- Trading

- Trading

- Markets

- Markets

- Products overview

- Forex

- Commodities

- Metals

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- Platforms

- Platforms

- Platforms

- Platforms

- Platforms overview

- MetaTrader 4

- MetaTrader 5

- Education

- Education

- Education

- Education

- News & analysis

- Education Hub

- Economic calendar

- Help & support

- Help & support

- About

- Trading

- Trading

- Markets

- Markets

- Products overview

- Forex

- Commodities

- Metals

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- Platforms

- Platforms

- Platforms

- Platforms

- Platforms overview

- MetaTrader 4

- MetaTrader 5

- Education

- Education

- Education

- Education

- News & analysis

- Education Hub

- Economic calendar

- Help & support

- Help & support

- About

- Home

- News & Analysis

- Economic Updates

- US stocks give up early gains as bulls fail to hold key support and yields rise

- Home

- News & Analysis

- Economic Updates

- US stocks give up early gains as bulls fail to hold key support and yields rise

News & AnalysisNews & Analysis

News & AnalysisNews & AnalysisUS stocks give up early gains as bulls fail to hold key support and yields rise

12 August 2022 By Lachlan MeakinUS indexes finished mixed with early gains on a post CPI honeymoon and a soft PPI were erased during the session as investors realised they may have become too optimistic about a Fed pivot, with the drift lower in risk coinciding with a sharp rebound in bond yields.

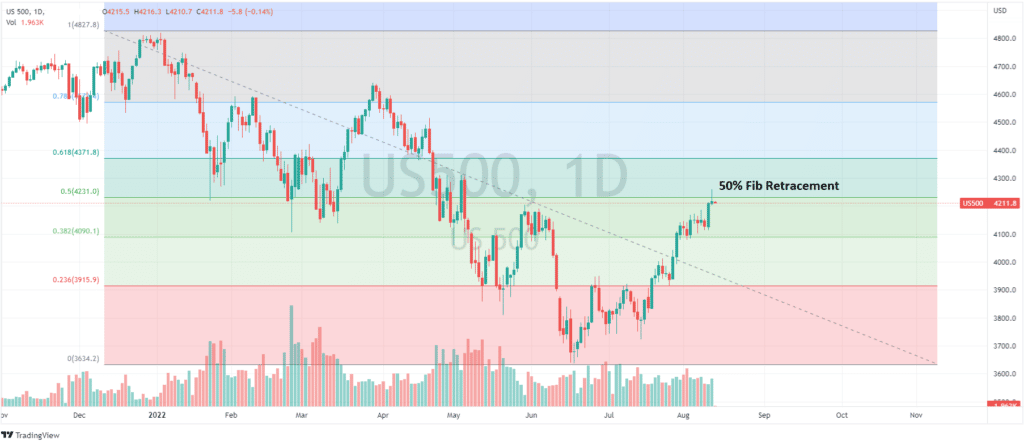

The closely watched 50% fib retracement level from the January all-time high to Junes bear market lows at 4220 on the S&P 500 was tested for the first time, but the bulls failed to hold it as the rally fizzled. This level is an important one as there has never been a bear market rally that closed above the 50% fib that subsequently went on to make new lows.

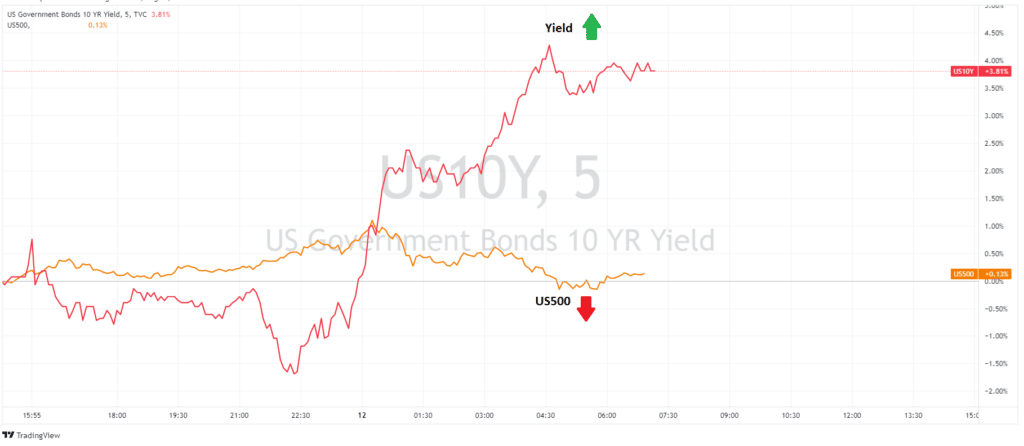

10-Year yields dipped on the lower than expected PPI figure but rebounded sharply on traders repricing Fed rate expectations, dragging down equities and showing that the Fed is still in the driving seat in regards to the recent stock market rally and it’s future direction.

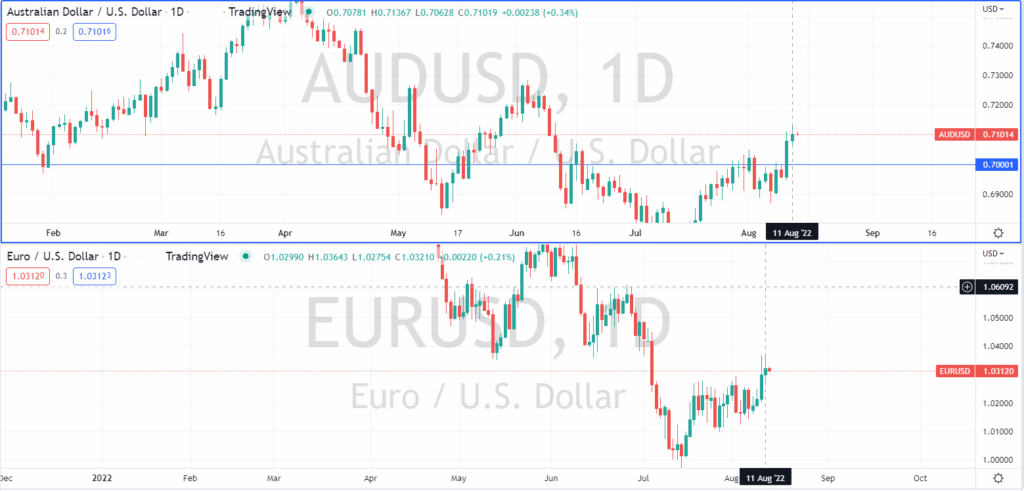

The US Dollar was mostly softer with EURUSD testing the post-soft CPI highs and AUDUSD breaking through the 0.71 USD level.

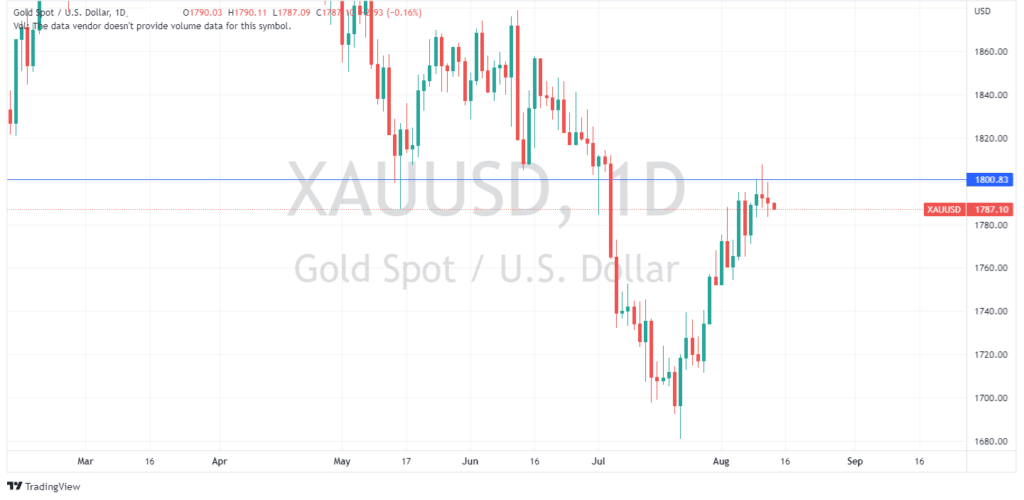

This did not help gold though, with rising bond yields and lowering of inflation expectations weighing on the precious metal, sending it to session lows, with the 1800 level proving stiff resistance.

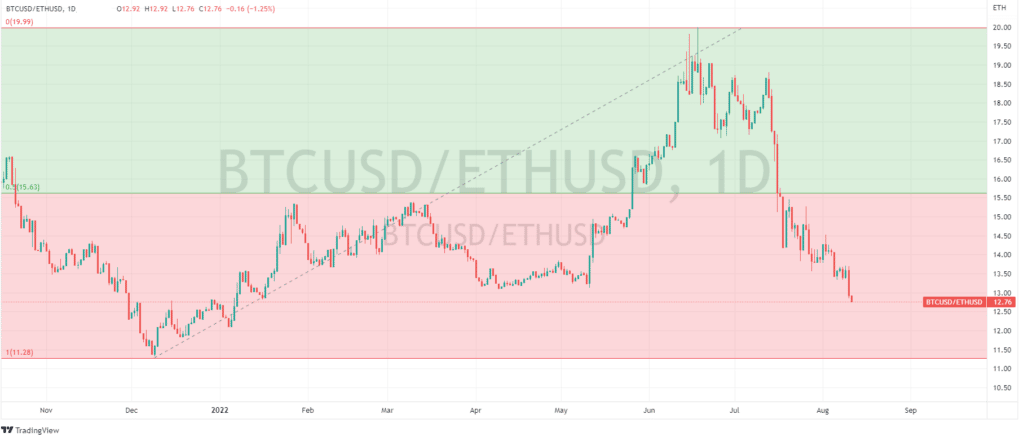

In the crypto space, Ethereum led the charge higher as investor optimism grows for a successful merge into ETH 2.0, scheduled for September 15. ETHUSD was last trading around $1,900 more than doubling from its June crash lows and sending the BTC/ETH ratio below 13, a level not seen since January.

In economic releases, Sterling traders will be watching the UK GDP released today at 06:00 GMT (4pm AEST) especially after the dour economic predictions from the BoE at their last policy meeting.

The information provided is of general nature only and does not take into account your personal objectives, financial situations or needs. Before acting on any information provided, you should consider whether the information is suitable for you and your personal circumstances and if necessary, seek appropriate professional advice. All opinions, conclusions, forecasts or recommendations are reasonably held at the time of compilation but are subject to change without notice. Past performance is not an indication of future performance. Go Markets Pty Ltd, ABN 85 081 864 039, AFSL 254963 is a CFD issuer, and trading carries significant risks and is not suitable for everyone. You do not own or have any interest in the rights to the underlying assets. You should consider the appropriateness by reviewing our TMD, FSG, PDS and other CFD legal documents to ensure you understand the risks before you invest in CFDs. These documents are available here.

#Economy #Economics #Finance #MarketsNext Article

USDJPY provides potential trade after holding a key Fibonacci level

The USDJPY has been in an extremely strong upward trend since September 2021. This pair's recent price action has also been charactarised by relatively weak retracements as it has trended higher. Inflationary pressures have acted as a strong catalyst for the USD against most other currencies further aided by the Federal Reserve taking a strong stan...

August 12, 2022Read More >Previous Article

Buying opportunity on the GBPAUD

Buying opportunity on the GBPAUD A short/medium term trading opportunity has arisen on the GBPAUD. The Pound has been weakening after the...

August 12, 2022Read More >Please share your location to continue.

Check our help guide for more info.

- Trading