- Trading

- Trading

- Markets

- Markets

- Products overview

- Forex

- Commodities

- Metals

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- Platforms

- Platforms

- Platforms

- Platforms

- Platforms overview

- MetaTrader 4

- MetaTrader 5

- Education

- Education

- Education

- Education

- News & analysis

- Education Hub

- Economic calendar

- Help & support

- Help & support

- About

- Trading

- Trading

- Markets

- Markets

- Products overview

- Forex

- Commodities

- Metals

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- Platforms

- Platforms

- Platforms

- Platforms

- Platforms overview

- MetaTrader 4

- MetaTrader 5

- Education

- Education

- Education

- Education

- News & analysis

- Education Hub

- Economic calendar

- Help & support

- Help & support

- About

- Home

- News & Analysis

- Articles

- Economic Updates

- US Stocks Mixed in Choppy Session Driven by Data and Fed Speakers

- Home

- News & Analysis

- Articles

- Economic Updates

- US Stocks Mixed in Choppy Session Driven by Data and Fed Speakers

News & AnalysisNews & Analysis

News & AnalysisNews & AnalysisUS Stocks Mixed in Choppy Session Driven by Data and Fed Speakers

2 March 2023 By Lachlan MeakinUS stock indexes went on a rollercoaster ride in their Wednesday session after weaker then expected US ISM and Manufacturing PMI figures were offset by prices paid showing a return to expansionary territory adding to inflationary concerns after the string of hot January prints. Adding to the mix was Hawkish rhetoric from voting Fed member Kashkari and a lead in from Europe where Germany joined France and Spain in releasing hotter than expected inflation figures.

The Dow Jones managed to eke out a tiny gain, while both the S&P 500 and Nasdaq finished down for the session, both finding support at their critical 200 Day moving average.

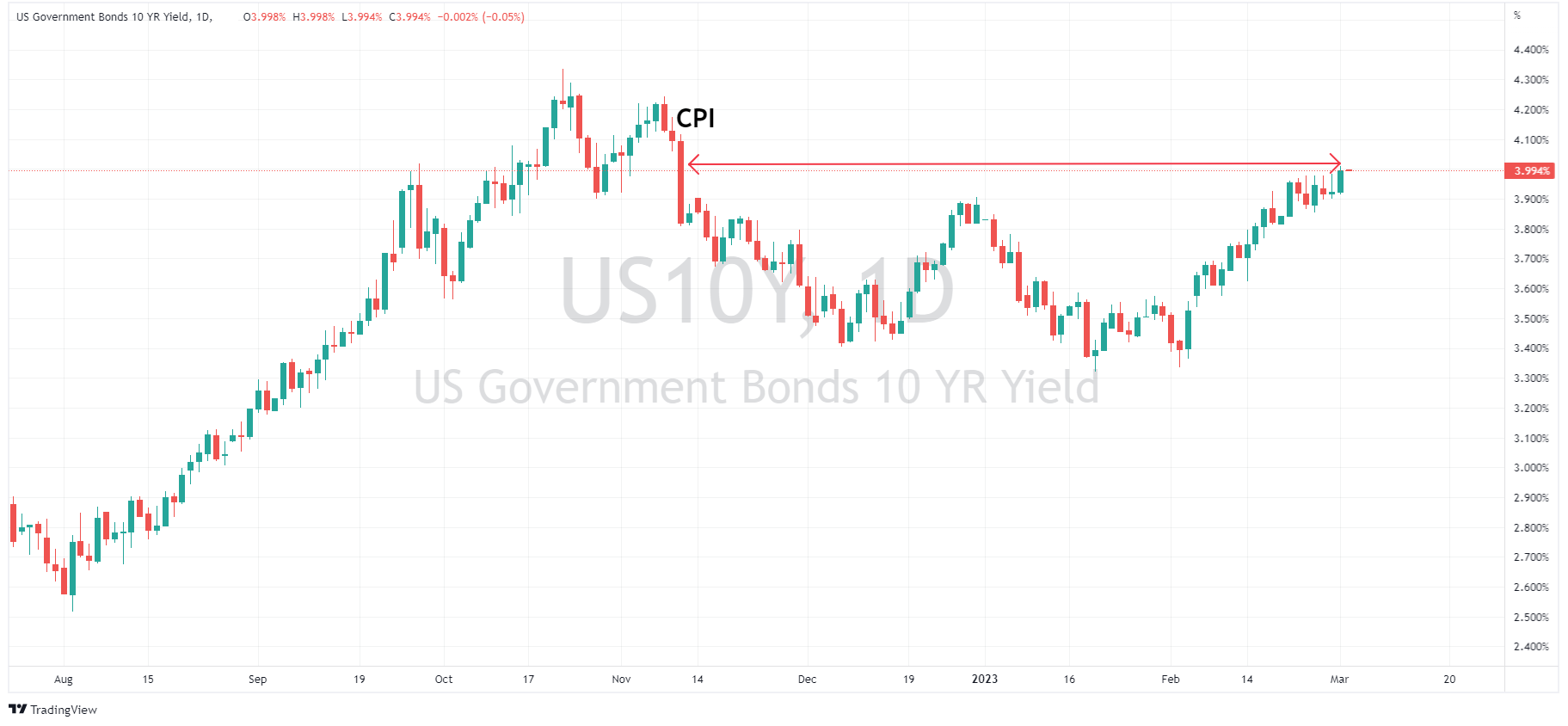

Bond yields moved higher across all maturities , with the closely watched 10-Year breaking through the important 4.00% level, a major resistance area that has held during 2023 to this point. This was the first time the 10-Year had breached the 4.00% level since the November 2022 weak CPI print.

Crude Oil prices also whipsawed in Wednesdays session , swinging wildly on strong China PMIs, Hot German inflation, another crude inventory builds, and US PMI figures.

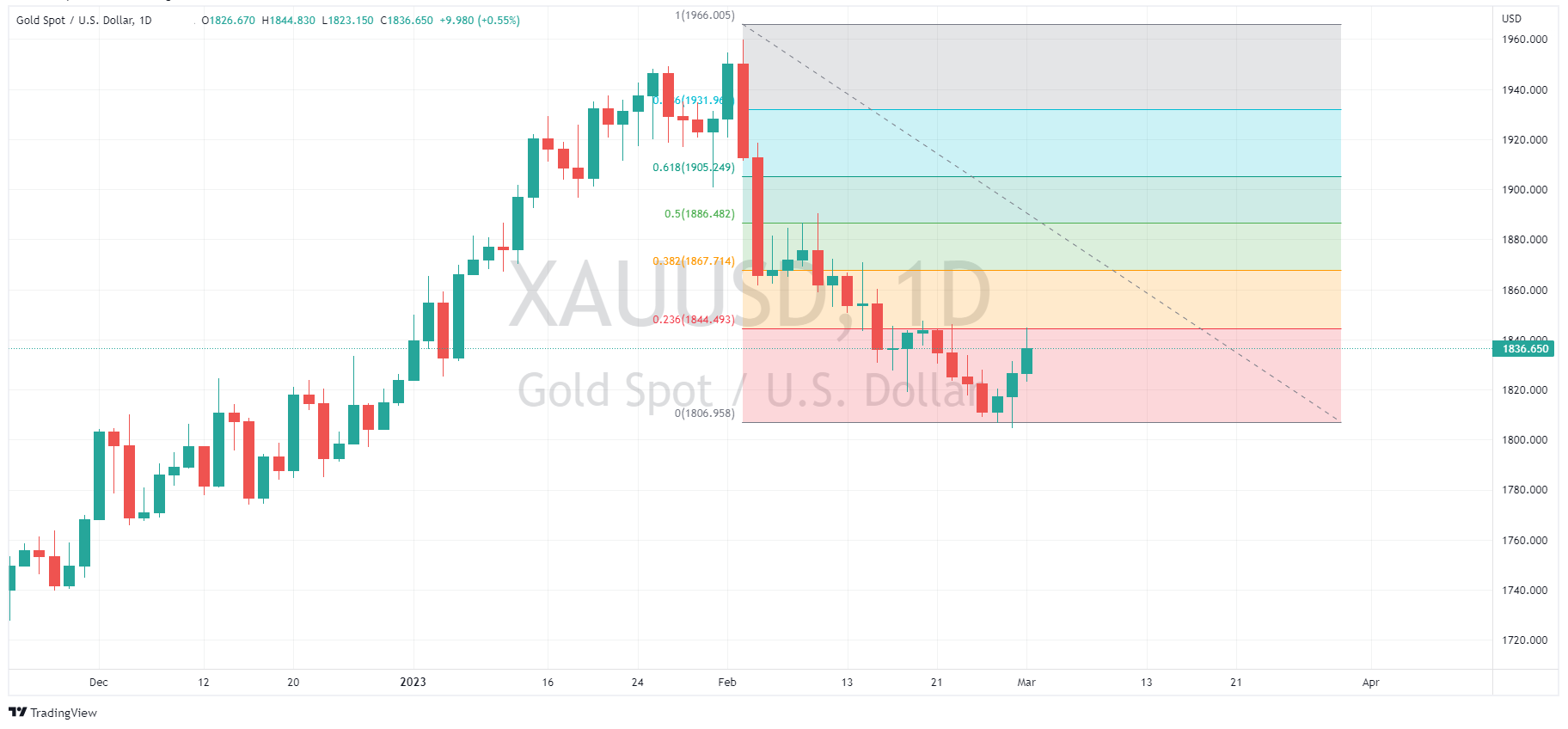

Gold extended Tuesdays bounce on a weaker USD and higher inflation fears, touching on 1845 USd per ounce before finding resistance at its 23.6% Fibonacci level from the high seen in February.

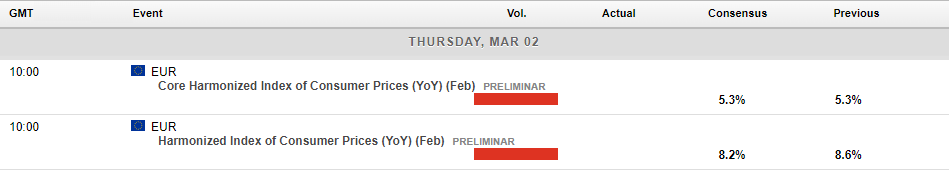

In todays major economic releases, we have some more inflation figures out of the EU with the Core Harmonized Index of Consumer Prices (HICP) released at 10:00 GMT. Whilst inflation figures have been the hot topic in economic releases lately, with German, French and Spanish figures already released this EU wide figure may not have any surprises in store.

The information provided is of general nature only and does not take into account your personal objectives, financial situations or needs. Before acting on any information provided, you should consider whether the information is suitable for you and your personal circumstances and if necessary, seek appropriate professional advice. All opinions, conclusions, forecasts or recommendations are reasonably held at the time of compilation but are subject to change without notice. Past performance is not an indication of future performance. Go Markets Pty Ltd, ABN 85 081 864 039, AFSL 254963 is a CFD issuer, and trading carries significant risks and is not suitable for everyone. You do not own or have any interest in the rights to the underlying assets. You should consider the appropriateness by reviewing our TMD, FSG, PDS and other CFD legal documents to ensure you understand the risks before you invest in CFDs. These documents are available here.

#Economy #Economics #Finance #MarketsNext Article

US stocks lift off after Bostic comments, EU sees record inflation print driving bond yields higher

A strong US labour market figure , unemployment claims dropped to 190k when 196k was expected, in combination with a record high Core CPI figure out of Europe saw the US equity session get off to a rocky start as bond yields soared. That all changed later in the session as a Bloomberg headline hit with comments from Fed member Bostic. Whi...

March 3, 2023Read More >Previous Article

AUD CPI eases but Interest Rates could continue rising

The Consumer Price Index (CPI) is an inflation indicator that is closely watched by the markets and policymakers as a gauge of economic fluctuation an...

March 2, 2023Read More >Please share your location to continue.

Check our help guide for more info.

- Trading