- Trading

- Trading

- Markets

- Markets

- Products overview

- Forex

- Commodities

- Metals

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- Platforms

- Platforms

- Platforms

- Platforms

- Platforms overview

- MetaTrader 4

- MetaTrader 5

- Education

- Education

- Education

- Education

- News & analysis

- Education Hub

- Economic calendar

- Help & support

- Help & support

- About

- Trading

- Trading

- Markets

- Markets

- Products overview

- Forex

- Commodities

- Metals

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- Platforms

- Platforms

- Platforms

- Platforms

- Platforms overview

- MetaTrader 4

- MetaTrader 5

- Education

- Education

- Education

- Education

- News & analysis

- Education Hub

- Economic calendar

- Help & support

- Help & support

- About

- Home

- News & Analysis

- Economic Updates

- US stocks drop, yields rise as J-Hole hangover and a hawkish ECB weigh on markets.

- Home

- News & Analysis

- Economic Updates

- US stocks drop, yields rise as J-Hole hangover and a hawkish ECB weigh on markets.

News & AnalysisNews & Analysis

News & AnalysisNews & AnalysisUS stocks drop, yields rise as J-Hole hangover and a hawkish ECB weigh on markets.

30 August 2022 By Lachlan MeakinUS and European equities continued their decline after Fridays Jerome Powell inspired sell-off , though the pace was more moderate in a choppy, range bound session.

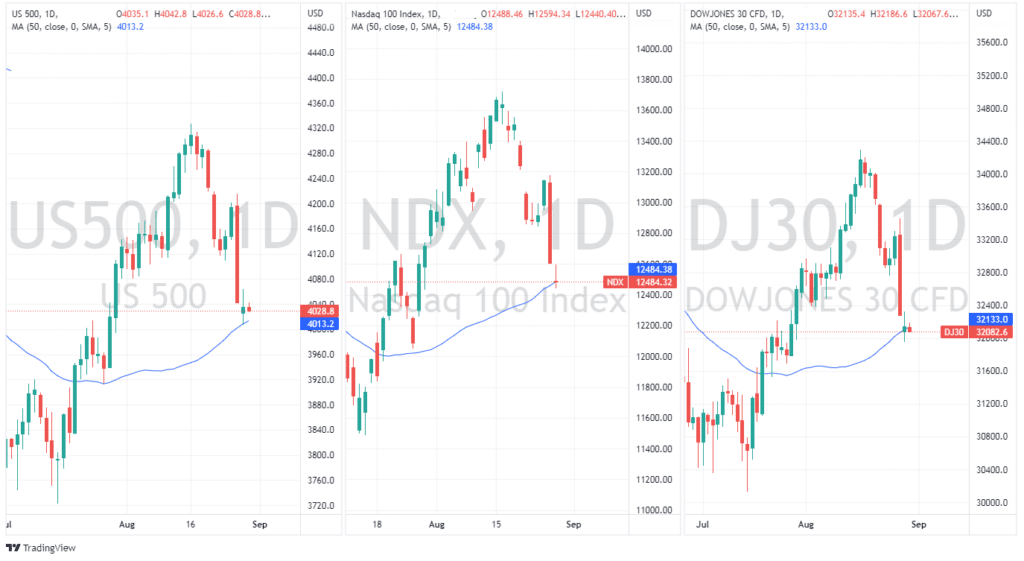

The risk sensitive NASDAQ is down around 5% post the Fed chairs comments at the Jackson Hole symposium. All three major US indices found support at their 50 day moving average during the session, this will be a level to watch in the upcoming trading days.

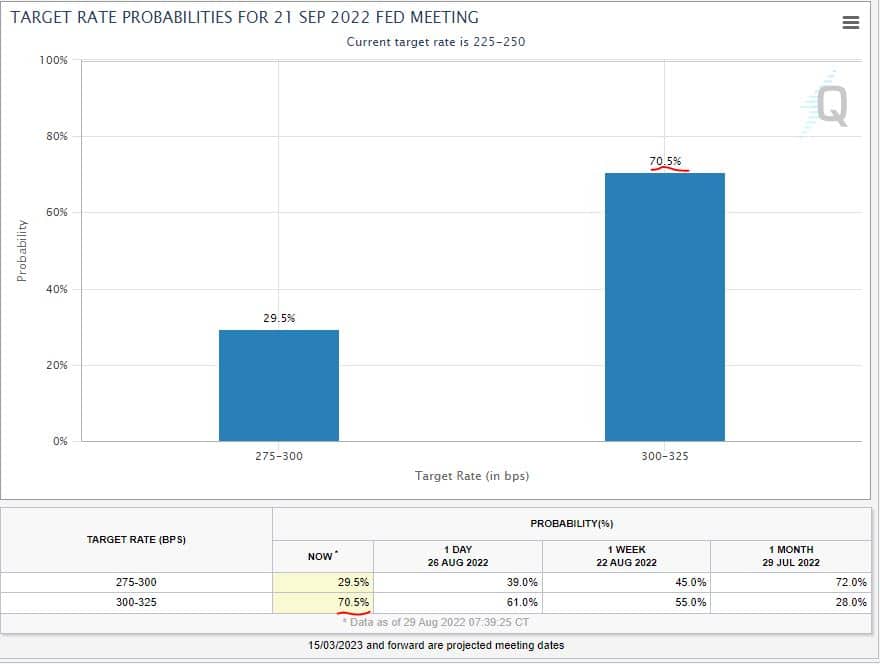

Bonds also sold off, with yields rising as market participants continued to re-price the Fed rate hike trajectory and subsequent easing in the future after the hawkish tone on Friday, rate markets are now pricing in a 70% chance of another 75bp hike at the Feds September meeting.

In FX markets the USD was mostly flat, the Euro reclaimed the parity level on some hawkish comments from ECB members on the weekend and a drop in regional gas prices tumbled on news that Germany is better prepared for the winter than initially feared.

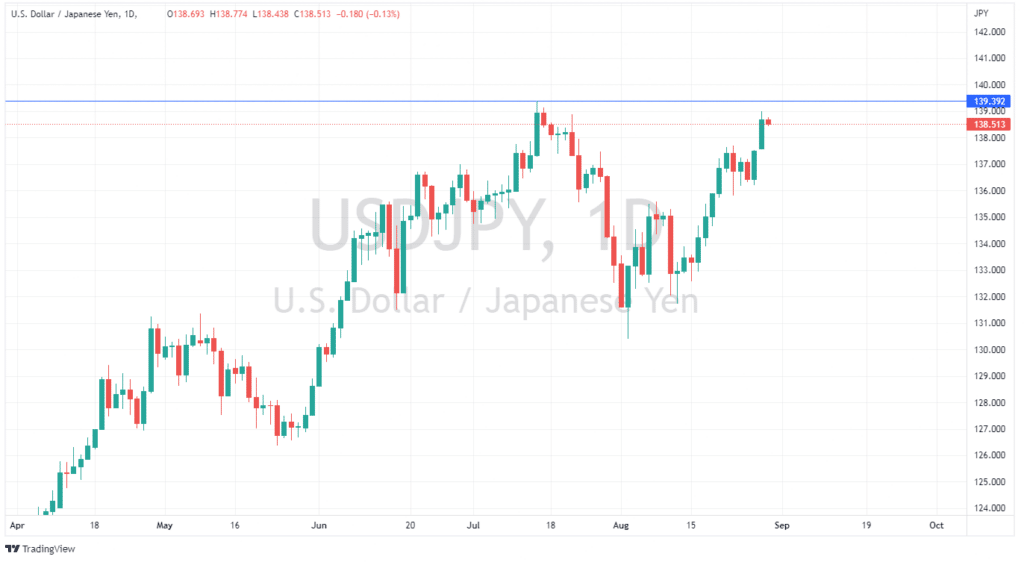

JPY continued to weaken against the greenback as rising treasury yields increased the US-Japan rate differentials even further, this has been the biggest driver of the strength in the USDJPY which now is close to testing the highs set in July.

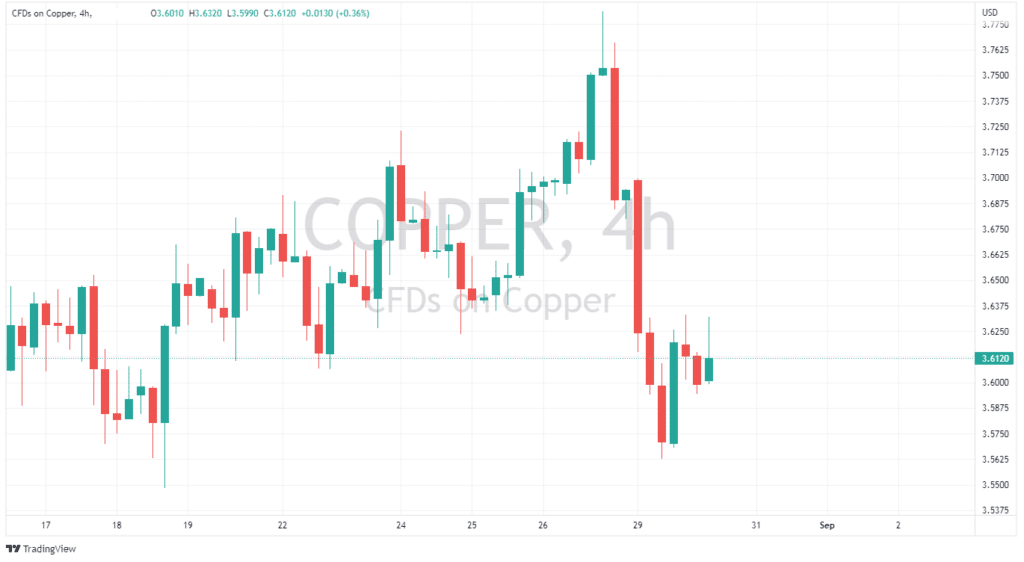

Commodities were mixed with Copper continuing its slide on the back of global growth concerns.

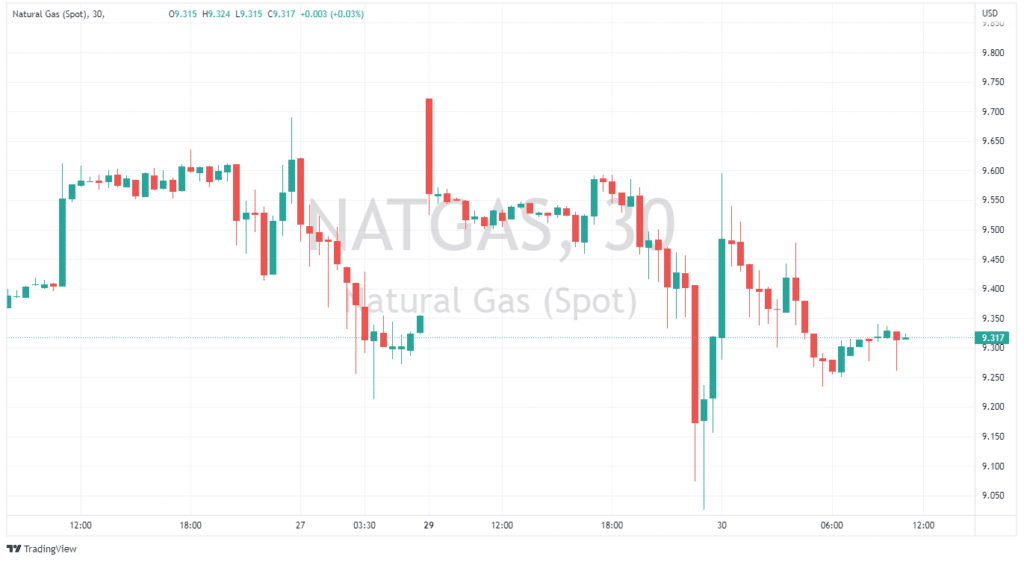

Natural Gas was extremely volatile as comments from European leaders regarding emergency measure plans saw the price whipsaw violently during the session, closing the gap up at open and finishing the day flat from Fridays close.

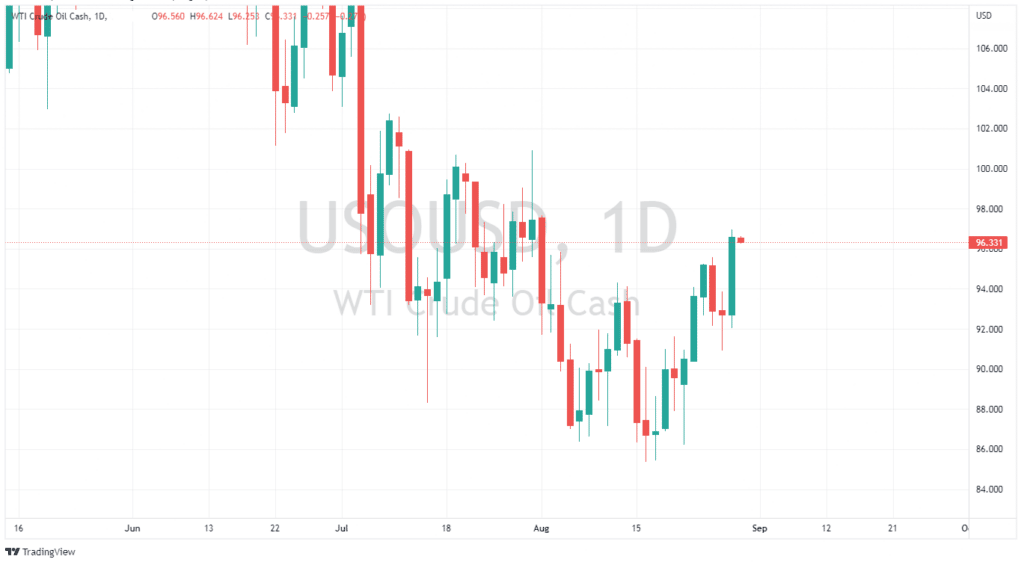

Crude oil jumped to fresh August highs aided by the softer dollar, as well as the overhang from OPEC production cut suggestions and Middle East geopolitical uncertainty.

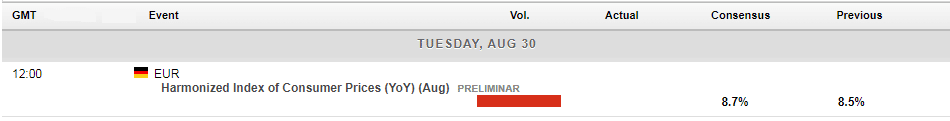

In today’s economic announcements, the German CPI figure will be one that is closely watched and expected to see inflation in Europe’s biggest economy continue to rise and will take on extra importance after some of the hawkish rhetoric out of ECB members over the weekend.

The information provided is of general nature only and does not take into account your personal objectives, financial situations or needs. Before acting on any information provided, you should consider whether the information is suitable for you and your personal circumstances and if necessary, seek appropriate professional advice. All opinions, conclusions, forecasts or recommendations are reasonably held at the time of compilation but are subject to change without notice. Past performance is not an indication of future performance. Go Markets Pty Ltd, ABN 85 081 864 039, AFSL 254963 is a CFD issuer, and trading carries significant risks and is not suitable for everyone. You do not own or have any interest in the rights to the underlying assets. You should consider the appropriateness by reviewing our TMD, FSG, PDS and other CFD legal documents to ensure you understand the risks before you invest in CFDs. These documents are available here.

#Economy #Economics #Finance #MarketsNext Article

Is the price of wheat ready to bounce?

The price of wheat is finally starting to show positive signs after an aggressive sell off that has been ongoing since May 2022. There is hope that the price of the commodity may begin to climb again with the price finally finding some support. The price has been impacted by growing fears that production may slip may increasing volatili...

August 30, 2022Read More >Previous Article

Space X and T-Mobile Joint Enterprise

Space X – Space Exploration Technologies Corp. is an American spacecraft manufacturer, space launch provider, and a satellite communications cor...

August 30, 2022Read More >Please share your location to continue.

Check our help guide for more info.

- Trading