- Trading

- Trading

- Markets

- Markets

- Products overview

- Forex

- Commodities

- Metals

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- Platforms

- Platforms

- Platforms

- Platforms

- Platforms overview

- MetaTrader 4

- MetaTrader 5

- Education

- Education

- Education

- Education

- News & analysis

- Education Hub

- Economic calendar

- Help & support

- Help & support

- About

- Trading

- Trading

- Markets

- Markets

- Products overview

- Forex

- Commodities

- Metals

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- Platforms

- Platforms

- Platforms

- Platforms

- Platforms overview

- MetaTrader 4

- MetaTrader 5

- Education

- Education

- Education

- Education

- News & analysis

- Education Hub

- Economic calendar

- Help & support

- Help & support

- About

- Home

- News & Analysis

- Economic Updates

- Why are US retail giants bleeding?

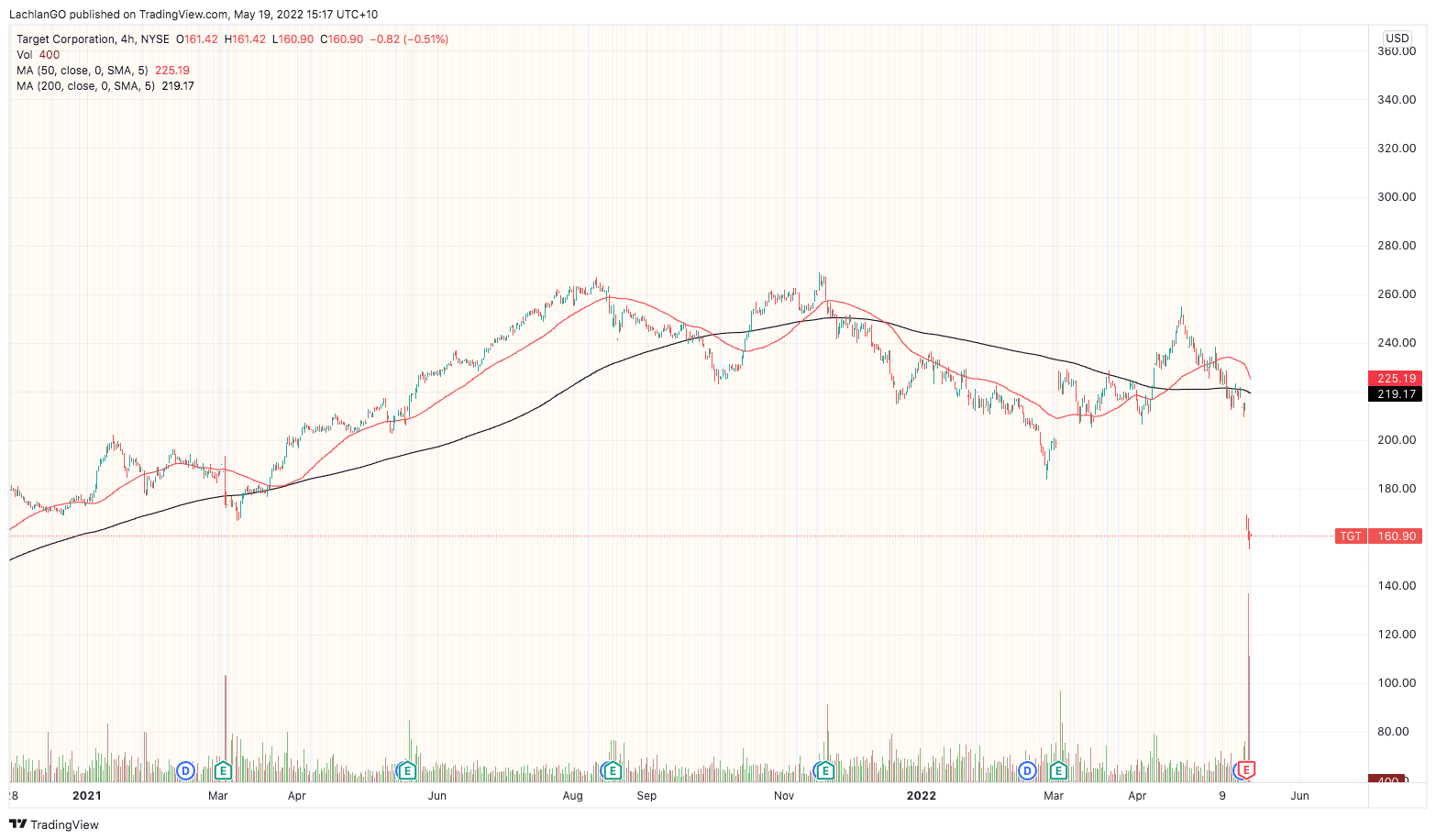

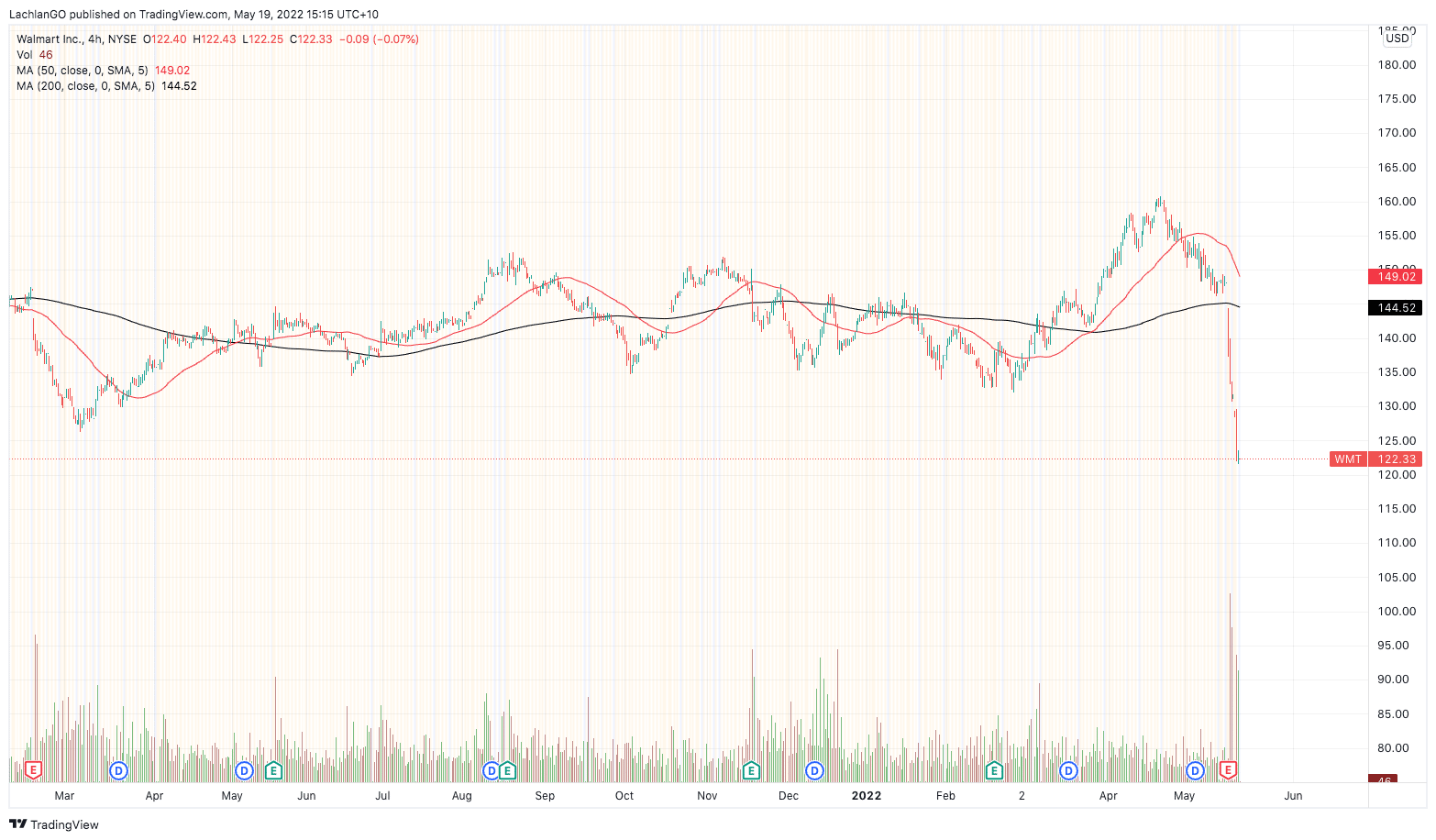

News & AnalysisRetail and consumer staples Walmart and Target have seen dramatic drops in their share prices in the last week as the cost of inflation begins to take its toll. Both retail in the USA have become unstuck as the consequences of high inflation begins to take effect. The companies saw a big drop in profitability as rising costs continue to put pressure on the bottom line.

Earnings results

Target announced a poor first quarterly result including a disappointing profit margin of 5% which was only half of the same result from the quarter a year ago. Even though revenue rose by 4%, slightly higher than expected, net income fell nearly 52% from a year ago to $1.01 billion. Per share earnings were also below analyst expectations coming in at $2.19 a share. In response the share price dropped 25%, its largest drop since 1987. The key reason for the increase in costs was the increase in wages delivery and logistic costs. Furthermore, fears that more interest rate hikes will do little to help the costs also drove the share prices lower.

Walmart also released similar results with strong sales but poor profitability. They cut their full year earnings which saw a drag on the share price. Walmart CEO, Doug McMillon pinned their poor results on the environment in the USA that is creating high inflations levels particularly in food and fuel. McMillion outlined that the “Bottom line results were unexpected and reflect the unusual environment.”

The Walmart price chart below shows the sudden sell off after quarterly results were released.

Consumer trends show buyers are moving away from big appliances and technology purchases towards consumer staples such as a food and home supplies. Consumers are making choices to be less aggressive with their spending habits. This may indicated that much of the forward buying towards electronics and other appliances made during the pandemic are slowing down. This indicates that the effects of inflation may still have some way to go before easing.

Flow on Effects

The sell off two of the major retailers in USA has the market on edge. Increased freight costs largely due to the rising petrol prices have caused havoc on the companies margins. However, the fear was not just felt in these major companies. Amazon also suffered as investors conveyed their own fears on the logistics and supply chain costs. In addition, the sheer scale of Amazon’s operation requiring 1.6 million global employees means that it is at the mercy of rising wage and supply chain costs.

Going forward, consumer staples should be aware that they will not necessarily be safe from the impact of inflation. Companies in Australia such as WES, COL and WOW are not immune from the impacts on inflation. Other companies such as KGN, JBH, TPW and other retailers may also see a tough road ahead if a similar trend appears in Australia.

The information provided is of general nature only and does not take into account your personal objectives, financial situations or needs. Before acting on any information provided, you should consider whether the information is suitable for you and your personal circumstances and if necessary, seek appropriate professional advice. All opinions, conclusions, forecasts or recommendations are reasonably held at the time of compilation but are subject to change without notice. Past performance is not an indication of future performance. Go Markets Pty Ltd, ABN 85 081 864 039, AFSL 254963 is a CFD issuer, and trading carries significant risks and is not suitable for everyone. You do not own or have any interest in the rights to the underlying assets. You should consider the appropriateness by reviewing our TMD, FSG, PDS and other CFD legal documents to ensure you understand the risks before you invest in CFDs. These documents are available here.

#Economy #Economics #Finance #MarketsNext Article

Deere & Co. tops estimates

Deere & Co. (DE) reported its financial results on Friday for the second quarter ended May 1, 2022. The American manufacturer of farm machinery and industrial equipment reported revenue of $13.37 billion in the quarter (up by 11% year-over-year), topping analyst estimate of $13.231 billion. Earnings per share also coming in above expectat...

May 22, 2022Read More >Previous Article

Target Q1 results announced

Target Corporation (TGT) reported its Q1 financial results before the market open in the US on Wednesday. The US department store chain reported re...

May 19, 2022Read More >Please share your location to continue.

Check our help guide for more info.

- Trading