- Trading

- Trading

- Markets

- Markets

- Products overview

- Forex

- Commodities

- Metals

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- Platforms

- Platforms

- Platforms

- Platforms

- Platforms overview

- MetaTrader 4

- MetaTrader 5

- Education

- Education

- Education

- Education

- News & analysis

- Education Hub

- Economic calendar

- Help & support

- Help & support

- About

- Trading

- Trading

- Markets

- Markets

- Products overview

- Forex

- Commodities

- Metals

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- Platforms

- Platforms

- Platforms

- Platforms

- Platforms overview

- MetaTrader 4

- MetaTrader 5

- Education

- Education

- Education

- Education

- News & analysis

- Education Hub

- Economic calendar

- Help & support

- Help & support

- About

- Home

- News & Analysis

- Economic Updates

- Wells Fargo Q2 results are here

- 1 Month +6.89%

- 3 Month -11.26%

- Year-to-date -14.28%

- 1 Year -7.11%

- Citigroup $47

- Morgan Stanley $59

- RBC Capital $45

- Raymond James $50

- BMO Capital $60

- Piper Sandler $63

News & AnalysisWells Fargo & Co. (WFC) announced its Q2 financial results before the opening bell on Wall Street on Friday. The US financial services company missed analyst expectations for the quarter.

Revenue was reported at $17.028 billion for Q2 vs. $17.479 billion expected.

Earnings per share at $0.74 per share vs. $0.80 per share estimated.

”While our net income declined in the second quarter, our underlying results reflected our improving earnings capacity with expenses declining and rising interest rates driving strong net interest income growth. Loan balances increased with growth in both consumer and commercial loans. Credit quality remained strong, and we continued to execute on our efficiency initiatives. Noninterest income declined as higher interest rates and weaker financial markets reduced our vent,” CEO of Wells Fargo, Charlie Scharf said in a press release when the results were announced.

”Looking ahead, our results should continue to benefit from the rising interest rate environment with growth in net interest income expected to more than offset any further near-term pressure on noninterest income. We do expect credit losses to increase from these incredibly low levels, but we have yet to see any meaningful deterioration in either our consumer or commercial portfolios. Our efficiency initiatives continue to be on track, and the recent Federal Reserve stress test confirmed our strong capital position and our capacity to return excess capital to shareholders through dividends and common stock repurchases,” Scharf concluded.

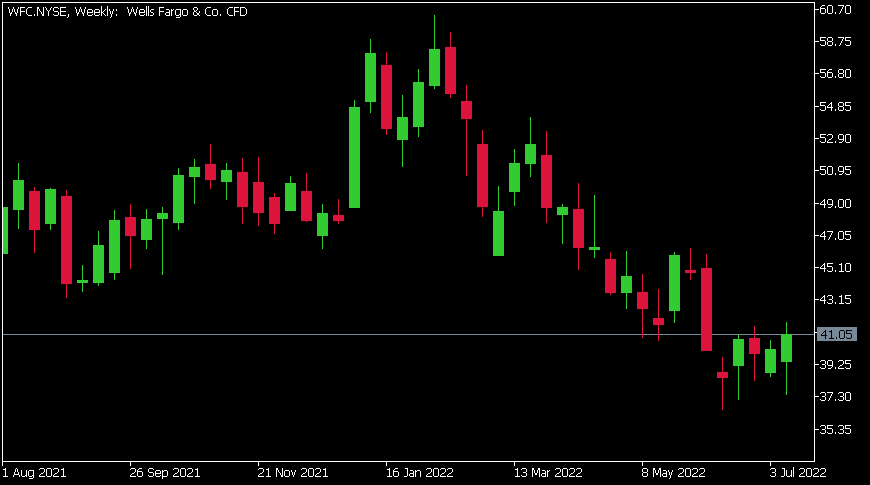

Wells Fargo & Co. (WFC) chart

Shares of Wells Fargo were up by 6.17% at the end of the trading day on Friday at $41.05 per share.

Here is how the stock has performed in the past year:

Wells Fargo price targets

Wells Fargo & Co. is the 68th largest company in the world with a market cap of $155.89 billion.

You can trade Wells Fargo & Co. (WFC) and many other stocks from the NYSE, NASDAQ, HKEX and the ASX with GO Markets as a Share CFD.

Sources: Wells Fargo & Co., TradingView, MetaTrader 5, Benzinga, CompaniesMarketCap

The information provided is of general nature only and does not take into account your personal objectives, financial situations or needs. Before acting on any information provided, you should consider whether the information is suitable for you and your personal circumstances and if necessary, seek appropriate professional advice. All opinions, conclusions, forecasts or recommendations are reasonably held at the time of compilation but are subject to change without notice. Past performance is not an indication of future performance. Go Markets Pty Ltd, ABN 85 081 864 039, AFSL 254963 is a CFD issuer, and trading carries significant risks and is not suitable for everyone. You do not own or have any interest in the rights to the underlying assets. You should consider the appropriateness by reviewing our TMD, FSG, PDS and other CFD legal documents to ensure you understand the risks before you invest in CFDs. These documents are available here.

#Economy #Economics #Finance #MarketsNext Article

Sour Apple wrecks tech as recession fears see USD soften

US stocks took a sharp dive at the end of their session with the Nasdaq swinging from +1.5% to -1% on the day, the move lower conincided with a report on the newswires the Apple plans to slow hiring and curb spending next year to prepare for a possible recession. This is being taken as a sign that the Federal Reserve’s tightening plans are sta...

July 19, 2022Read More >Previous Article

The Week Ahead – Central banks in focus, can the ECB or BOJ surprise?

Friday’s session saw a big rally in US equities as rate markets pared back some the pricing in of a 100bp hike at the next FOMC meeting after the re...

July 18, 2022Read More >Please share your location to continue.

Check our help guide for more info.

- Trading