- Trading

- Trading

- Markets

- Markets

- Products overview

- Forex

- Commodities

- Metals

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- Platforms

- Platforms

- Platforms

- Platforms

- Platforms overview

- MetaTrader 4

- MetaTrader 5

- Education

- Education

- Education

- Education

- News & analysis

- Education Hub

- Economic calendar

- Help & support

- Help & support

- About

- Trading

- Trading

- Markets

- Markets

- Products overview

- Forex

- Commodities

- Metals

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- Platforms

- Platforms

- Platforms

- Platforms

- Platforms overview

- MetaTrader 4

- MetaTrader 5

- Education

- Education

- Education

- Education

- News & analysis

- Education Hub

- Economic calendar

- Help & support

- Help & support

- About

- Home

- News & Analysis

- Articles

- Economic Updates

- US stocks mostly lower as bank woes sour risk sentiment, BoE hikes rates

- Home

- News & Analysis

- Articles

- Economic Updates

- US stocks mostly lower as bank woes sour risk sentiment, BoE hikes rates

News & AnalysisNews & Analysis

News & AnalysisNews & AnalysisUS stocks mostly lower as bank woes sour risk sentiment, BoE hikes rates

12 May 2023 By Lachlan MeakinUS indices closed the session mixed with outperformance in Nasdaq, propped up by Google(GOOG) as their continuing I/O event bolstered their stock price. However, other major indices finished solidly in the red, with the Dow down over 200 points, dragged down by Disney, and the S&P500 and Russell 2000 suffering from further banking woes after PacWest(PACW) reported a 10% draining of deposits, seeing its stock price tank 22% on the day.

FX Markets

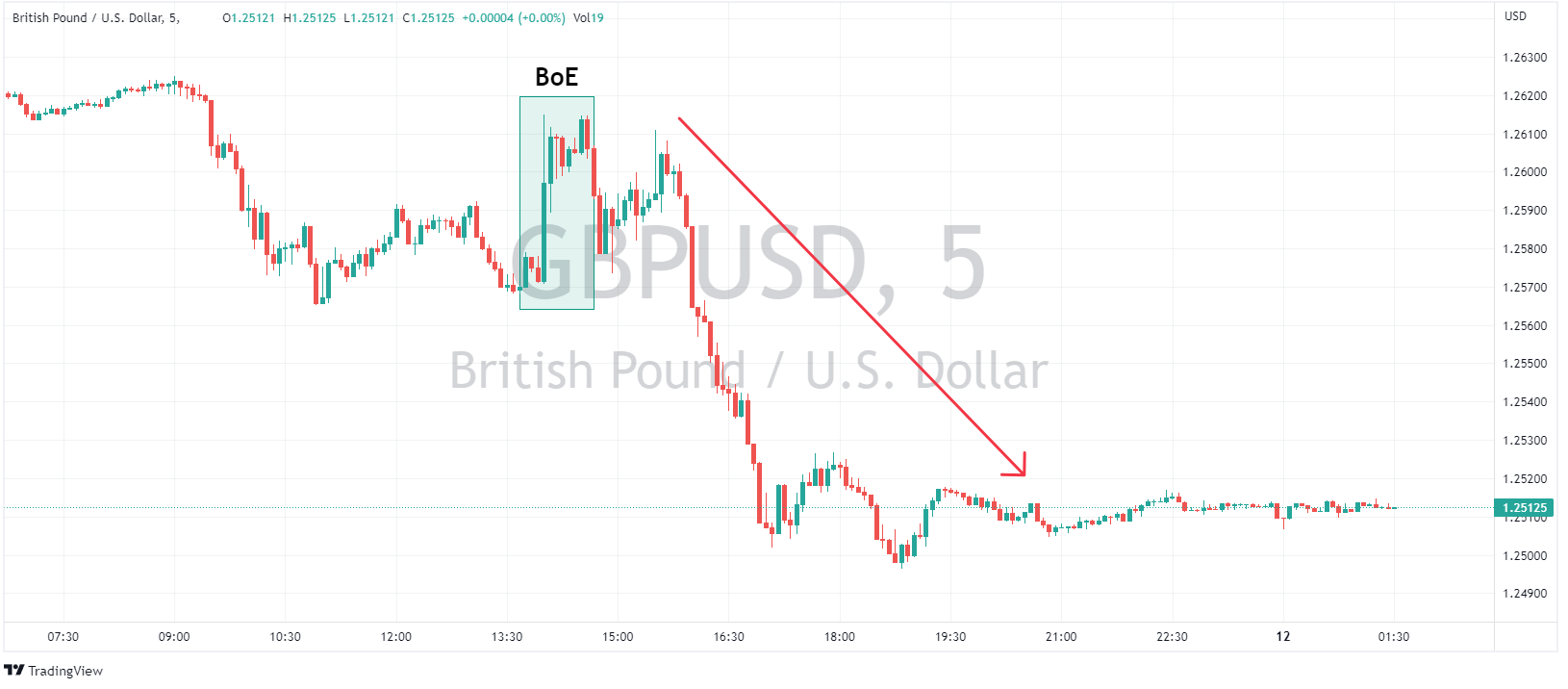

In Thursday’s main risk even the Bank of England hiked rates 25bp as expected by the usual 7-2 vote split, this is now 12 hikes in a row for the BoE. The accompanying statement had a bit of each way for the doves and hawks, with the BoE stating that “prior tightening was yet to make its way into the economy” but also opting to retain guidance that “if there were to be evidence of more persistent (inflation) pressures, then further tightening in monetary policy would be required”.

GBPUSD initially spiked higher to test the major resistance above 1.26, but quickly gave back all the gains and then some as rates markets priced in a less aggressive BoE going forward.

To be fair the USD did push higher against most currencies, despite a lower than expected PPI reading. Soured risk sentiment caused by banking jitters and the ongoing debt ceiling impasse seeing haven flows into the USD. The UD Dollar Index pushing through the minor resistance at 101.80, settling above the 102 mark.

Commodities

An initial spike in Gold quickly sold off as a surging USD saw XAUUSD push below it’s 2020 support level to finish the session well in the red. Safe haven traders now seem to be favouring the USD and JPY over gold which is an ominous sign for the gold bulls if it lasts.

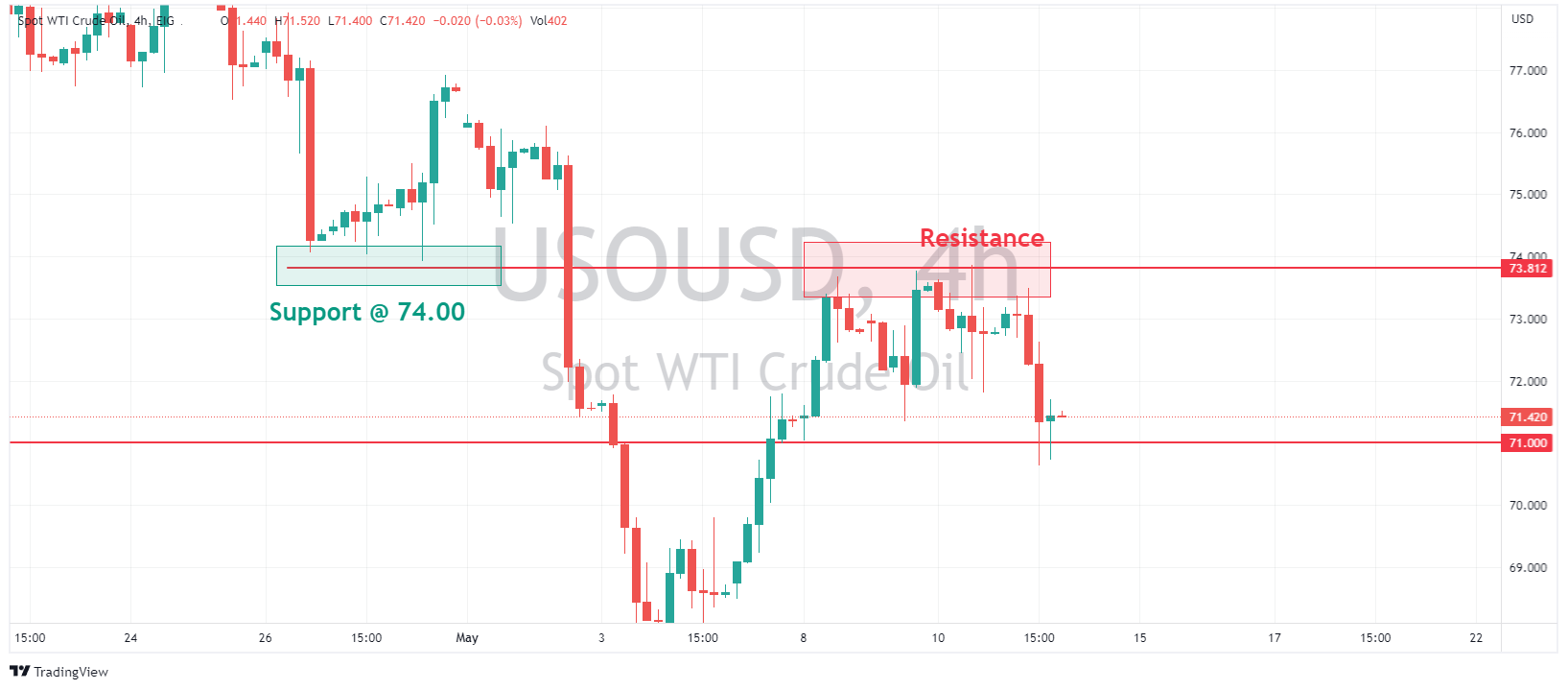

Crude Oil was lower on Thursday, weighed on by cooler than expected Chinese inflation data, a resurgent USD, and risk-off sentiment on banking woes. The lower than expected CPI and PPI out of China stoked demand concerns and worries the post-COVID rebound is not as strong as hoped.

USOUSD sliding to $71 USD a barrel before finding some support.

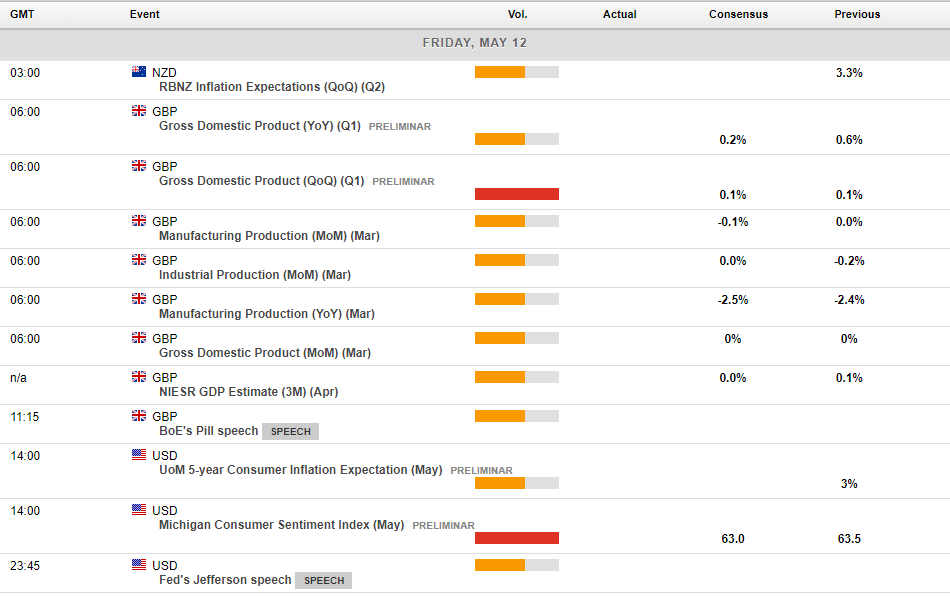

Today’s main risk events are the NZ Inflation expectations figure, with the NZD outperforming lately a high reading here could see the AUDNZD push even lower, setting up for a possible mean reversion trade. UK GDP is unlikely to have much effect on the market after Thursdays BoE meeting, while Consumer Sentiment out of the US will be a good gauge on US economic health and swing the needle somewhat in the markets Fed expectations for June.

The information provided is of general nature only and does not take into account your personal objectives, financial situations or needs. Before acting on any information provided, you should consider whether the information is suitable for you and your personal circumstances and if necessary, seek appropriate professional advice. All opinions, conclusions, forecasts or recommendations are reasonably held at the time of compilation but are subject to change without notice. Past performance is not an indication of future performance. Go Markets Pty Ltd, ABN 85 081 864 039, AFSL 254963 is a CFD issuer, and trading carries significant risks and is not suitable for everyone. You do not own or have any interest in the rights to the underlying assets. You should consider the appropriateness by reviewing our TMD, FSG, PDS and other CFD legal documents to ensure you understand the risks before you invest in CFDs. These documents are available here.

#Economy #Economics #Finance #MarketsNext Article

The Week ahead – US retail sales, jobs data from UK and Australia, RBA minutes.

Global markets enter the 3rd week of May against the backdrop of rising market concern regarding the ongoing US debt ceiling impasse as well as ongoing risks in the US banking system, both of which dampening risk sentiment and seeing markets rangebound as they await a solid catalyst to get moving. US 1 year Credit Default Swap price spiking on d...

May 15, 2023Read More >Previous Article

Bank of England hikes again

Bank of England announced the latest policy decision on Thursday, raising interest rates for the 12th consecutive time from 4.25% to 4.5%, which was i...

May 11, 2023Read More >Please share your location to continue.

Check our help guide for more info.

- Trading