- Trading

- Trading

- Markets

- Markets

- Products overview

- Forex

- Commodities

- Metals

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- Platforms

- Platforms

- Platforms

- Platforms

- Platforms overview

- MetaTrader 4

- MetaTrader 5

- Education

- Education

- Education

- Education

- News & analysis

- Education Hub

- Economic calendar

- Help & support

- Help & support

- About

- Trading

- Trading

- Markets

- Markets

- Products overview

- Forex

- Commodities

- Metals

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- Platforms

- Platforms

- Platforms

- Platforms

- Platforms overview

- MetaTrader 4

- MetaTrader 5

- Education

- Education

- Education

- Education

- News & analysis

- Education Hub

- Economic calendar

- Help & support

- Help & support

- About

- Home

- News & Analysis

- Economic Updates

- What Premier Investments’ latest results tells us about Retail sector post pandemic

- Home

- News & Analysis

- Economic Updates

- What Premier Investments’ latest results tells us about Retail sector post pandemic

News & AnalysisNews & Analysis

News & AnalysisNews & AnalysisWhat Premier Investments’ latest results tells us about Retail sector post pandemic

25 March 2022 By GO MarketsPremier Investments is a company that was established as an investment vehicle to maximise growth in capital returns to shareholders through the acquisition of controlling or strategic shareholdings in premier Australian companies, with a particular focus on retailing, importing and distributing.

Premier Investments’ Half-Year Results

Premier Investments has announced a record interim dividend after one of their brands, Peter Alexander, posted record sales for the first half of the 2022 financial year despite multiple lockdowns across Melbourne and Sydney.

Peter Alexander recorded sales of $227.4 million, which is an increase of 11.4% compared to the first half of 2021. The lockdown may have provided an opportunity for people to invest in their working from home outfits.

Premier’s second half to the year had a strong start with total global sales increasing by 6.2% compared to the second half of 2021. Net profit had dropped 13% to $163.6 million compared to the first half of 2021.

Premier Retail delivered earnings before interest and tax (EBIT) of $212 million, including significant items. This is slightly above their projection for this period, it is 4-5% higher than expectations. Premier Retail EBIT excluding significant items was $196.4 million, up 5.5% compared with the first half of 2021.

Compared to the first half of 2021, sales recorded $769.9 million, which is an increase of 0.6%. Global like-for-like sales were up 8.9%.

Online sales increased by 27.3% to $195.4 million and now represent 25.4% of group sales. These sales have offset the lost store sales due to the lockdowns. Premier is looking to increase online sales, this is because online sales generates a higher margin than conventional bricks and mortar stores.

Premier Investments has announced an interim dividend of 46 cents per share, which is payable on the 27th of July. This is an increase of 35.3% compared to the previous period’s dividend of 34 cents per share.

In January, the retailer flagged it will exit four sites in Sydney’s MidCity shopping centre as it takes a hardline approach to store-by-store profitability and a steady, tough stance with landlords.

Premier’s chairman, Solomon Lew, said: “In the final two months of the first half of 2022, we managed the impacts of the omicron variant across our entire global business. Despite these challenges, Premier has once again delivered outstanding results, reflecting the high calibre of our board, our talented senior management team, and the commitment and dedication of our team members across the globe”.

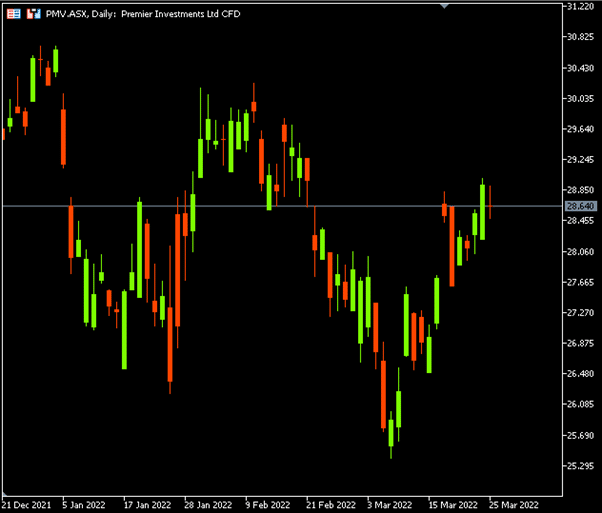

Premier Investments is currently trading at $28.64, which is 6.74% lower than January’s high of $30.71.

All in all, Premier Investments’ great start to the year can be an indication that the retail sector is strongly recovering after the pandemic. Only time will tell if this growth can be sustained or that the increase is driven by customers’ temporary desires to shop after the lockdown period.

If you would like to take this opportunity to invest in Premier Investments and don’t already have a trading account, you can register for a Shares or Shares CFD account at GO Markets.

Sources: GO Markets MT5, Premierinvestments, ASX, Insideretail, Wikipedia, AFR

The information provided is of general nature only and does not take into account your personal objectives, financial situations or needs. Before acting on any information provided, you should consider whether the information is suitable for you and your personal circumstances and if necessary, seek appropriate professional advice. All opinions, conclusions, forecasts or recommendations are reasonably held at the time of compilation but are subject to change without notice. Past performance is not an indication of future performance. Go Markets Pty Ltd, ABN 85 081 864 039, AFSL 254963 is a CFD issuer, and trading carries significant risks and is not suitable for everyone. You do not own or have any interest in the rights to the underlying assets. You should consider the appropriateness by reviewing our TMD, FSG, PDS and other CFD legal documents to ensure you understand the risks before you invest in CFDs. These documents are available here.

#Economy #Economics #Finance #MarketsNext Article

Market set for another volatile week

The market looks for another volatile week as geopolitical concerns and high commodity prices look likely to remain a key factor in the last week of March. Market sentiment will also be dictated by the Federal Reserve's responses to key core figures coming out later this week. Commodities Oil prices are set to remain in focus with concerns fr...

March 28, 2022Read More >Previous Article

Western Countries consider new sanctions against Russia, limiting their access to gold.

The USA and other Western nations have intimated that they are planning to block Russia's access to its international stockpile of gold. Russia has so...

March 25, 2022Read More >Please share your location to continue.

Check our help guide for more info.

- Trading