- Trading

- Trading

- Markets

- Markets

- Products overview

- Forex

- Commodities

- Metals

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- Platforms

- Platforms

- Platforms

- Platforms

- Platforms overview

- MetaTrader 4

- MetaTrader 5

- Education

- Education

- Education

- Education

- News & analysis

- Education Hub

- Economic calendar

- Help & support

- Help & support

- About

- Trading

- Trading

- Markets

- Markets

- Products overview

- Forex

- Commodities

- Metals

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- Platforms

- Platforms

- Platforms

- Platforms

- Platforms overview

- MetaTrader 4

- MetaTrader 5

- Education

- Education

- Education

- Education

- News & analysis

- Education Hub

- Economic calendar

- Help & support

- Help & support

- About

- Home

- News & Analysis

- Economic Updates

- Walgreens Boots Alliance exceeds Wall Street expectations

- Home

- News & Analysis

- Economic Updates

- Walgreens Boots Alliance exceeds Wall Street expectations

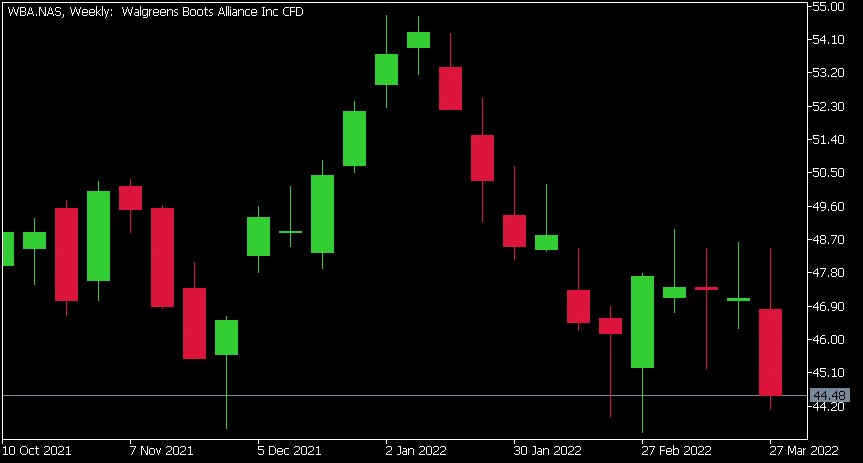

- 1 Month: +1.58%

- 3 Month: -8.71%

- Year-to-date: -9.01%

- 1 Year: -13.32%

News & AnalysisNews & Analysis

News & AnalysisNews & AnalysisWalgreens Boots Alliance Inc. reported its latest financial results for the second quarter of fiscal 2022 on Thursday.

The pharmaceutical company reported revenue of $33.756 billion in the quarter, beating analyst forecast of $33.228 billion.

Earnings per also topped analyst estimates at $1.59 per share vs. $1.39 per share expected.

CEO Rosalind Brewer commented on the latest results: “Second quarter results demonstrated broad-based execution, driving strong comparable sales and robust earnings growth. We continue to make important strides along our strategic priorities, building a consumer-centric, technology-enabled healthcare enterprise at the center of local communities. VillageMD and Shields are delivering tremendous pro forma sales growth compared to their year-ago standalone results, and our Walgreens Health segment is on track toward long-term targets. The strategic review of our Boots business is progressing, and our transformational actions are accelerating sustainable value creation.”

Walgreens Boots Alliance Inc. chart

Shares of Walgreens Boots Alliance were down by 6% during the trading day on Thursday at $44.48 per share.

Here is how the stock has performed in the past year –

Walgreens is the 453rd largest company in the world with a market cap of $40.97 billion.

You can trade Walgreens Boots Alliance Inc. (WBA) and many other stocks from the NYSE, NASDAQ, HKEX and the ASX with GO Markets as a Share CFD.

Sources: Walgreens Boots Alliance Inc., TradingView, CompaniesMarketCap

The information provided is of general nature only and does not take into account your personal objectives, financial situations or needs. Before acting on any information provided, you should consider whether the information is suitable for you and your personal circumstances and if necessary, seek appropriate professional advice. All opinions, conclusions, forecasts or recommendations are reasonably held at the time of compilation but are subject to change without notice. Past performance is not an indication of future performance. Go Markets Pty Ltd, ABN 85 081 864 039, AFSL 254963 is a CFD issuer, and trading carries significant risks and is not suitable for everyone. You do not own or have any interest in the rights to the underlying assets. You should consider the appropriateness by reviewing our TMD, FSG, PDS and other CFD legal documents to ensure you understand the risks before you invest in CFDs. These documents are available here.

#Economy #Economics #Finance #MarketsNext Article

Biden’s push toward electric vehicles as he looks to invoke the Defence Production Act

US President Joe Biden is pushing to invoke the Defence Production Act as soon as the end of the week. The president is aiming to boost domestic production of critical minerals which are essential to the production of Electric Vehicle (EV) batteries and military hardware. The legislation was originally designed to help the federal government gai...

April 1, 2022Read More >Previous Article

State of Play for FAANG stocks

The FAANG stocks are perhaps the most well-known and well-advertised stocks in the market. The FAANG stocks are made up of META (Which used to be Face...

April 1, 2022Read More >Please share your location to continue.

Check our help guide for more info.

- Trading