- Trading

- Trading

- Markets

- Markets

- Products overview

- Forex

- Commodities

- Metals

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- Platforms

- Platforms

- Platforms

- Platforms

- Platforms overview

- MetaTrader 4

- MetaTrader 5

- Education

- Education

- Education

- Education

- News & analysis

- Education Hub

- Economic calendar

- Help & support

- Help & support

- About

- Trading

- Trading

- Markets

- Markets

- Products overview

- Forex

- Commodities

- Metals

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- Platforms

- Platforms

- Platforms

- Platforms

- Platforms overview

- MetaTrader 4

- MetaTrader 5

- Education

- Education

- Education

- Education

- News & analysis

- Education Hub

- Economic calendar

- Help & support

- Help & support

- About

- Home

- News & Analysis

- Economic Updates

- US stocks extend sell-off, yields spike, GBP flash crashes

- Home

- News & Analysis

- Economic Updates

- US stocks extend sell-off, yields spike, GBP flash crashes

News & AnalysisNews & Analysis

News & AnalysisNews & AnalysisUS stocks extend sell-off, yields spike, GBP flash crashes

27 September 2022 By Lachlan MeakinWall St extended its sell-off in Mondays session, continuing on from Friday (albeit not as pronounced) against a backdrop of spiking bond yields, growth concerns and turmoil in the FX market.

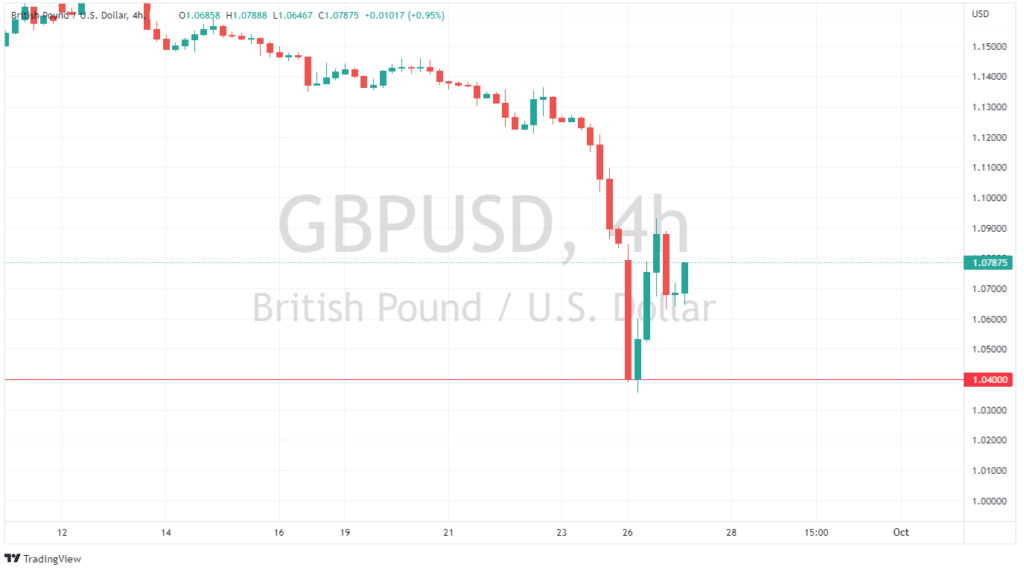

The S&P 500 closed at it’s lowest since late 2020 and the Dow slipped into bear market territory as investors fled risk assets. The USD was again dominant helped along by further fallout from the UK’s fiscal plans that saw GBPUSD flash crash below 1.04 to new all-time lows mid session.

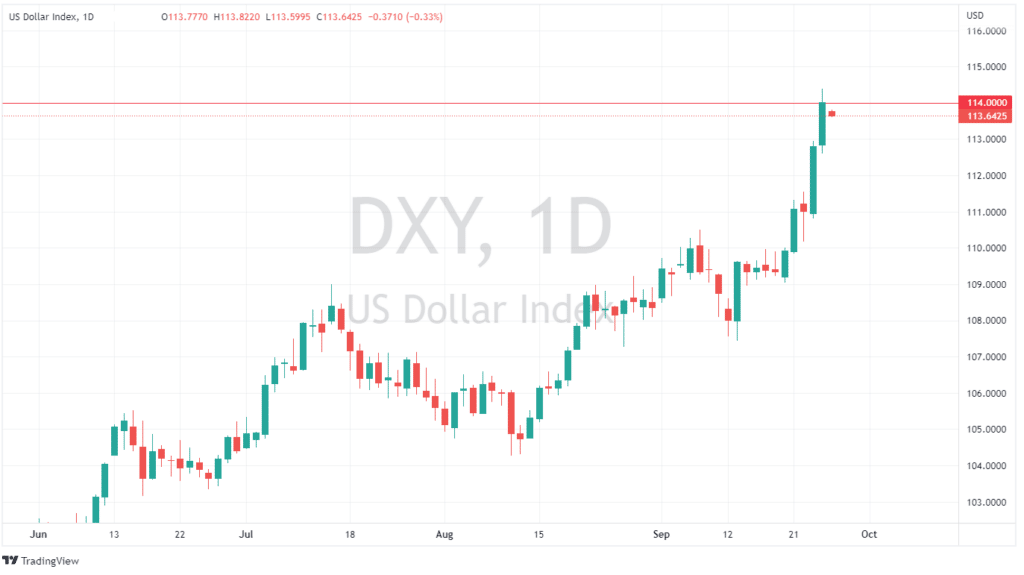

The US Dollar index remained firmer and rose back above the 114.00 level also benefitting from macro fundamentals such as relative US economic outperformance and demand for the Greenback amid a subdued risk sentiment. The Index is up a stunning 4% in the last 5 days – its biggest such move since the peak of the COVID Panic in March 2020.

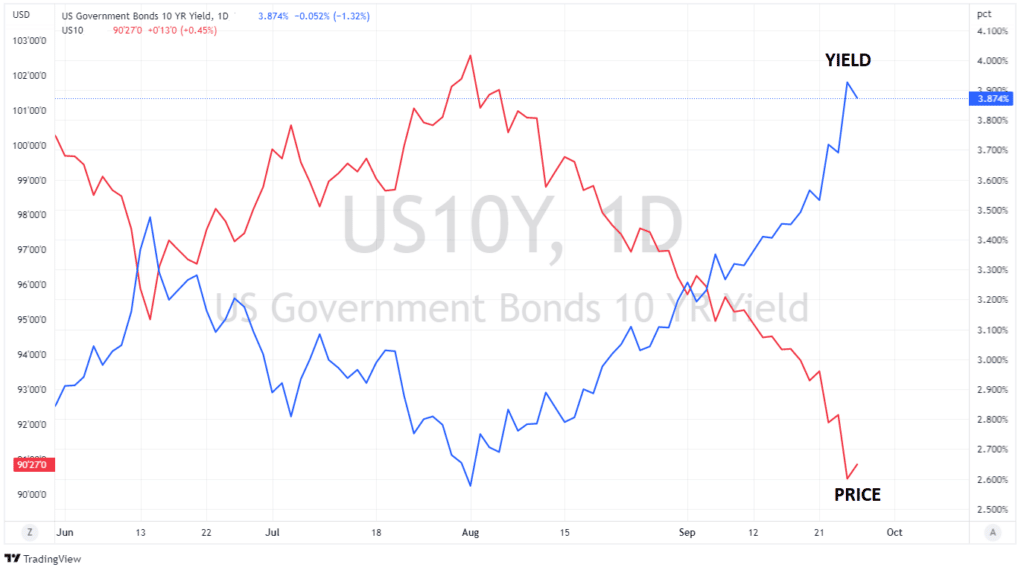

Another big factor in recent US dollar strength is the steep rise in the US 10 year bond yield as Bonds continue to sell off (Price moves inversely to yield) on the back of the a Hawkish Fed raising market expectations of their rate hiking trajectory.

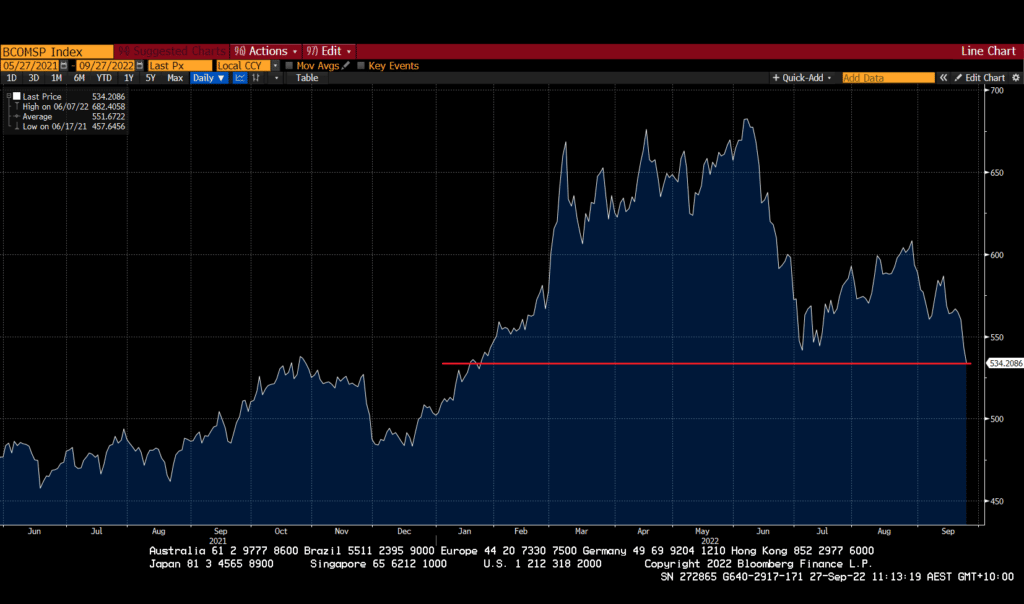

Unsurprisingly commodities also got clobbered on rampant USD strength and global slowdown concerns, with the Bloomberg Commodity Spot Index hitting its lowest level in 8 months.

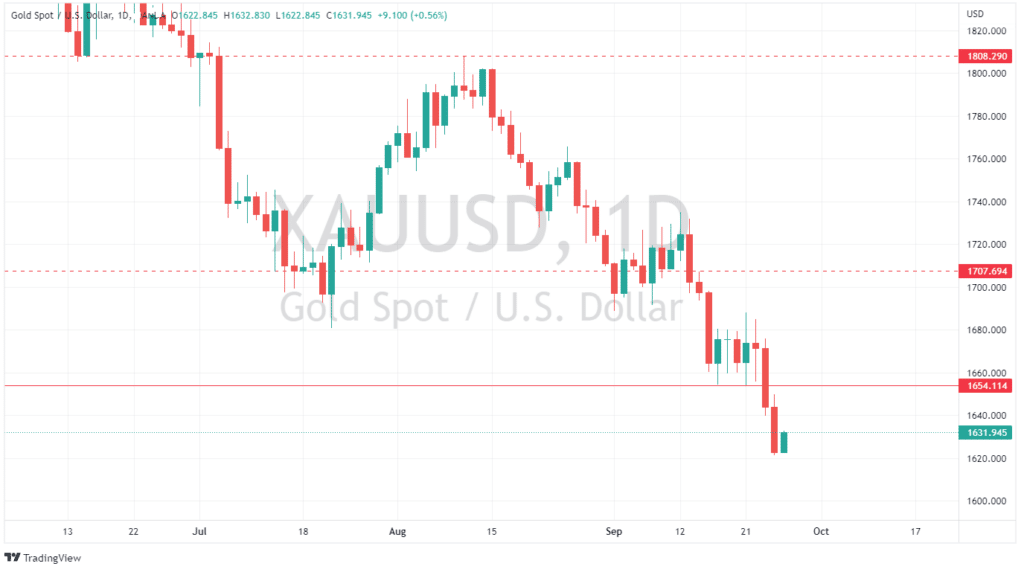

Gold continues its slide after breaking its support levels in Friday’s session, back to it’s lowest level since April 2020.

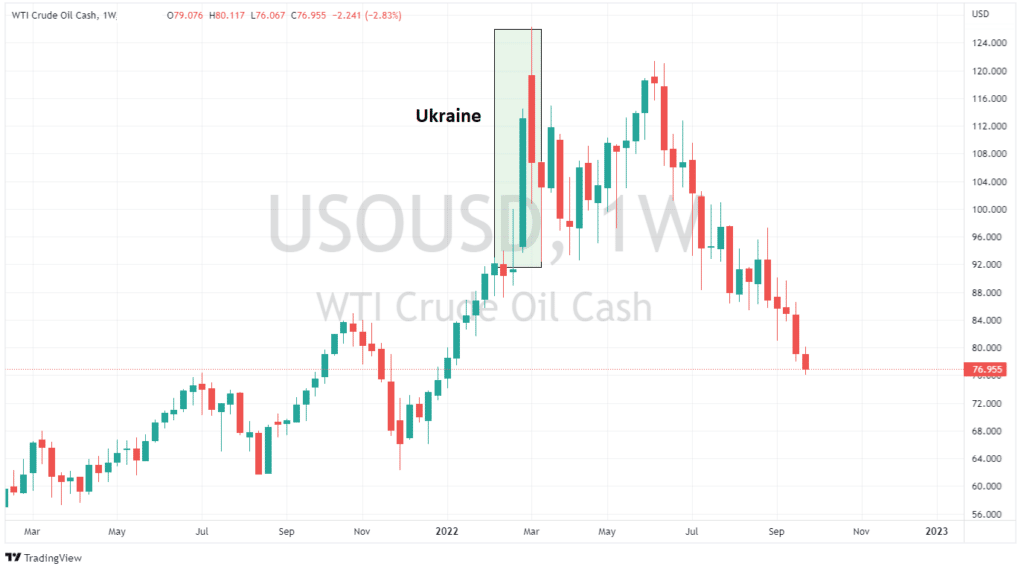

US Crude oil also got crushed, plunging below the $80 a barrel level , well under pre Ukraine invasion levels and within touching distance of the 2022 lows set in January.

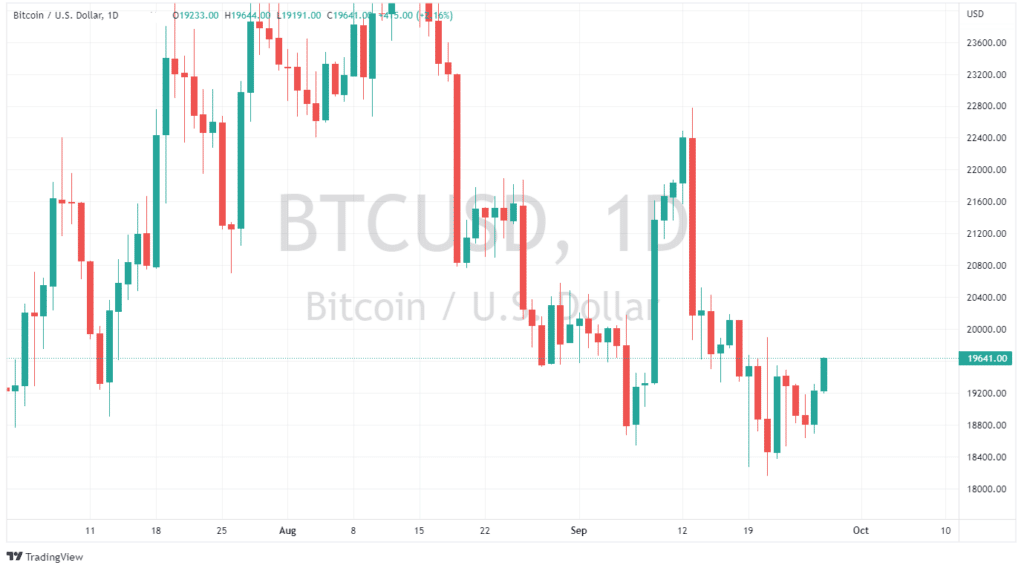

One risk asset that did perform well was Bitcoin which, despite USD strength rallied from it’s support levels to retake the 19k USD handle, turmoil in the FX market has seen BTC looking more attractive as an alternative to the USD than other currencies.

The information provided is of general nature only and does not take into account your personal objectives, financial situations or needs. Before acting on any information provided, you should consider whether the information is suitable for you and your personal circumstances and if necessary, seek appropriate professional advice. All opinions, conclusions, forecasts or recommendations are reasonably held at the time of compilation but are subject to change without notice. Past performance is not an indication of future performance. Go Markets Pty Ltd, ABN 85 081 864 039, AFSL 254963 is a CFD issuer, and trading carries significant risks and is not suitable for everyone. You do not own or have any interest in the rights to the underlying assets. You should consider the appropriateness by reviewing our TMD, FSG, PDS and other CFD legal documents to ensure you understand the risks before you invest in CFDs. These documents are available here.

#Economy #Economics #Finance #MarketsNext Article

When will the AUD find support?

The AUD has fallen to lows not since the beginning of the Covid 19 pandemic and does not look like stopping anytime soon. With global commodity prices coming down and fears of a recession causing panic sell offs the AUD has been victim to a two-fold attack. The general recession fears push growth assets including the Australian dollar downward as i...

September 27, 2022Read More >Previous Article

Why has the GBP Collapsed to record lows?

It hasn’t been a good Monday morning for some investors or English travelers who wish to sell the GBP to go abroad, as the Sterling Pound has co...

September 27, 2022Read More >Please share your location to continue.

Check our help guide for more info.

- Trading