- Trading

- Trading

- Markets

- Markets

- Products overview

- Forex

- Commodities

- Metals

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- Platforms

- Platforms

- Platforms

- Platforms

- Platforms overview

- MetaTrader 4

- MetaTrader 5

- Education

- Education

- Education

- Education

- News & analysis

- Education Hub

- Economic calendar

- Help & support

- Help & support

- About

- Trading

- Trading

- Markets

- Markets

- Products overview

- Forex

- Commodities

- Metals

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- Platforms

- Platforms

- Platforms

- Platforms

- Platforms overview

- MetaTrader 4

- MetaTrader 5

- Education

- Education

- Education

- Education

- News & analysis

- Education Hub

- Economic calendar

- Help & support

- Help & support

- About

- Home

- News & Analysis

- Articles

- Economic Updates

- US stocks decline as weak JOLTS data and Dimon comments spook investors

- Home

- News & Analysis

- Articles

- Economic Updates

- US stocks decline as weak JOLTS data and Dimon comments spook investors

News & AnalysisNews & Analysis

News & AnalysisNews & AnalysisUS stocks decline as weak JOLTS data and Dimon comments spook investors

5 April 2023 By Lachlan MeakinUS equities snapped a 4-day winning streak as the “bad news is good news” narrative for equities faltered in Tuesdays session.

Before the cash session the JOLTS job openings figure was released and came in much lower than expected, this is a key gauge of US labour market tightness that the Fed has referenced throughout its aggressive interest rate hiking cycle, and was closely watched, especially ahead Fridays NFP figure.

Rate hike odds for May dropped to 40%, this was not enough to rescue equities though as recession fears took over , the Dow , Nasdaq and S&P 500 all finishing down around 0.5%

Equity markets weren’t helped either by comments from Jamie Dimon of JP Morgan in his annual letter to shareholders where he stated that the banking crisis “is not over yet” and would have “repercussions for years to come.” This saw small and mid size banking stocks take a big hit, dragging down the Russell 2000 by almost 2%

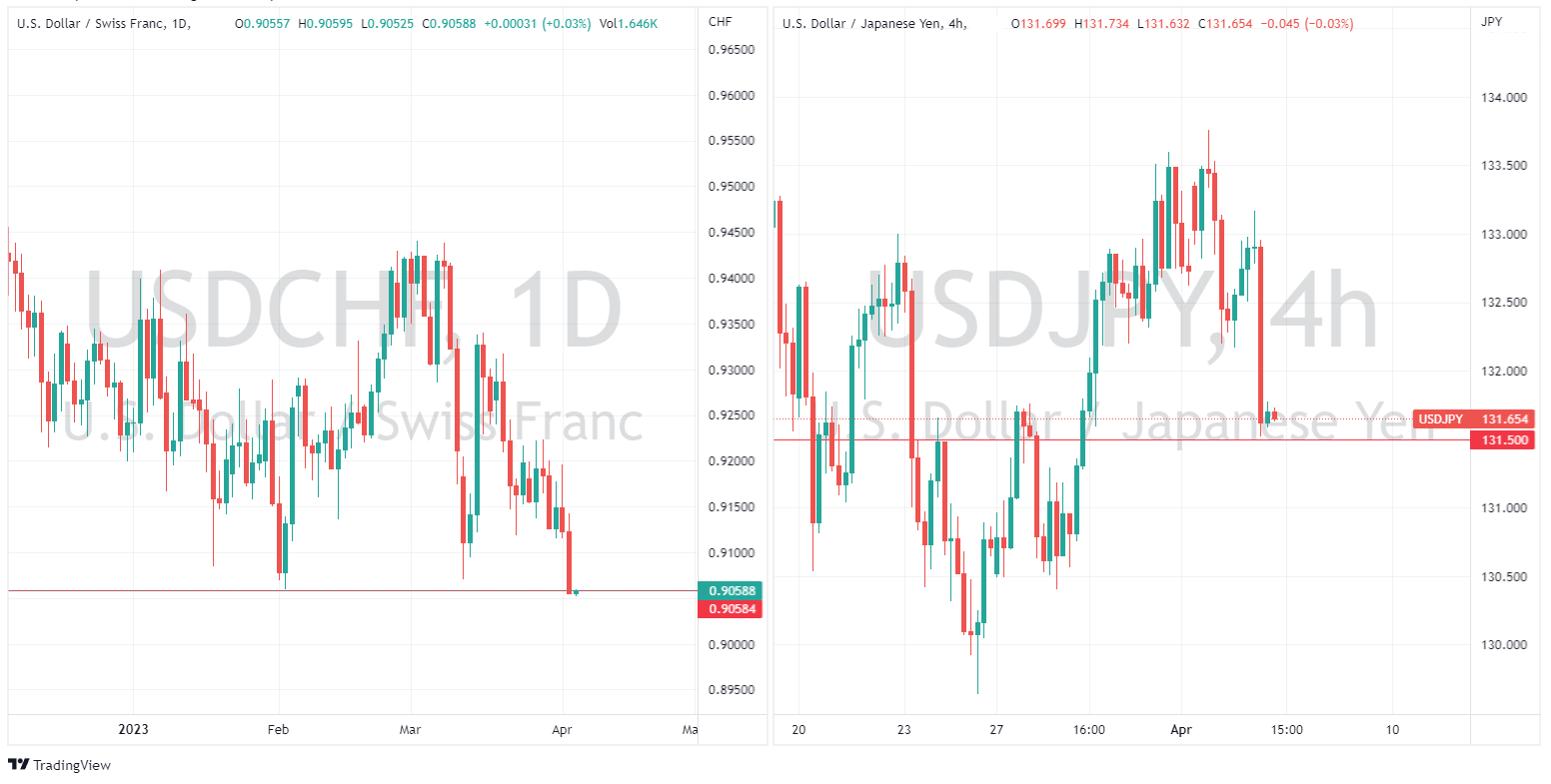

In Forex the repricing lower of rate expectations saw the USD lower in the session, with the US dollar index take a 101-handle hitting its lowest level since February and sitting on a critical support level.

Safe havens currencies the CHF and JPY, both outperformed the greenback on risk-off conditions

USD/CHF hovering around 0.9050, the bottom of the day’s range and another major support level, while USD/JPY hit a low of 131.53 as the Yen ran out of momentum just above the psychological 131.50 level.

The Aussie dollar was the clear laggard in wake of the RBA rate decision, where it held rates after 10 straight hikes. This saw the AUDNZD giving up all of Mondays gains and trading under 1.07 level, just above major support at 1.0670.

In commodities, Oil managed to hold it’s gains from Yesterdays gap up with the surprise voluntary cut by OPEC over the weekend continuing to underpin prices.

Gold was a big mover as a weaker dollar, lower rates and risk-off saw it smash through the top of it’s recent trading range, hitting it’s highest level in 12 months, settling around the 2020 USD an ounce level.

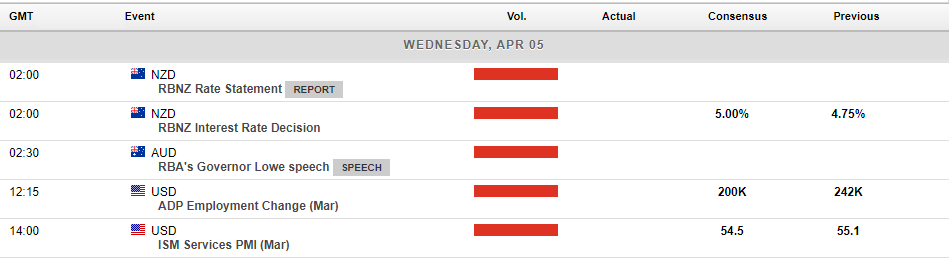

In todays economic announcements, more employment data from the US which again will be closely watched ahead of Fridays NFP, at the same time Canadian employment figures will be released, USDCAD traders beware. We also have a rate announcement from the RBNZ where a 25bp hike is expected and priced into the markets.

The information provided is of general nature only and does not take into account your personal objectives, financial situations or needs. Before acting on any information provided, you should consider whether the information is suitable for you and your personal circumstances and if necessary, seek appropriate professional advice. All opinions, conclusions, forecasts or recommendations are reasonably held at the time of compilation but are subject to change without notice. Past performance is not an indication of future performance. Go Markets Pty Ltd, ABN 85 081 864 039, AFSL 254963 is a CFD issuer, and trading carries significant risks and is not suitable for everyone. You do not own or have any interest in the rights to the underlying assets. You should consider the appropriateness by reviewing our TMD, FSG, PDS and other CFD legal documents to ensure you understand the risks before you invest in CFDs. These documents are available here.

#Economy #Economics #Finance #MarketsNext Article

Tech Tanks, Defensives hold up the Dow as Weak Data Stokes Recession Fears

US markets continued to wobble in Wednesday’s session after another weak employment figure and a miss on Services PMI indicated the US economy might finally start to be slowing down after a year of aggressive hiking from the Federal Reserve. The Tech heavy and more risk sensitive Nasdaq led declines, closely followed by the Russell 2000 as reg...

April 6, 2023Read More >Previous Article

RBA leaves cash rate unchanged but leaves the door open for future hikes if needed

After 10 hikes on the trot and what will no doubt be a relief for mortgage holders the RBA held the official cash rate at 3.60%. The rate decision was...

April 4, 2023Read More >Please share your location to continue.

Check our help guide for more info.

- Trading