- Trading

- Trading

- Markets

- Markets

- Products overview

- Forex

- Commodities

- Metals

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- Platforms

- Platforms

- Platforms

- Platforms

- Platforms overview

- MetaTrader 4

- MetaTrader 5

- Education

- Education

- Education

- Education

- News & analysis

- Education Hub

- Economic calendar

- Help & support

- Help & support

- About

- Trading

- Trading

- Markets

- Markets

- Products overview

- Forex

- Commodities

- Metals

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- Platforms

- Platforms

- Platforms

- Platforms

- Platforms overview

- MetaTrader 4

- MetaTrader 5

- Education

- Education

- Education

- Education

- News & analysis

- Education Hub

- Economic calendar

- Help & support

- Help & support

- About

- Home

- News & Analysis

- Economic Updates

- Week Ahead :FOMC meeting looms as next major catalyst

- Home

- News & Analysis

- Economic Updates

- Week Ahead :FOMC meeting looms as next major catalyst

News & AnalysisNews & Analysis

News & AnalysisNews & AnalysisAll eyes will be on the Federal Reserve this week as they meet again to decide on the next set of interest rate hikes. The Fed is expected to raise rates by 25 bps with the accompanying statement providing important insight as to their sentiment going forward. The question to be answered will be whether a recession will be avoided, or inflation is still too high and needs to be tapered.

In the equities market, the Nasdaq had another powerful week as it continues to climb higher to begin the year. The Index rose by 4.75% and is now just sitting below its 50-week moving average which has been a stubborn resistance level. The Dow Jones was a little less exuberant as it rose by just 1.81% and the S&P 500 rose by 2.47% breaking through its own 50 week moving average. Across the globe, the ASX200 was a little weaker than previous weeks, although as it enters territory near its all-time high with an unsure market, it may face some resistance in the short term.

The price of Brent Oil was unable to reclaim its 50-week moving average closing the week down 1.84% to $86 as is consolidates and Gold has had another mixed week as is continues to struggle break above $2000 per ounce.

Stocks In the Spotlight

Arufura Rare Earths, (ARU)

Arufura is one of the most advanced rare earths juniors racing to produce high quality NdPr at scalable level outside of China. The company owns the Nolans Project in the Northern Territory just 135km south of Allice Springs. The company has outlined the economics of its project with a NPV of Two Billion Dollars and potentially lifting the NPV to closer to 4.2 Billion dollars in best case scenario. With strong off take partners in automobile manufacturers Hyundai and Kia, the company represents a tier one project with significant upside and is hoping to begin construction in 2023. The current share price is $0.565 which is its 12-month high.

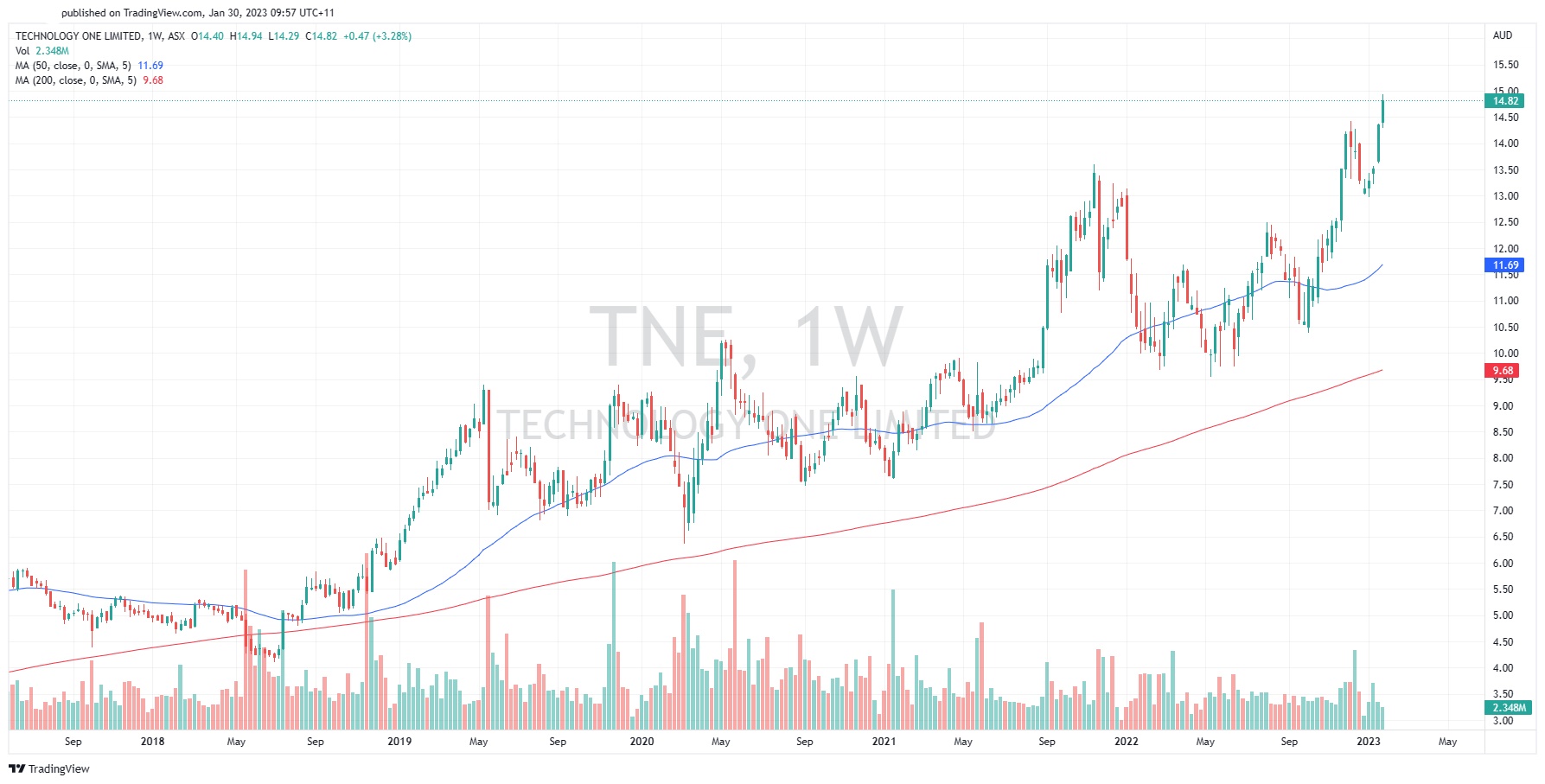

Technology One, (TNE)

Technology One is a SAAS software business that supports organisations interact with their customers and employees. The company operates in wide a range of sectors and operates with a high level security over its data. The company much like the rest of the technology sector had a difficult 2022. Although, its relative performance made it one of the better companies. The company has recently seen its share price rise to all-time highs and is currently trading at $14.82. This has been somewhat due to the recovery in the sector and due to its underlying financial performance. In the 2022FY, the company increased its revenue by 18% to $369 million and its NPAT to 22% for $88.8 million.

IGO Ltd, (IGO)

IGO is a leading nickel, copper, and cobalt mining company. With the EV battery revolution taking over, the company is positioning itself to be a leader in a space that should be expanding and require immense investment in the next 10-20 years. IGO recently entered a joint venture with Tianqi Lithium corporation to takeover Essential metals a junior lithium explorer to expand its suite of products. This would allow to be one of the most diversified miners in the country exclusive of companies such as BHP and Rio Tinto. The company’s share price also received a boost from a recent spike in copper spot prices. The share price is currently trading at $15.81.

Weekly Ex Dividend dates

30 January

BOQ – Bank of Queensland

PCI – Perpetual Credit Income Trust

GCI – Gryphon Capital Income trust

DJW – Djerriwarrh Investments Ltd

TCF – 360 Capital Enhanced Income Fund

31 January

KKC – KKR Credit Income Fund

CVC – CVC Limited

MXT – Metrics Master Income Trust

MOT – Metrics Income opportunities Trust

1 February

BHYB – Betashares Australian Major Banks Hybrids INDEX ETF

AGVT – Betashares Australian Government Bond ETF

PLUS – Vaneck Australian Corporate Bond Plus ETF

EZL – EUROZ Hartleys Group

GCAP – Vaneck Bentham GL Cap Se Active ETF (Managed Fund)

FLOT – Vaneck Floating rate ETF

EBND – Vaneck Emerging Inc Opportunities Active ETF

NBI – NB Global Income Trust

AMH – Amcil Ltd

HCRD – Betahsares interest rate hedged Aus Corp Bond ETF

CRED – Betashares Australian Investment Grade Corporate Bond ETF

BNDS – Betashares Westn Asset Aus Bond Fund

PGG – Partners Group Global Income Fund

SUBD – Vaneck Australian Subordinated Debt ETF

AAA – Betashares High Interest Cash ETF

QPON – Betashares Australian bank Senior Floating rate Bond ETF

OZBD – Betashares Australian Composite Bond ETF

HVST – Betashares Australian Dividend Harvester Fund

2 February

AFI – Australian Foundation Investment Company

Key Economic Events -Australian Eastern Standard Time

Wednesday

12:30am – CAD GDP m/m

2:00am – USD CB Consumer Confidence

8:45am – NZD Employment Change q/q

8:45am – NZD Unemployment Rate

Thursday

12:15am – USD ADP Non-Farm Employment Change

2:00am – USD FOMC Statement

2:00am – USD Federal Funds rate

2:00am – USDFOMC Press Conference

11:00pm – GBP BOE Monetary Policy Report

11:00pm – GBP MPC Official Bank rate Votes

11:00pm – GBP monetary Policy Statement

11:00pm – GBP Official bank rate

Friday

12:15am – EUR Main Refinancing rate

12:15am – EUR Monetary Policy Statement

12:45am – EUR ECB Press Conference

Saturday

12:30 am – USD Average Hourly Earnings m/m

12:30 am – USD Non-Farm Employment Change

12:30 am – USD Unemployment Rate

2:00am – USD ISM Services PMI

The information provided is of general nature only and does not take into account your personal objectives, financial situations or needs. Before acting on any information provided, you should consider whether the information is suitable for you and your personal circumstances and if necessary, seek appropriate professional advice. All opinions, conclusions, forecasts or recommendations are reasonably held at the time of compilation but are subject to change without notice. Past performance is not an indication of future performance. Go Markets Pty Ltd, ABN 85 081 864 039, AFSL 254963 is a CFD issuer, and trading carries significant risks and is not suitable for everyone. You do not own or have any interest in the rights to the underlying assets. You should consider the appropriateness by reviewing our TMD, FSG, PDS and other CFD legal documents to ensure you understand the risks before you invest in CFDs. These documents are available here.

#Economy #Economics #Finance #MarketsNext Article

US Dollar Index Testing Key Level

US Dollar Fundamental Analysis Recent data indicated that the U.S. economy grew strongly in the fourth quarter which has boosted the Dollar against the Euro. This has supported the Federal Reserve's hawkish stance in spite of reports that US consumer spending has fallen, and inflation has cooled. According to the Commerce Department, the Consumer ...

January 31, 2023Read More >Previous Article

AUD hits $0.71 for first time since August 2022

The Australian dollar has continued its rise against the USD reaching the highest level in almost 3 months. With risk on assets receiving a boost and ...

January 27, 2023Read More >Please share your location to continue.

Check our help guide for more info.

- Trading