- Trading

- Trading

- Markets

- Markets

- Products overview

- Forex

- Commodities

- Metals

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- Platforms

- Platforms

- Platforms

- Platforms

- Platforms overview

- MetaTrader 4

- MetaTrader 5

- Education

- Education

- Education

- Education

- News & analysis

- Education Hub

- Economic calendar

- Help & support

- Help & support

- About

- Trading

- Trading

- Markets

- Markets

- Products overview

- Forex

- Commodities

- Metals

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- Platforms

- Platforms

- Platforms

- Platforms

- Platforms overview

- MetaTrader 4

- MetaTrader 5

- Education

- Education

- Education

- Education

- News & analysis

- Education Hub

- Economic calendar

- Help & support

- Help & support

- About

- Home

- News & Analysis

- Economic Updates

- US stocks tumble, USD rallies as Fed hawks and China protests sour risk appetite

- Home

- News & Analysis

- Economic Updates

- US stocks tumble, USD rallies as Fed hawks and China protests sour risk appetite

- 0950ET *MESTER SAYS SHE DOESN’T THINK FED NEAR A PAUSE IN TIGHTENING, NEED TO SEE SEVERAL MORE GOOD INFLATION READINGS

- 1200ET *WILLIAMS SAYS FED STILL HAS MORE WORK TO DOON INFLATION, FURTHER TIGHTENING SHOULD HELP REDUCE INFLATION

- 1200ET *BULLARD: RISK THAT FED WILL HAVE TO GO HIGHER ON RATES IN 2023, MARKETS UNDERPRICING RISK FOMC MAY BE MORE AGGRESSIVE, FED HAS `A WAYS TO GO TO GET TO’ RESTRICTIVE RATES, FIRST 250 BPS OF TIGHTENING WAS JUST GETTING TO NEUTRAL, TIME TO LET QT PROGRAM RUN FOR NOW; SO FAR, SO GOOD

- 1600ET *BRAINARD SAYS FED POLICY NEEDS TO BE RESTRICTIVE FOR SOME TIME

News & AnalysisNews & Analysis

News & AnalysisNews & AnalysisUS stocks tumble, USD rallies as Fed hawks and China protests sour risk appetite

29 November 2022 By Lachlan MeakinStocks were sold globally in Mondays session as risk appetite took a hit on civil unrest and increasing Covid cases in China dashing re-opening hopes. Adding to this was the reset of the “Fed Pivot” narrative with a quartet of Fed governors throwing cold water on that idea, re-iterating the Fed was in for the long haul in their quest to tame inflation.

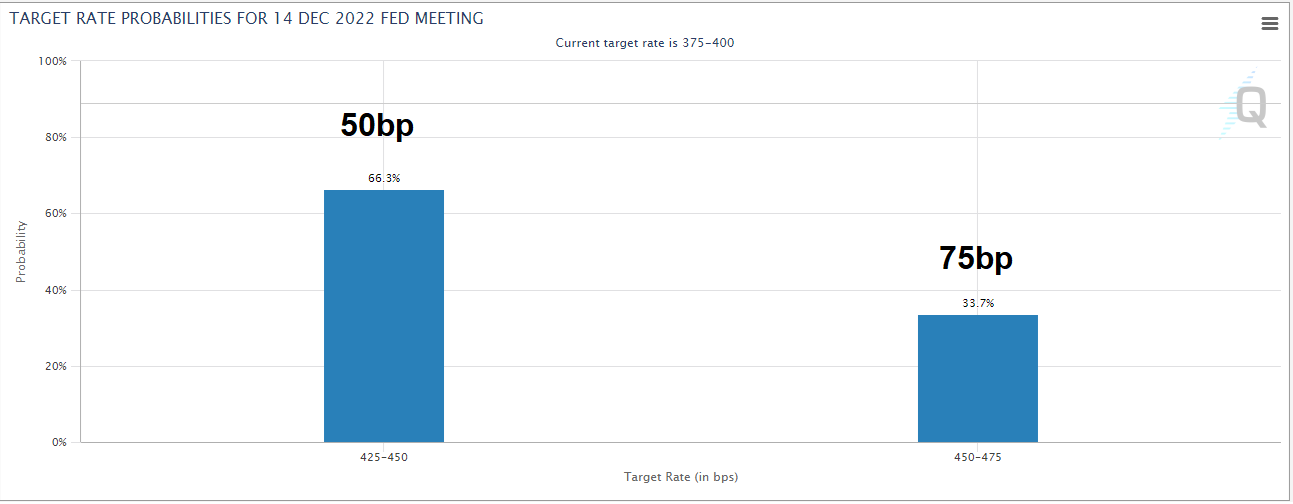

The market took these comments to show an imminent pause looks unlikely, and a pivot even less likely, sending risk-assets lower. Also a sharp re-pricing in Fed fund futures trying to predict the next size of the Feds rate hike, yesterday it was sitting at 75% of 50bp, 25% a 75bp hike, after these Fed member comments the odds are now 66% to 34%, a huge move.

The US dollar saw a large intraday swing as markets re-priced, after initial weakness the US dollar index skyrocketed to recoup losses and then some.

Crude oil was another market that had a rollercoaster ride, with China inspired growth concern gap down on the open, retraced sharply on comments from Eurasia Group that OPEC might be discussing more production cuts, not hikes.

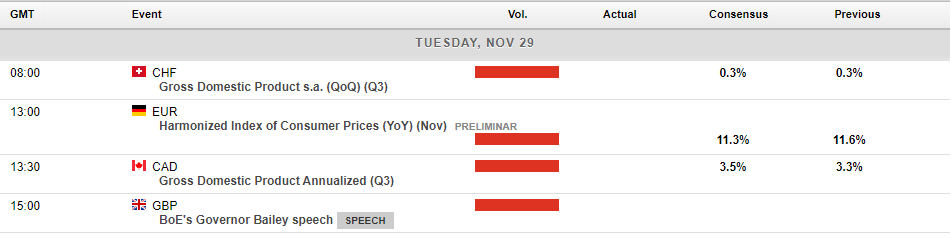

Todays calendar is fairly light again, though it does feel like the calm before the storm as a slew of top tier releases will start on Wednesday.

The information provided is of general nature only and does not take into account your personal objectives, financial situations or needs. Before acting on any information provided, you should consider whether the information is suitable for you and your personal circumstances and if necessary, seek appropriate professional advice. All opinions, conclusions, forecasts or recommendations are reasonably held at the time of compilation but are subject to change without notice. Past performance is not an indication of future performance. Go Markets Pty Ltd, ABN 85 081 864 039, AFSL 254963 is a CFD issuer, and trading carries significant risks and is not suitable for everyone. You do not own or have any interest in the rights to the underlying assets. You should consider the appropriateness by reviewing our TMD, FSG, PDS and other CFD legal documents to ensure you understand the risks before you invest in CFDs. These documents are available here.

#Economy #Economics #Finance #MarketsNext Article

Will BlockFi be another FTX?

Not even one week after crypto exchange FTX officially filed for bankruptcy another Cryptocurrency entity has felt the wrath and submitted its own Chapter 11. The spread and contagion effect from FTX was always a concern and now cryptocurrency lender BlockFi has fallen. BlockFi had been struggling even prior to the FTX collapse. In fact, the com...

November 29, 2022Read More >Previous Article

Pinduoduo tops revenue estimates for Q3 – the stock is rising

The Chinese e-commerce platform Pinduoduo Inc. (NASDAQ: PDD) announced its unaudited Q3 financial results on Monday. The company beat revenue estim...

November 29, 2022Read More >Please share your location to continue.

Check our help guide for more info.

- Trading