- Trading

- Trading

- Markets

- Markets

- Products overview

- Forex

- Commodities

- Metals

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- Platforms

- Platforms

- Platforms

- Platforms

- Platforms overview

- MetaTrader 4

- MetaTrader 5

- Education

- Education

- Education

- Education

- News & analysis

- Education Hub

- Economic calendar

- Help & support

- Help & support

- About

- Trading

- Trading

- Markets

- Markets

- Products overview

- Forex

- Commodities

- Metals

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- Platforms

- Platforms

- Platforms

- Platforms

- Platforms overview

- MetaTrader 4

- MetaTrader 5

- Education

- Education

- Education

- Education

- News & analysis

- Education Hub

- Economic calendar

- Help & support

- Help & support

- About

- Home

- News & Analysis

- Economic Updates

- Why is Bitcoin’s price falling and what is the aftermath?

- Home

- News & Analysis

- Economic Updates

- Why is Bitcoin’s price falling and what is the aftermath?

News & AnalysisNews & Analysis

News & AnalysisNews & AnalysisBitcoin, like many investment products, will be affected by decisions made by the U.S. Federal Reserve and their outlook on the U.S. economy.

There is currently a negative settlement on Bitcoin after the U.S. Federal Reserve actions have allowed for more aggressive withdrawal of liquidity. They have also mentioned that they will protect assets in the case of price drops in the form of a Fed Put.

At the recent U.S. Federal Reserve meeting, they have introduced plans to end the bond-purchase program in March, this is on the back of the U.S. inflation’s stickiness and the underlying strength in their economy. They have also suggested that there might be an interest-rate increase during March.

Fed Chairman Powell said, “The balance sheet is substantially larger than it needs to be and there’s a substantial amount of shrinkage that needs to be done”. This, coupled with the fact that there was no mention of asset prices support, has led experts to predict a short-term wave of volatile prices for Bitcoin.

In summary, the U.S. Federal Reserve has determined to closely monitor inflation to keep it in check. They have scheduled a few interest-rate increases throughout the year. This has resulted in a decline for all major asset classes, including Bitcoin.

Griffin Ardern, from Bluefin, had this to say regarding the volatility of Bitcoin: “the market sentiment is pessimistic, and liquidity appears to be accelerating its withdrawal from risky asset markets. In the futures market, investors are already reluctant to pay more premiums for far-month futures. That’s a vital bearish sign.”

Bitcoin prices have fallen as low as $35,550 (USD) during the past Asian trading session.

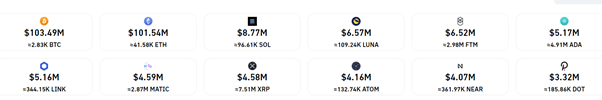

This price drop has resulted in a loss of over $103 million to Bitcoin traders. The losses were a result of the client’s positions being liquidated. Liquidation occurs when a client’s equity is lower than the margin requirement in a leveraged position.

The overall price drop across the crypto markets has resulted in $319 million in liquidation since the Fed meeting, with most of the loss felt by Bitcoin and Ether traders. Here is a chart provided by Coinglass to illustrate the figures.

Over half of these crypto traders were holding a long position and speculating that prices would become bullish and start to claim back to their previous highs.

There is currently a bearish outlook for Bitcoin as the price is reaching its new six month’s low. Matthew Dibb, from Stack Funds, has this to say: “Support remains relatively strong for bitcoin, but a +5% drop in the S&P 500 will likely have a profound impact on crypto to the downside”.

One of the reasons why the current price drop might be limited, is due to the fact that Bitcoin can be seen as a digital gold and an emerging technology. As long as Bitcoin’s technology has value and utility, the price will steadily recover.

Sources: https://www.federalreserve.gov/, https://www.tradingview.com/, https://www.coinglass.com/, https://www.fxstreet.com/

The information provided is of general nature only and does not take into account your personal objectives, financial situations or needs. Before acting on any information provided, you should consider whether the information is suitable for you and your personal circumstances and if necessary, seek appropriate professional advice. All opinions, conclusions, forecasts or recommendations are reasonably held at the time of compilation but are subject to change without notice. Past performance is not an indication of future performance. Go Markets Pty Ltd, ABN 85 081 864 039, AFSL 254963 is a CFD issuer, and trading carries significant risks and is not suitable for everyone. You do not own or have any interest in the rights to the underlying assets. You should consider the appropriateness by reviewing our TMD, FSG, PDS and other CFD legal documents to ensure you understand the risks before you invest in CFDs. These documents are available here.

#Economy #Economics #Finance #MarketsNext Article

Meta fourth quarter numbers are in

Meta Platforms (FB) reported its fourth quarter financial numbers after the closing bell on Wall Street on Wednesday. The company reported total revenue of $33.671 billion (up by 20% year-over-year), above analyst forecast of $33.357 billion. Earnings per share at $3.67 (down by 5% year-over-year), falling short of analyst estimate of $3.85 p...

February 3, 2022Read More >Previous Article

Firebrick Pharma debuts on ASX

An Australian pharmaceutical firm that's developing a world first virus-killing nasal spray has made its debut on the ASX. It was founded in 201...

January 28, 2022Read More >Please share your location to continue.

Check our help guide for more info.

- Trading