- Trading

- Trading

- Markets

- Markets

- Products overview

- Forex

- Commodities

- Metals

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- Platforms

- Platforms

- Platforms

- Platforms

- Platforms overview

- MetaTrader 4

- MetaTrader 5

- Education

- Education

- Education

- Education

- News & analysis

- Education Hub

- Economic calendar

- Help & support

- Help & support

- About

- Trading

- Trading

- Markets

- Markets

- Products overview

- Forex

- Commodities

- Metals

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- Platforms

- Platforms

- Platforms

- Platforms

- Platforms overview

- MetaTrader 4

- MetaTrader 5

- Education

- Education

- Education

- Education

- News & analysis

- Education Hub

- Economic calendar

- Help & support

- Help & support

- About

- Home

- News & Analysis

- Economic Updates

- US stocks continue rally on ugly PMI figures and dovish FOMC minutes

- Home

- News & Analysis

- Economic Updates

- US stocks continue rally on ugly PMI figures and dovish FOMC minutes

News & AnalysisNews & Analysis

News & AnalysisNews & AnalysisUS stocks continue rally on ugly PMI figures and dovish FOMC minutes

24 November 2022 By Lachlan MeakinUS indices finished another session up after a wild ride as the “bad news is good news” narrative saw a steep rally after disappointing services and manufacturing PMI’s were released, then sold off into the European close only to rally steeply again as what was considered dovish FOMC minutes were released late in the session. All major indices finished in the green, with the Nasdaq outperforming, finishing up almost 1%.

The FOMC minutes from November’s meeting were released late in the US session and were taken as mostly dovish. The minutes noted that a substantial majority of Fed members judged “a slowing in the pace of interest rate hikes would likely soon be appropriate”. This appeared to confirm the higher for longer ‘pause’ idea that was considered in the actual FOMC statement, before Chair Powell’s presser spooked the markets earlier in the month. Rates markets were quick to re-price expectations with Fed rate trajectory expectations shifting dovishly and the terminal rate falling and seeing the US dollar tumble to 1-week lows.

Cryptos also gained on improved risk sentiment, Bitcoin has rallied back above $16,500, erasing the losses from the FTX Hacker dumps, Ethereum not far behind.

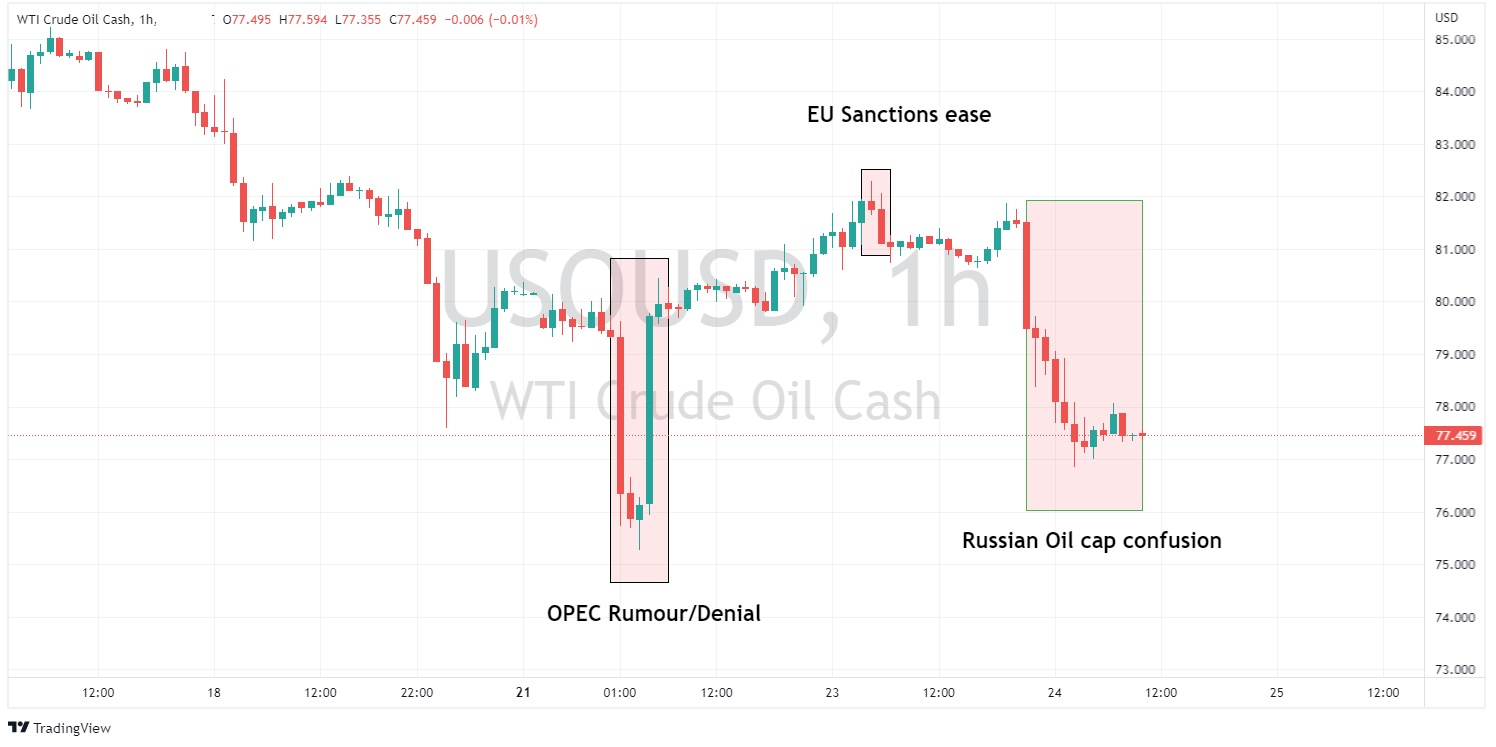

Crude Oil prices were the odd ones out as they fell after continued confusion over Russian oil price caps and US Department Of Energy reports of large product inventory builds. USOUSD tumbled over 4% back to the $77 handle, capping off a roller-coaster of a ride for oil traders this week.

With the US effectively finished for the week due to the Thanksgiving holiday the economic calendar is empty of any major event risks and low volume and volatility looks likely until Monday.

The information provided is of general nature only and does not take into account your personal objectives, financial situations or needs. Before acting on any information provided, you should consider whether the information is suitable for you and your personal circumstances and if necessary, seek appropriate professional advice. All opinions, conclusions, forecasts or recommendations are reasonably held at the time of compilation but are subject to change without notice. Past performance is not an indication of future performance. Go Markets Pty Ltd, ABN 85 081 864 039, AFSL 254963 is a CFD issuer, and trading carries significant risks and is not suitable for everyone. You do not own or have any interest in the rights to the underlying assets. You should consider the appropriateness by reviewing our TMD, FSG, PDS and other CFD legal documents to ensure you understand the risks before you invest in CFDs. These documents are available here.

#Economy #Economics #Finance #MarketsNext Article

What is an Economic Bubble and how to identify it?

Economic Bubbles are highly damaging phenomena’s that occur in financial systems that can cause a great deal of loss and pain to investors and traders. It is important that traders can identify the signs of a Bubble to both capitalise on opportunities and protect against the risk they pose. What is a Bub...

November 24, 2022Read More >Previous Article

Shares of Deere rise as financial results exceed expectations

Shares of Deere rise as financial results exceed expectations Deere & Company (NYSE: DE) announced financial results on Wednesday for the fourt...

November 24, 2022Read More >Please share your location to continue.

Check our help guide for more info.

- Trading