- Trading

- Trading

- Markets

- Markets

- Products overview

- Forex

- Commodities

- Metals

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- Platforms

- Platforms

- Platforms

- Platforms

- Platforms overview

- MetaTrader 4

- MetaTrader 5

- Education

- Education

- Education

- Education

- News & analysis

- Education Hub

- Economic calendar

- Help & support

- Help & support

- About

- Trading

- Trading

- Markets

- Markets

- Products overview

- Forex

- Commodities

- Metals

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- Platforms

- Platforms

- Platforms

- Platforms

- Platforms overview

- MetaTrader 4

- MetaTrader 5

- Education

- Education

- Education

- Education

- News & analysis

- Education Hub

- Economic calendar

- Help & support

- Help & support

- About

- Home

- News & Analysis

- Articles

- Economic Updates

- US stocks finish mostly up in chaotic session after CPI slip

- Home

- News & Analysis

- Articles

- Economic Updates

- US stocks finish mostly up in chaotic session after CPI slip

News & AnalysisNews & Analysis

News & AnalysisNews & AnalysisUS equity markets whipsawed in a volatile session after CPI figures showed a slight softening in the headline reading, this saw stocks initially rally, before dipping and rallying again to finish the session on a strong footing. The Nasdaq outperformed in a lower yield environment and was given a boost by Alphabet (GOOG) which rallied over 4% amid its I/O event, where it touted a slew of AI products and new Pixel devices.

Another big mover in the US stock market was The Walt Disney Company (DIS) which sunk over 1% during the regular session, with its downside accelerating after the bell as they released a disappointing earnings report, down almost 4.5% in the after market and dropping below the $100 a share level

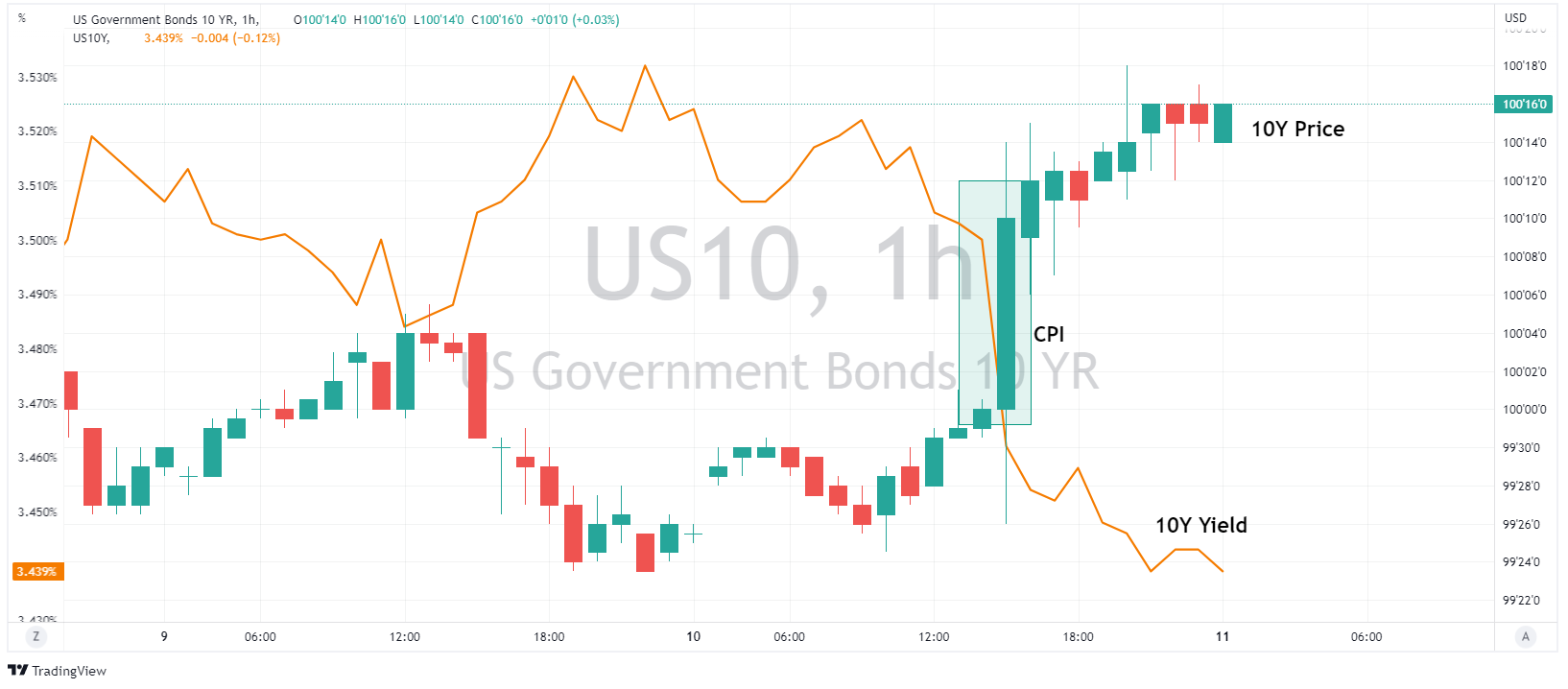

US CPI figures showed a decline in the y/y reading, dropping to 4.9% vs the expected 5.0% reading, the m/m figure remained static while the core reading showed some stubbornness coming it a bit higher m/m at 0.4% vs the expected 0.3%. However the unexpected drop in the headline figure (y/y) was enough to see bonds rally strongly and yields tumble as the market rushed to price in a less aggressive Fed rate hike path.

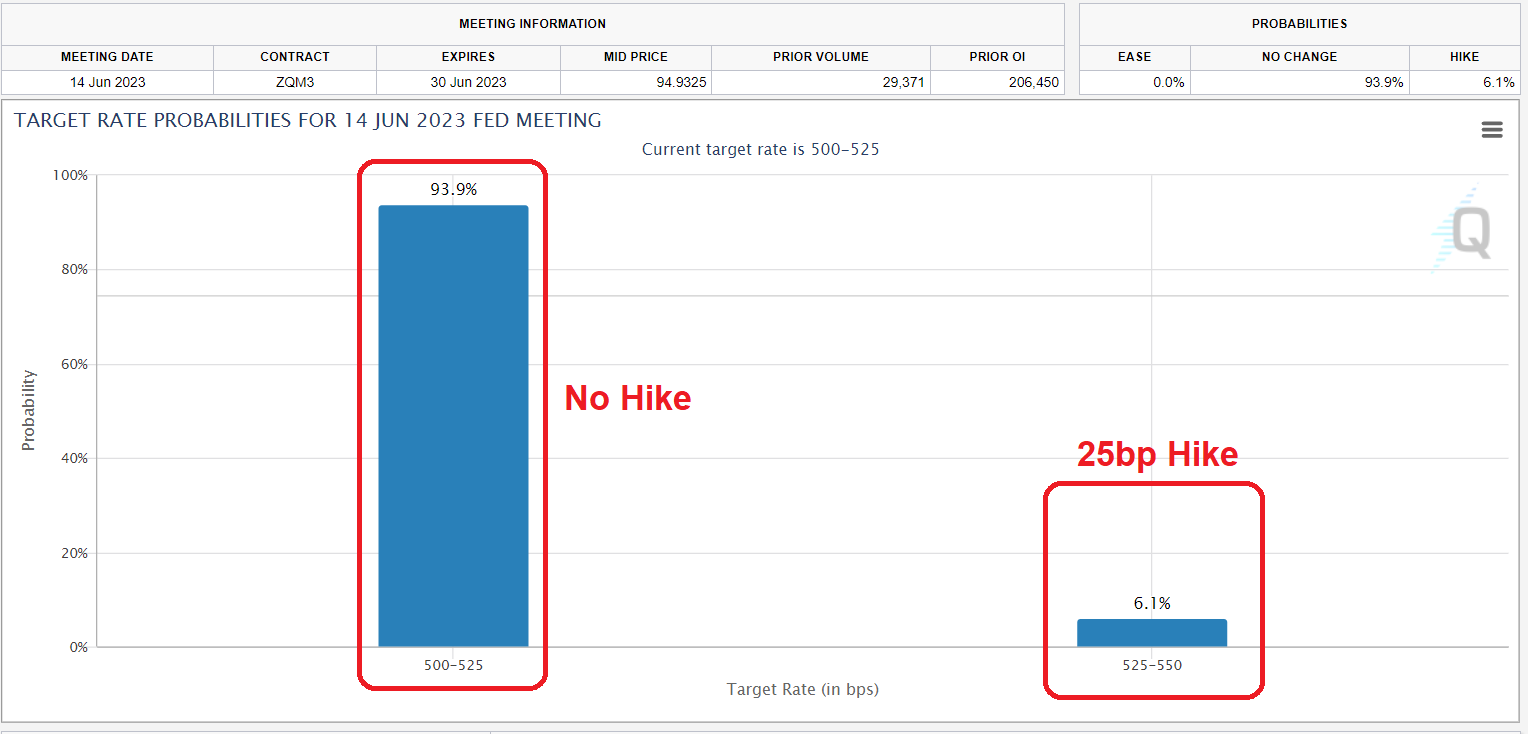

Odds of a hike at the FOMC June meeting also tanked, from 23% yesterday to just 6% post CPI, markets are also pricing in more rate cuts by year end, butting heads with recent Fed speakers who have pushed back against this narrative and should see some interesting trading opportunities as the year goes on as this battle continues.

FX Markets

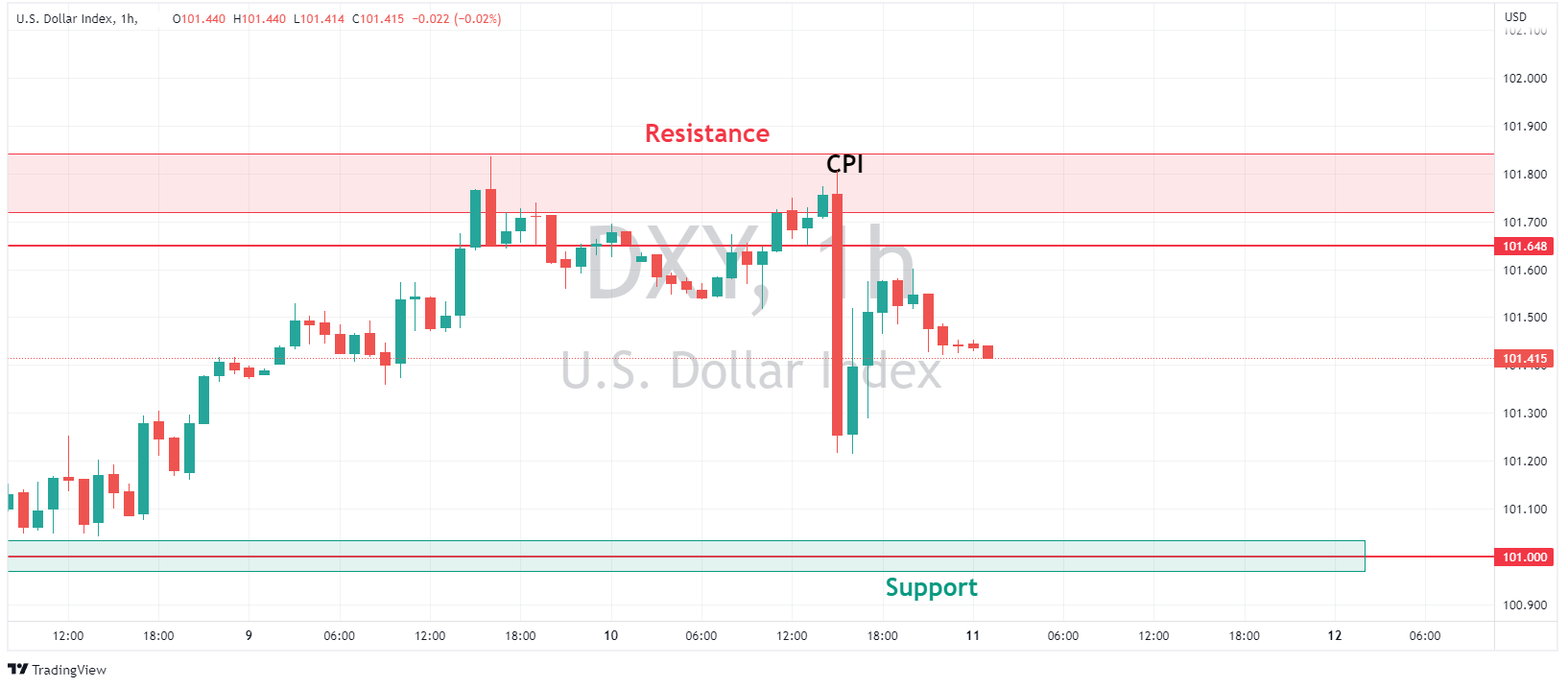

USD was choppy on Wednesday with a dovish CPI print sending the US Dollar Index to 101.21 from highs of 101.80 pre-data, with a drop in US yields being a key driver in its weakness. However, as risk sentiment deteriorated into the US afternoon DXY rallied up to 101.60 on haven flows, before dropping back modestly.

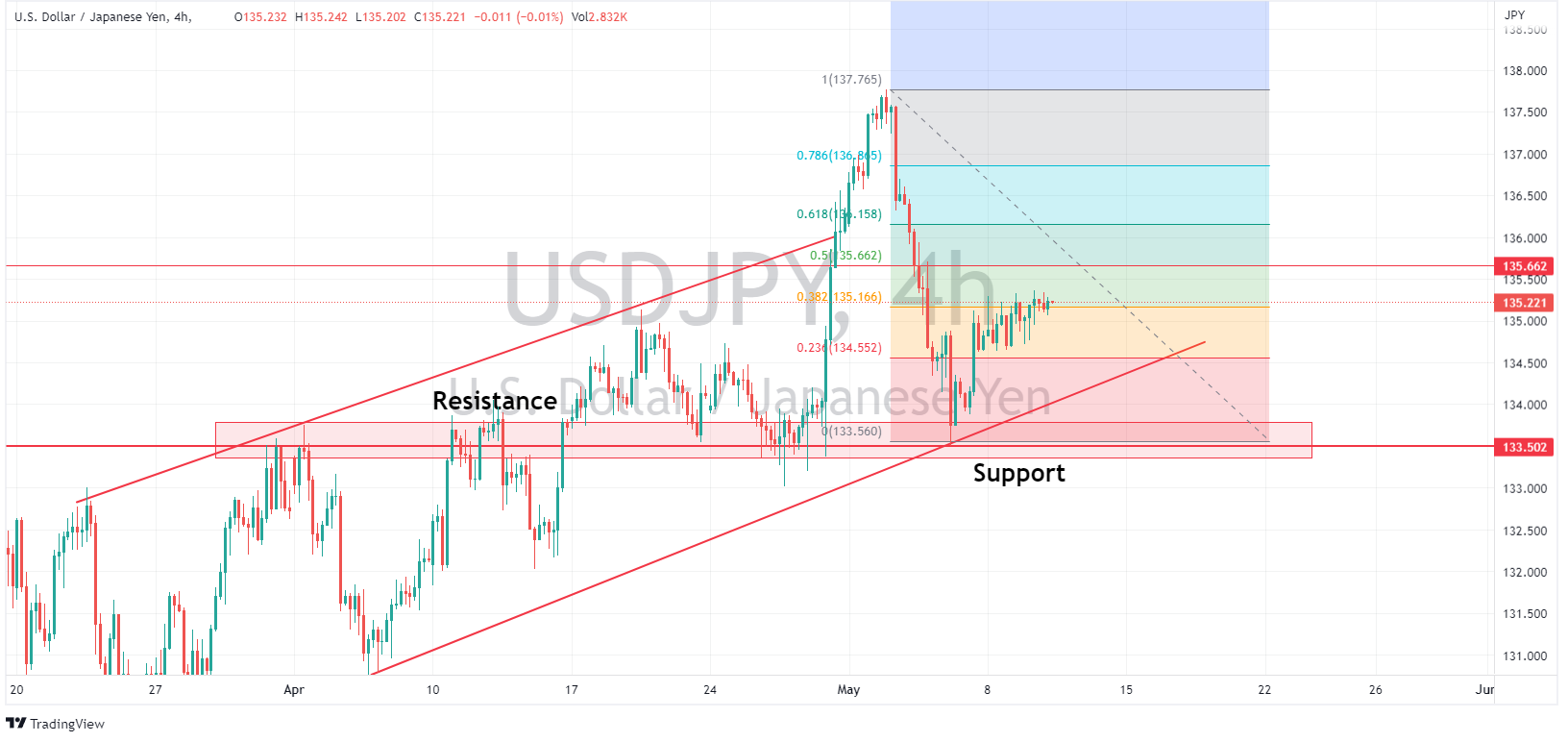

USDJPY was the pair to watch over the CPI figures, being the most sensitive to rate differentials and didn’t disappoint. The Yen strengthened, first on the CPI figure, then later in the session of safe haven flows, pushing USDJPY down to test it’s lower trend line before finding support.

Commodities

Gold prices went on a roller coaster ride in Wednesdays session, an initial strong push higher post CPI on a weaker USD and lower yields, was quickly rejected, with XAUUSD giving up all it’s gains before finding some buyers just above its 2020 support level.

Crude prices hit highs in wake of the CPI report, supported by the weaker dollar while the dovish release helped ease some recent demand fears. However USOUSD again found stiff resistance at the 73.81 USD a barrel level, selling off to finish the session in the red.

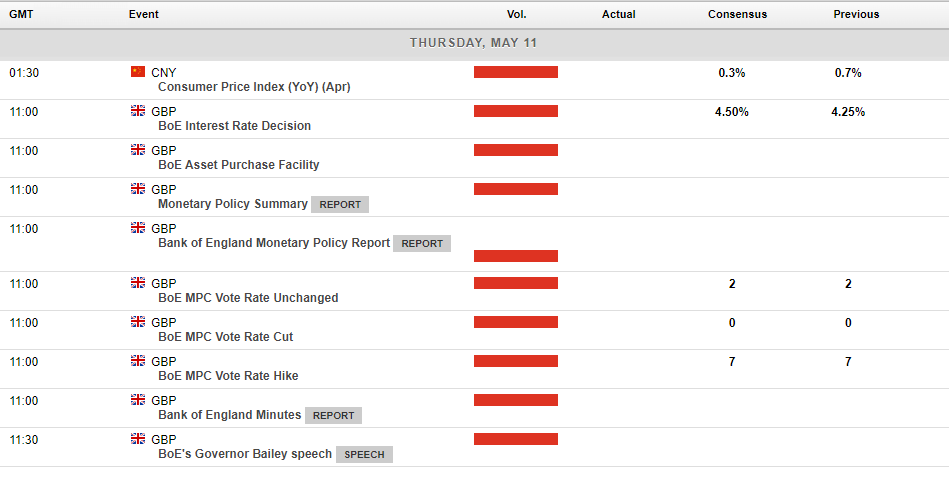

In today’s economic announcements, we have more US inflation figures from the producers this time in the PPI readings, but the main risk event will be the Bank of England rate decision at 12:00 GMT. The BoE is expected to hike another 25bp, with the market’s pricing in a 96% probability. Whether this is the last one is what the market is asking, the accompanying statement may go some way to decide that in the minds of traders.

The information provided is of general nature only and does not take into account your personal objectives, financial situations or needs. Before acting on any information provided, you should consider whether the information is suitable for you and your personal circumstances and if necessary, seek appropriate professional advice. All opinions, conclusions, forecasts or recommendations are reasonably held at the time of compilation but are subject to change without notice. Past performance is not an indication of future performance. Go Markets Pty Ltd, ABN 85 081 864 039, AFSL 254963 is a CFD issuer, and trading carries significant risks and is not suitable for everyone. You do not own or have any interest in the rights to the underlying assets. You should consider the appropriateness by reviewing our TMD, FSG, PDS and other CFD legal documents to ensure you understand the risks before you invest in CFDs. These documents are available here.

#Economy #Economics #Finance #MarketsNext Article

GBPUSD analysis – Is the Bank of England approaching peak rates?

The Bank of England (BoE) is due to release its interest rate decision today, with markets expecting a 12th consecutive hike to take interest rates to 4.50%. There has been increasing speculation that the BoE is reaching its terminal rates and could follow the lead of the US FOMC and the ECB in signaling a slowdown or pause on further rate hikes fo...

May 11, 2023Read More >Previous Article

Walt Disney continues to lose subscribers – the stock is falling

World’s largest entertainment company The Waly Disney Company (NYSE: DIS) announced second quarter financial results ended April 1, 2023, after the ...

May 11, 2023Read More >Please share your location to continue.

Check our help guide for more info.

- Trading