- Trading

- Trading

- Markets

- Markets

- Products overview

- Forex

- Commodities

- Metals

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- Platforms

- Platforms

- Platforms

- Platforms

- Platforms overview

- MetaTrader 4

- MetaTrader 5

- Education

- Education

- Education

- Education

- News & analysis

- Education Hub

- Economic calendar

- Help & support

- Help & support

- About

- Trading

- Trading

- Markets

- Markets

- Products overview

- Forex

- Commodities

- Metals

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- Platforms

- Platforms

- Platforms

- Platforms

- Platforms overview

- MetaTrader 4

- MetaTrader 5

- Education

- Education

- Education

- Education

- News & analysis

- Education Hub

- Economic calendar

- Help & support

- Help & support

- About

- Home

- News & Analysis

- Economic Updates

- US stocks dump and pump as strong data cools Fed-pivot hopes

- Home

- News & Analysis

- Economic Updates

- US stocks dump and pump as strong data cools Fed-pivot hopes

News & AnalysisNews & Analysis

News & AnalysisNews & AnalysisUS equities declined after a record two day winning streak, a volatile and choppy session ultimately ending with the S&P500 down 7.65 points (0.2%)

The Nasdaq (NDX100) saw the biggest swing, from down almost 2.5% at the European close, all the way back up to +0.5% until a very late session sell-off saw it finish down 0.25%

The choppiness reflected the see-sawing of narrative regarding a Fed pivot, or being less aggressive in their rate hiking cycle, this narrative is changing from news release to news release, with weak figures seeing the Fed pivot narrative on, strong figures seeing it off. With robust employment data and PMI figures out of the US before Wednesdays session, the Fed pivot narrative moved towards the off side causing the whipsawing we saw in risk assets.

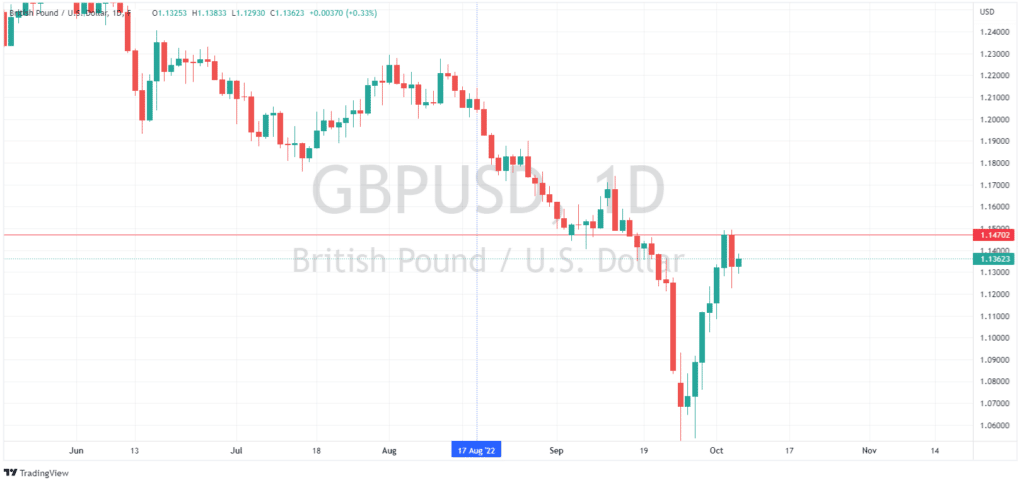

In FX, the Pound’s 6 day winning streak screeched to a halt, dropping 1% against the USD as traders piled back into the dollar on bets that the Federal Reserve will stick to hiking interest rates.

Oil prices rallied once again on the back of the OPEC+ production cut, a move that the Whitehouse has angrily called “short sighted” US Crude back (USOUSD) above $88 a barrel, another factor that will more than likely see inflation figures from the US remain sticky, giving the Federal Reserve more reason to stay the course of their rate hiking cycle.

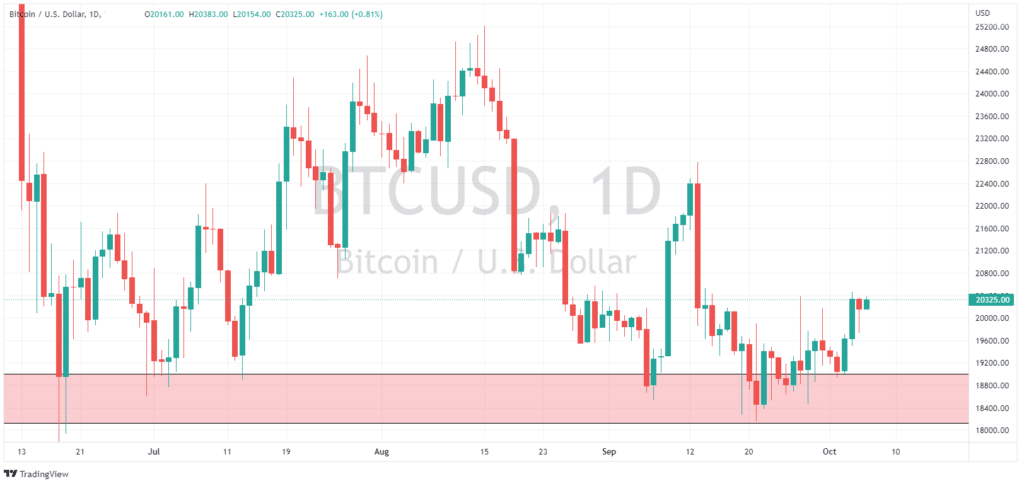

Bitcoins (BTCUSD) low volatility grind up continued, BTCUSD has shown a real de-coupling from tech and USD strength recently, making it’s own path and displaying strong support in the 19000-18000 zone.

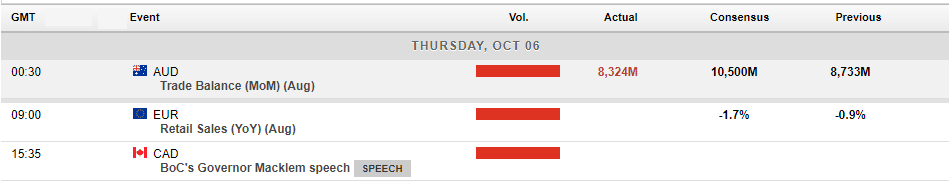

Todays scheduled economic announcements:

The information provided is of general nature only and does not take into account your personal objectives, financial situations or needs. Before acting on any information provided, you should consider whether the information is suitable for you and your personal circumstances and if necessary, seek appropriate professional advice. All opinions, conclusions, forecasts or recommendations are reasonably held at the time of compilation but are subject to change without notice. Past performance is not an indication of future performance. Go Markets Pty Ltd, ABN 85 081 864 039, AFSL 254963 is a CFD issuer, and trading carries significant risks and is not suitable for everyone. You do not own or have any interest in the rights to the underlying assets. You should consider the appropriateness by reviewing our TMD, FSG, PDS and other CFD legal documents to ensure you understand the risks before you invest in CFDs. These documents are available here.

#Economy #Economics #Finance #MarketsNext Article

Technical Analysis – Retracement for US Dollar

Starting from the weekly timeframe, US Dollar Index has been consistently trending upwards for the last 16 months. Using the 9 exponential moving average (EMA) on the weekly time frame, we can see the US Dollar retracing back to the EMA, bouncing off of it, then continuing with the trend, as seen below: Looking at the structure of the uptren...

October 7, 2022Read More >Previous Article

EURAUD testing mean of long-term range

The EURAUD buoyed by a weaker Australian Dollar lighter lighter monetary policy from the Reserve Bank of Australia, (RBA) has seen the currency pair m...

October 6, 2022Read More >Please share your location to continue.

Check our help guide for more info.

- Trading