- Trading

- Trading

- Markets

- Markets

- Products overview

- Forex

- Commodities

- Metals

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- Platforms

- Platforms

- Platforms

- Platforms

- Platforms overview

- MetaTrader 4

- MetaTrader 5

- Education

- Education

- Education

- Education

- News & analysis

- Education Hub

- Economic calendar

- Help & support

- Help & support

- About

- Trading

- Trading

- Markets

- Markets

- Products overview

- Forex

- Commodities

- Metals

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- Platforms

- Platforms

- Platforms

- Platforms

- Platforms overview

- MetaTrader 4

- MetaTrader 5

- Education

- Education

- Education

- Education

- News & analysis

- Education Hub

- Economic calendar

- Help & support

- Help & support

- About

- Home

- News & Analysis

- Economic Updates

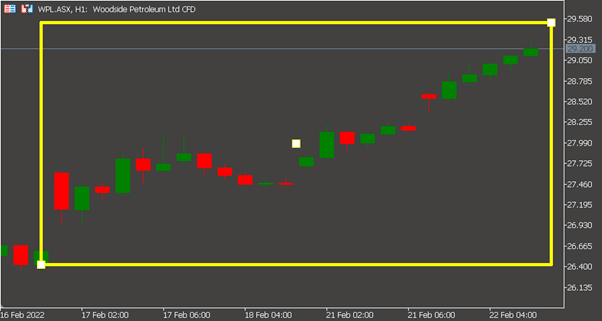

- Woodside’s surprising start to 2022

News & AnalysisAll prices in this article will be in USD unless otherwise stated.

Woodside Petroleum Ltd is an Australian petroleum exploration and production company. Woodside is the operator of oil and gas production and is Australia’s largest independent dedicated oil and gas company.

Woodside Petroleum shareholders will be able to share in the energy price surge that has helped fuel a $6 billion turnaround in bottom line profits for the full year and ensured a strong start to 2022 for the company.

Profits before interest and taxes have more than tripled to $1.62 billion. According to analysts’ consensus, an earnings upgrade could be on the table given last Thursday’s strong pricing for oil and gas, coupled with forward prices remaining robust for liquefied natural gas (LNG).

Woodside is also raising the share of its LNG production that is priced against buoyant spot price benchmarks. This would suggest further good news for Woodside, given that high spot prices are compared to oil-linked contract prices.

Other energy companies have also recorded strong performances, for example, Origin Energy has upgraded their full-year earning guidance on higher prices at its LNG project in QLD, this is expected to bring in $1.1 billion in cash flow for Origin this year.

Woodside has declared a final dividend of $1.05 per share. This is a strong contrast to 38 cents per share a year earlier where Woodside suffered a $4 billion net loss due to write-downs caused by the oil price crash in March 2020. The total dividend payout for the full year will be three times greater compared to 2020, at $1.35 per share. This has exceeded some analysts’ expectations. Woodside share prices have been rising ever since last Thursday’s release of the annual report. The share price is currently at $29.20 (AUD), which is a two year high.

This great start to the year has followed the major merger announcement made late last year in November. Woodside is in the final stages of a merger with BHP’s petroleum business. This merger is scheduled to complete in early June and is subject to a vote by Woodside shareholders, scheduled to be held a fortnight earlier on May 19.

The merger, coupled with the decision to start a $16.5 billion Scarborough and Pluto-2 project in Western Australia, have put Woodside in a strong financial position to start off 2022. The project will provide significant cash flow and is expected to generate returns for shareholders and help fund any future developments or investments.

All in all, Woodside is starting 2022 off with a bang, as they are looking to make the most out of the momentum by making smart calculated decisions on where to invest. They recently rewarded shareholders with a surprising dividend payment, which exceeded expectations. Woodside has a bright future ahead of them as they are merging with another mammoth of a company, BHP.

If you would like to take this opportunity to invest in Woodside Petroleum, login or register for a Shares or Shares CFD account at GO Markets.

Sources: GO Markets MT5, ASX, Wikipedia, Mediastatements (WA), AFR.

The information provided is of general nature only and does not take into account your personal objectives, financial situations or needs. Before acting on any information provided, you should consider whether the information is suitable for you and your personal circumstances and if necessary, seek appropriate professional advice. All opinions, conclusions, forecasts or recommendations are reasonably held at the time of compilation but are subject to change without notice. Past performance is not an indication of future performance. Go Markets Pty Ltd, ABN 85 081 864 039, AFSL 254963 is a CFD issuer, and trading carries significant risks and is not suitable for everyone. You do not own or have any interest in the rights to the underlying assets. You should consider the appropriateness by reviewing our TMD, FSG, PDS and other CFD legal documents to ensure you understand the risks before you invest in CFDs. These documents are available here.

#Economy #Economics #Finance #MarketsNext Article

Origin brings forward the closure of Australia’s largest coal plant

Origin Energy is a major integrated electricity generator, and electricity and natural gas retailer. It operates Australia’s largest coal-fired power station at Eraring, Lake Macquarie, New South Wales, with their headquarters in Sydney. Origin originally had plans to close down its only coal-fired power plant in 2032. However, they have recen...

February 24, 2022Read More >Previous Article

Home Depot tops expectations

Home Depot Inc. reported its fourth quarter earnings results before the opening bell in the US today. The world’s largest home improvement retail...

February 23, 2022Read More >Please share your location to continue.

Check our help guide for more info.

- Trading