms

- Platforms

- Platforms overview

- MetaTrader 4

- MetaTrader 5

- Education

- Education

- Education

- Education

- News & analysis

- Education Hub

- Economic calendar

- Help & support

- Help & support

- About

- Trading

- Trading

- Markets

- Markets

- Products overview

- Forex

- Commodities

- Metals

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- Platforms

- Platforms

- Platforms

- Platforms

- Platforms overview

- MetaTrader 4

- MetaTrader 5

- Education

- Education

- Education

- Education

- News & analysis

- Education Hub

- Economic calendar

- Help & support

- Help & support

- About

- Home

- News & Analysis

- Articles

- Economic Updates

- US stocks continue rally, Gold takes a big hit and EURUSD outperforms ahead of pivotal FOMC meeting

- Home

- News & Analysis

- Articles

- Economic Updates

- US stocks continue rally, Gold takes a big hit and EURUSD outperforms ahead of pivotal FOMC meeting

News & AnalysisNews & Analysis

News & AnalysisNews & AnalysisUS stocks continue rally, Gold takes a big hit and EURUSD outperforms ahead of pivotal FOMC meeting

22 March 2023 By Lachlan MeakinUS equities rallied for a second day amid further stability in the banking sector with assurances from treasury secretary Janet Yellen that the US financial system was safe helping to improve investors mood.

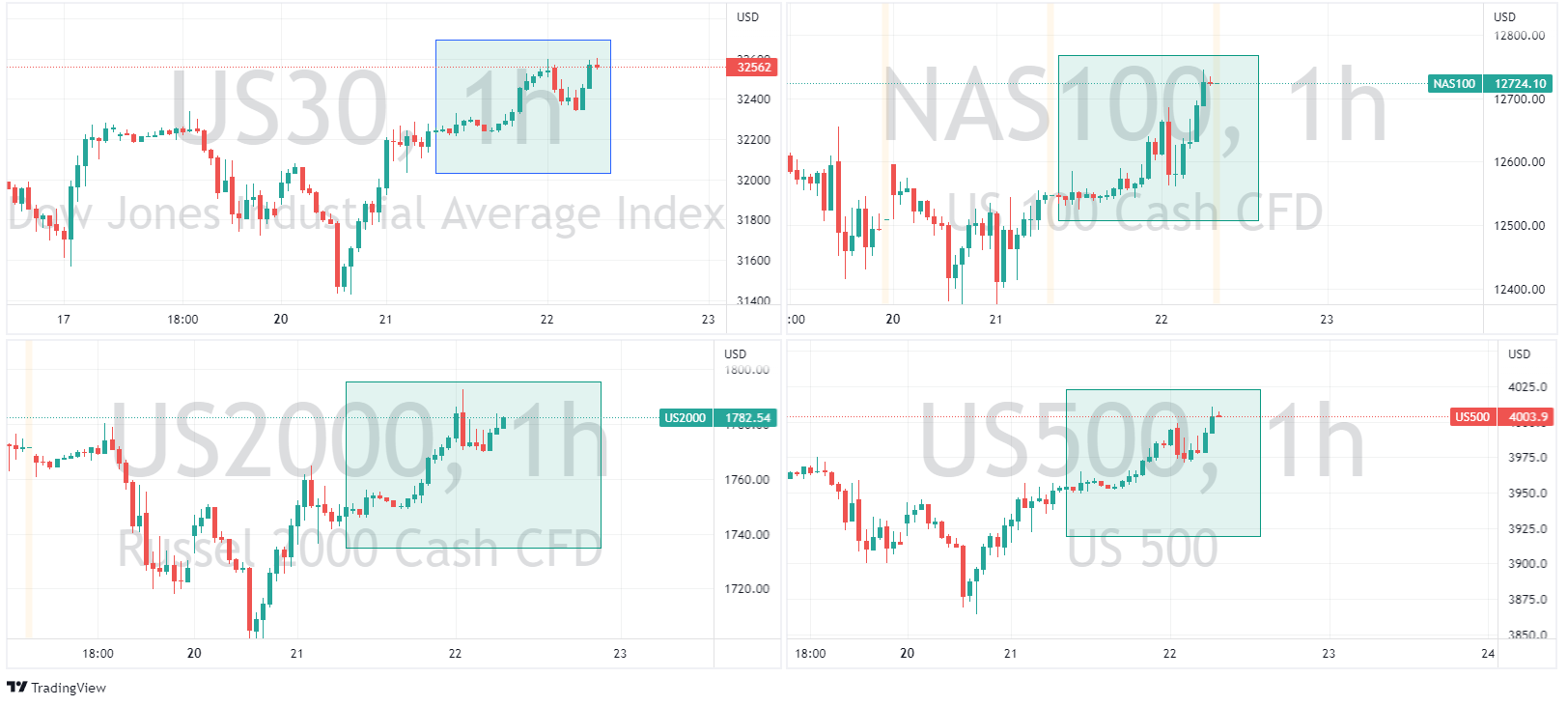

All major indexes finished in the green with a big bounce in regional banks seeing the Russel 2000 outperform, up almost 2% on the day, with the risk sensitive Nasdaq not far behind.

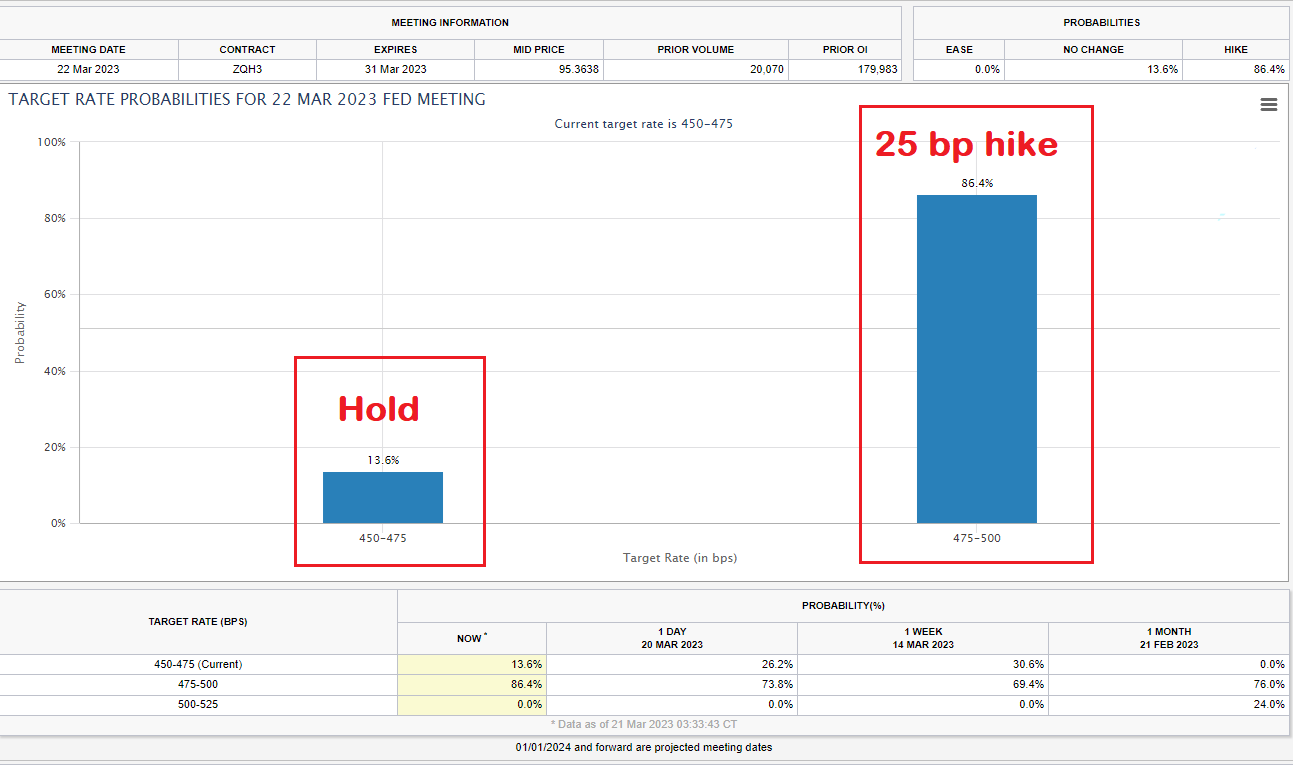

An easing of fears saw the markets reprice a higher chance of a Fed rate hike later today, what was a 50 -50 bet between a hike or a pause a few days ago has now moved to the Fed funds pricing in a 85% chance of a 25bp hike in today’s pivotal meeting.

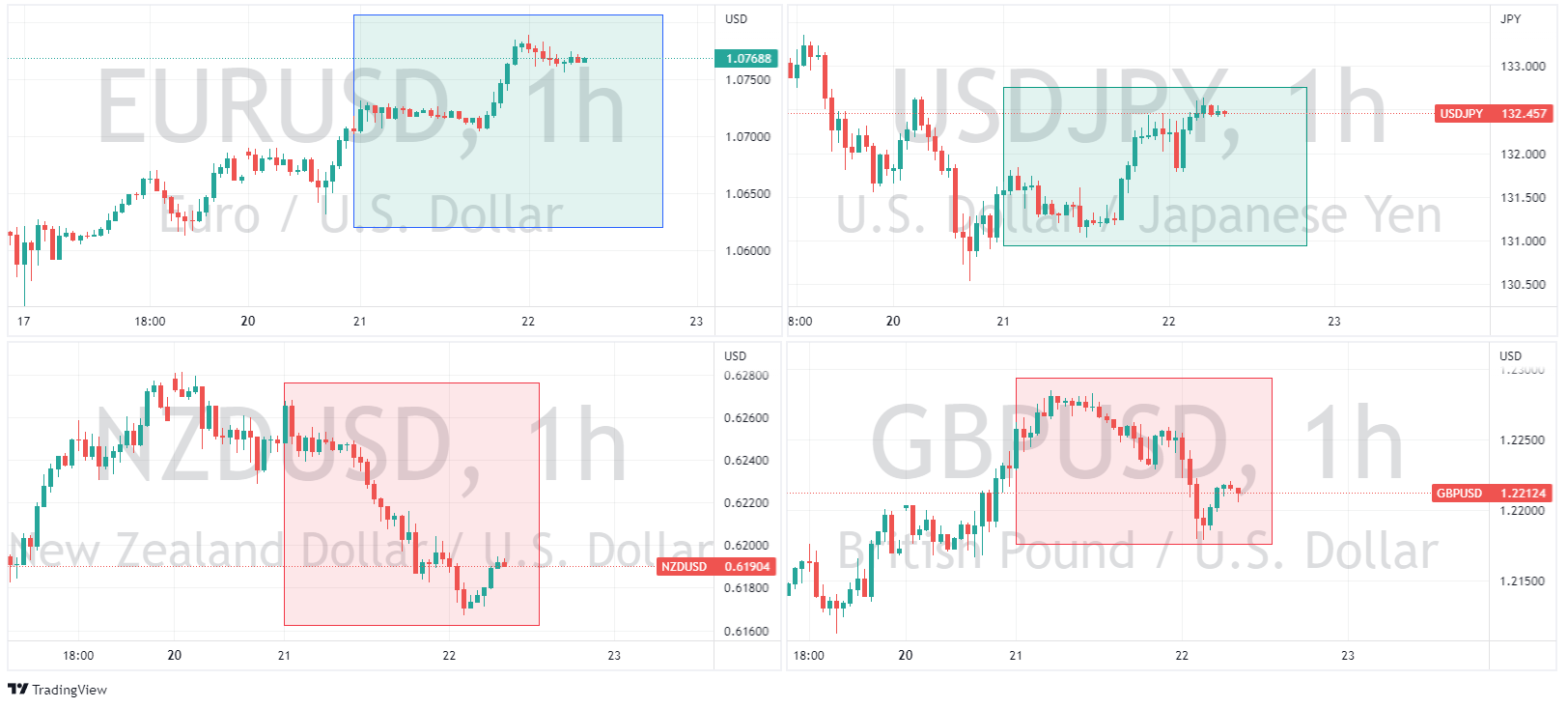

In FX markets, this repricing saw the US dollar stronger against most it’s peers, with the big exception of the Euro which continued to rally on some hawkish comments from the ECB, it set new March highs and is on the way to test the Feb highs. Higher yield differentials didn’t help the Yen, and again the laggard was the NZD as recession fears still linger, the NZD being particularly sensitive to risk.

Higher yields and improving risk sentiment also saw gold take a big hit, dropping almost $40 an ounce to the 1940 level.

WTI Oil also continued it’s rally from Monday, surging back above the 69$ a barrel level, just stopping short of it’s 70$ a barrel resistance level, which will be a big level to watch in the coming days.

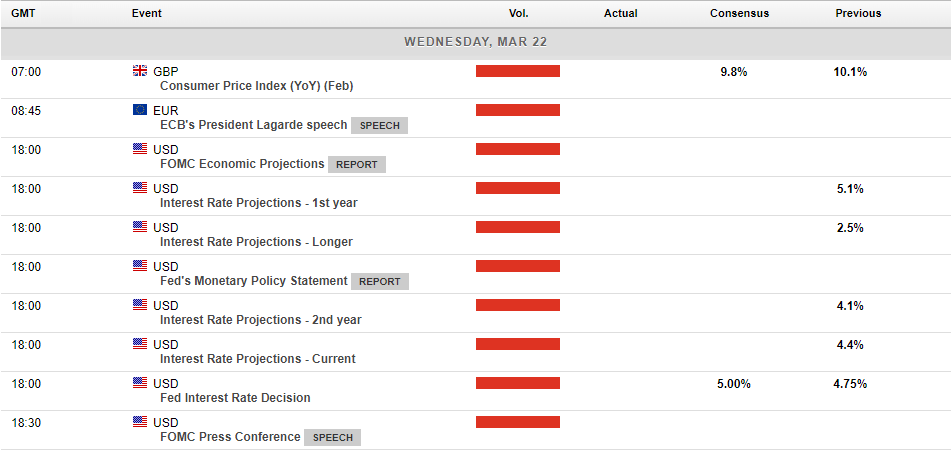

Later today, we have the first of the Major Central banks rate decisions, this one is the big one with the FOMC, markets are pricing in a 25bp hike, but most the action I suspect will come from the accompanying statement as traders look to see what the Fed has to say about recent bank crisis and what clues are given as to their future direction. Major volatility over this announcement is a given.

The information provided is of general nature only and does not take into account your personal objectives, financial situations or needs. Before acting on any information provided, you should consider whether the information is suitable for you and your personal circumstances and if necessary, seek appropriate professional advice. All opinions, conclusions, forecasts or recommendations are reasonably held at the time of compilation but are subject to change without notice. Past performance is not an indication of future performance. Go Markets Pty Ltd, ABN 85 081 864 039, AFSL 254963 is a CFD issuer, and trading carries significant risks and is not suitable for everyone. You do not own or have any interest in the rights to the underlying assets. You should consider the appropriateness by reviewing our TMD, FSG, PDS and other CFD legal documents to ensure you understand the risks before you invest in CFDs. These documents are available here.

#Economy #Economics #Finance #MarketsNext Article

The Fed, between a rock and a hard place – FOMC preview

Todays FOMC rate decision is certainly in play, with recent turmoil in the banking sector caused in no small part by aggressive Fed hikes over the last 12 months, throws a very big spanner in the works of the Feds plan to combat inflation. Up until a couple of weeks ago a 50bp hike was pretty much fully priced in as the Fed refused to budge on t...

March 22, 2023Read More >Previous Article

Nike results announced

World’s largest sporting goods company, Nike Inc. (NYSE:NKE) reported fiscal 2023 financial results for its third quarter after the closing bell in ...

March 22, 2023Read More >Please share your location to continue.

Check our help guide for more info.

- Trading