- Trading

- Trading

- Markets

- Markets

- Products overview

- Forex

- Commodities

- Metals

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- Platforms

- Platforms

- Platforms

- Platforms

- Platforms overview

- MetaTrader 4

- MetaTrader 5

- Education

- Education

- Education

- Education

- News & analysis

- Education Hub

- Economic calendar

- Help & support

- Help & support

- About

- Trading

- Trading

- Markets

- Markets

- Products overview

- Forex

- Commodities

- Metals

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- Platforms

- Platforms

- Platforms

- Platforms

- Platforms overview

- MetaTrader 4

- MetaTrader 5

- Education

- Education

- Education

- Education

- News & analysis

- Education Hub

- Economic calendar

- Help & support

- Help & support

- About

- Home

- News & Analysis

- Economic Updates

- Walt Disney earnings fall short of estimates

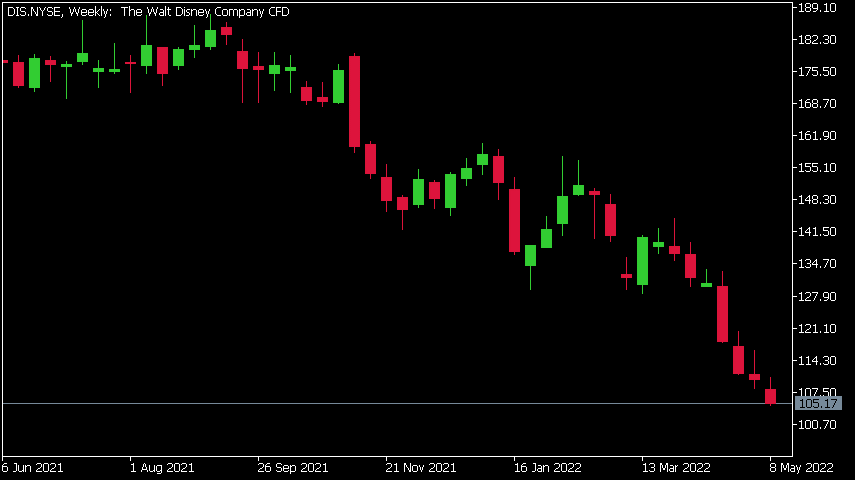

- 1 Month -20.51%

- 3 Month -28.54%

- Year-to-date -32.07%

- 1 Year -40.84%

- JP Morgan: $175

- Citigroup: $200

- Morgan Stanley: $170

- Wells Fargo: $196

News & AnalysisThe Walt Disney Company (DIS) reported the latest financial results for its second fiscal quarter on Wednesday.

World’s largest entertainment company reported revenue of $19.249 billion (an increase of 23% year-over-year) for the quarter vs. $20.054 billion expected.

Earnings per share reported at $1.08 per share (an increase of 37% year-over-year), falling short of analyst forecast of $1.19 per share.

Total Disney+ subscriptions rose to 137.7 million in the quarter vs. 135 million expected.

Bob Chapek, CEO of Walt Disney commented on the latest results: ”Our strong results in the second quarter, including fantastic performance at our domestic parks and continued growth of our streaming services—with 7.9 million Disney+ subscribers added in the quarter and total subscriptions across all our DTC offerings exceeding 205 million—once again proved that we are in a league of our own.”

”As we look ahead to Disney’s second century, I am confident we will continue to transform entertainment by combining extraordinary storytelling with innovative technology to create an even larger, more connected, and magical Disney universe for families and fans around the world,” Chapek added.

The Walt Disney Company chart

Shares of Walt Disney were down by 2.29% on Wednesday, trading at $105.17 per share.

Here is how the stock has performed in the past year:

Walt Disney price targets

The Walt Disney Company is the 48th largest company in the world with a market cap of $191.54 billion.

You can trade The Walt Disney Company (DIS) and many other stocks from the NYSE, NASDAQ, HKEX and the ASX with GO Markets as a Share CFD.

Sources: The Walt Disney Company, TradingView, CompaniesMarketCap

The information provided is of general nature only and does not take into account your personal objectives, financial situations or needs. Before acting on any information provided, you should consider whether the information is suitable for you and your personal circumstances and if necessary, seek appropriate professional advice. All opinions, conclusions, forecasts or recommendations are reasonably held at the time of compilation but are subject to change without notice. Past performance is not an indication of future performance. Go Markets Pty Ltd, ABN 85 081 864 039, AFSL 254963 is a CFD issuer, and trading carries significant risks and is not suitable for everyone. You do not own or have any interest in the rights to the underlying assets. You should consider the appropriateness by reviewing our TMD, FSG, PDS and other CFD legal documents to ensure you understand the risks before you invest in CFDs. These documents are available here.

#Economy #Economics #Finance #MarketsNext Article

Beyond Meat posts disappointing Q1 results – the stock is falling

Beyond Meat Inc. (BYND) reported its first quarter financial results after the closing bell in the US on Wednesday. The US plant-based meat producer reported revenue that fell short of analyst estimates at $109.455 million (up by 1.2% year-over-year) vs. $112.398 million expected. Loss per share reported at -$1.58 per share, higher than estim...

May 12, 2022Read More >Previous Article

How to trade the Volatility Contraction Pattern

The Volatility Contraction Pattern, (VCP) is a famous trading pattern identified and dissected by Market Wizard, Mark Minervini. The premise of the pa...

May 11, 2022Read More >Please share your location to continue.

Check our help guide for more info.

- Trading