- Trading

- Trading

- Markets

- Markets

- Products overview

- Forex

- Commodities

- Metals

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- Platforms

- Platforms

- Platforms

- Platforms

- Platforms overview

- MetaTrader 4

- MetaTrader 5

- Education

- Education

- Education

- Education

- News & analysis

- Education Hub

- Economic calendar

- Help & support

- Help & support

- About

- Trading

- Trading

- Markets

- Markets

- Products overview

- Forex

- Commodities

- Metals

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- Platforms

- Platforms

- Platforms

- Platforms

- Platforms overview

- MetaTrader 4

- MetaTrader 5

- Education

- Education

- Education

- Education

- News & analysis

- Education Hub

- Economic calendar

- Help & support

- Help & support

- About

- Home

- News & Analysis

- Economic Updates

- US stocks falter as yields rise ahead of Fed chairs Jerome Powell speech

- Home

- News & Analysis

- Economic Updates

- US stocks falter as yields rise ahead of Fed chairs Jerome Powell speech

News & AnalysisNews & Analysis

News & AnalysisNews & AnalysisUS stocks falter as yields rise ahead of Fed chairs Jerome Powell speech

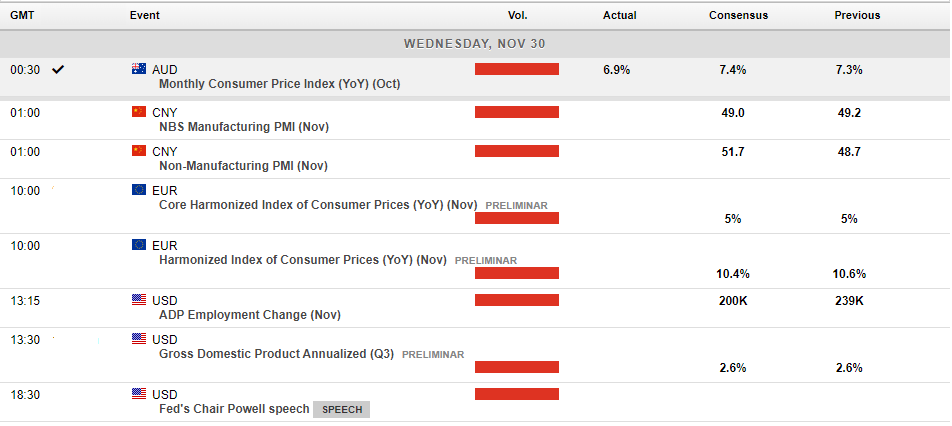

30 November 2022 By Lachlan MeakinAfter a positive lead from the APAC region on China re-opening optimism, US markets drifted lower as traders braced themselves for an expected hawkish Jerome Powell speech to be delivered midway through todays US session.

The Dow Jones eked out a small gain while the more risk and interest rate sensitive Nasdaq was the underperformer, not helped by a steep drop in AAPL (despite seemingly good news that the iPhone production plant in Zhengzhou is set to loosen COVID restrictions)

The US dollar pared early weakness amid a higher yield environment and risk-off in equities. FX traders also positioning for a hawkish speech from Fed Chair Powell on Wednesday. EURUSD traded lower after finding stiff resistance just under the 1.0400 level. Softer than expected German and Spanish inflation data also giving hope that the ECB may go the 50bp hike route, rather than 75bp at their December meeting.

Bitcoin, decoupling from its usual correlation to tech stocks, found a bid in Tuesdays session. BTCUSD touch on 16.5k before finding resistance.

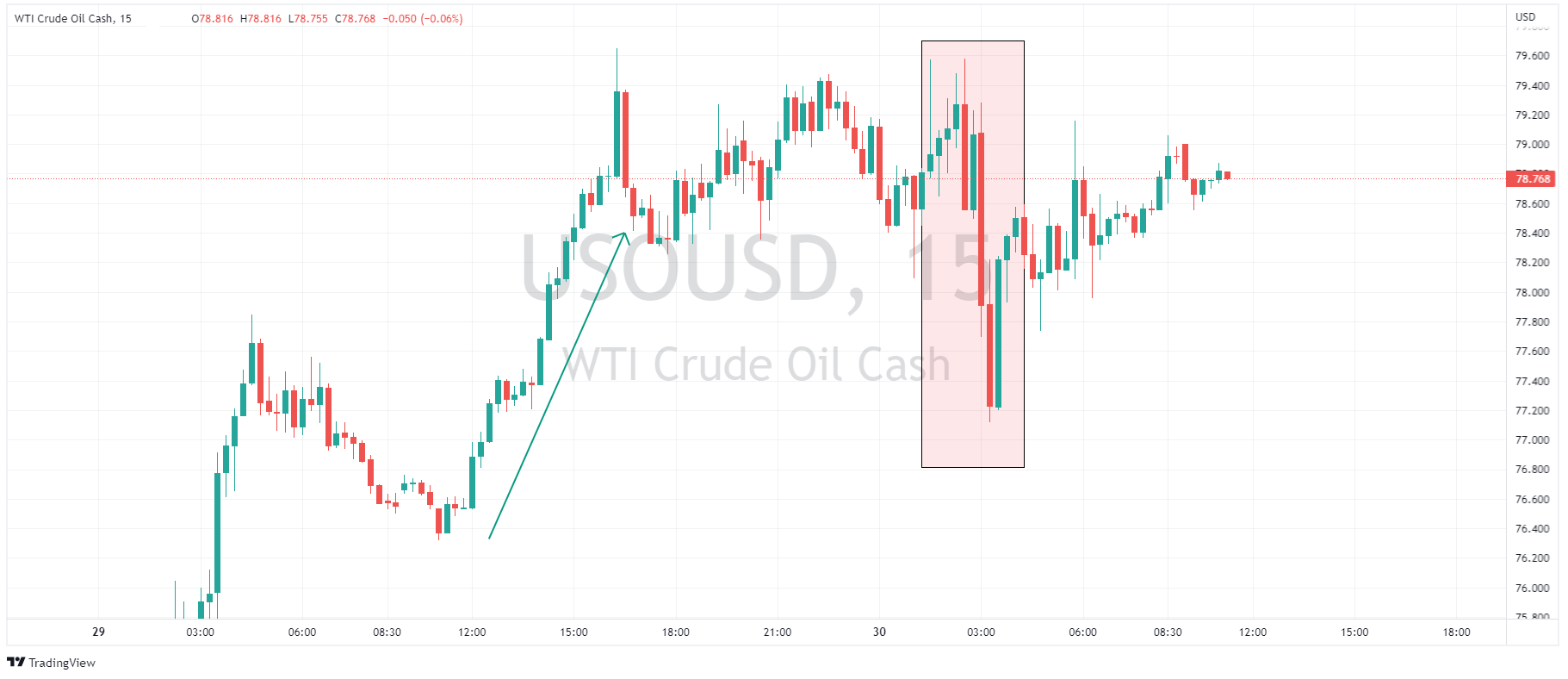

US Crude Oil prices ended the session after API reported a larger than expected draw on inventory, though flip-flopping headlines from OPEC+ leaks and reports on China COVID restrictions caused a volatile session.

In todays economic releases, the big one will by Fed Chair Jerome Powell’s speech midway through the US session. With recent comments from other Fed governors pushing back on pause or pivot optimism the market is expecting a hawkish tone and positioning accordingly.

The information provided is of general nature only and does not take into account your personal objectives, financial situations or needs. Before acting on any information provided, you should consider whether the information is suitable for you and your personal circumstances and if necessary, seek appropriate professional advice. All opinions, conclusions, forecasts or recommendations are reasonably held at the time of compilation but are subject to change without notice. Past performance is not an indication of future performance. Go Markets Pty Ltd, ABN 85 081 864 039, AFSL 254963 is a CFD issuer, and trading carries significant risks and is not suitable for everyone. You do not own or have any interest in the rights to the underlying assets. You should consider the appropriateness by reviewing our TMD, FSG, PDS and other CFD legal documents to ensure you understand the risks before you invest in CFDs. These documents are available here.

#Economy #Economics #Finance #MarketsNext Article

Bitcoin rockets after powerful spike

Bitcoin rockets powerful spike Bitcoin’s price has seemingly spiked out of nowhere in what has been in one of its strongest moves in days. With Bitcoin’s price suffering from sector volatility, it and most other cryptocurrencies has seen an aggressive sell off. This current rise in price is threatening to test the upper resistance po...

November 30, 2022Read More >Previous Article

Intuit results exceed expectations

Intuit Inc. (NASDAQ: INTU) reported its latest financial results for the first quarter of fiscal 2023, which ended October 31, after the market close ...

November 30, 2022Read More >Please share your location to continue.

Check our help guide for more info.

- Trading