- Trading

- Trading

- Markets

- Markets

- Products overview

- Forex

- Commodities

- Metals

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- Platforms

- Platforms

- Platforms

- Platforms

- Platforms overview

- MetaTrader 4

- MetaTrader 5

- Education

- Education

- Education

- Education

- News & analysis

- Education Hub

- Economic calendar

- Help & support

- Help & support

- About

- Trading

- Trading

- Markets

- Markets

- Products overview

- Forex

- Commodities

- Metals

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- Platforms

- Platforms

- Platforms

- Platforms

- Platforms overview

- MetaTrader 4

- MetaTrader 5

- Education

- Education

- Education

- Education

- News & analysis

- Education Hub

- Economic calendar

- Help & support

- Help & support

- About

- Home

- News & Analysis

- Economic Updates

- Woolworths’ latest green light from Goldman Sachs explained

- Home

- News & Analysis

- Economic Updates

- Woolworths’ latest green light from Goldman Sachs explained

News & AnalysisNews & Analysis

News & AnalysisNews & AnalysisWoolworths Group Limited is an Australian trans-Tasman retailer headquartered in Bella Vista, Sydney, with extensive operations throughout Australia and New Zealand. It is the largest company in Australia by revenue and the second-largest in New Zealand.

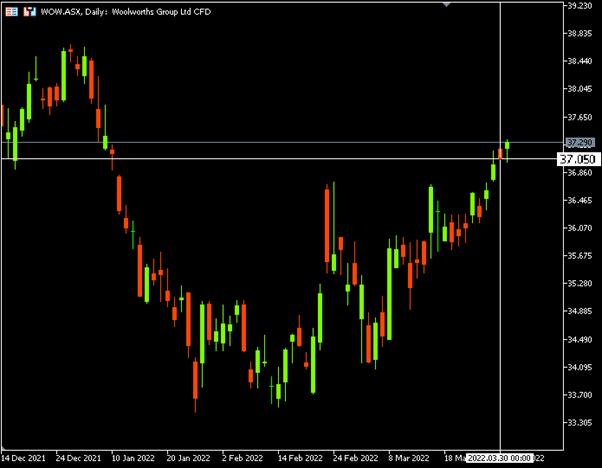

Goldman Sachs has labelled Woolworths as a buy in their latest broker note release. Woolworths’ share prices have increased since the announcement made earlier this week. Yesterday’s closing price of $37.05 was an increase of 2.2% compared to last Friday’s close of $36.23.

Investors have been buying into Woolworths as a reaction to the release of Goldman Sachs’ broker note. According to the note, Goldman Sachs has initiated coverage on Woolworths’ shares and announced a buy rating with a target price of $40.50.

Based on this assessment, they believe there is a potential increase of nearly 11% over the next 12 months. The last time the price has reached $40 was in December last year.

Goldman Sachs has also forecasted a fully franked 93 cents per share dividend for the 2022 financial year with a following 111.40 cents per share in financial year 2023. This could potentially bring the total return on offer to around 13.5%.

Goldman Sachs has stated there are three key reasons for their positive take on Woolworths. These reasons are Woolworths’ alternative revenue streams, digital consumer strategy and its defensive qualities in the current inflation environment.

In respect to alternative revenue streams, Goldman Sachs believes media services can become a major source of revenue for Woolworths. In their statement, they explained: “Media services, where retailers’ digital assets (including APP, website, email etc.) can act as ad platforms for its vendor brands, is one such potential, with early success seen in US peers (Walmart and Kroger). As long as the retailer can provide the brands with a target audience and high quality touch points with personalised media exposure and measured returns (with higher ROI than other mass media allocation), brands will likely shift spend onto the platform. As part of our DCF, we forecast that by 2030, WOW will be able to deliver A$1B revenue at ~30% EBIT margin for the Media business, which appears conservative compared to Walmart and Kroger delivering ~60% EBIT margin.”

As for their digital consumer strategy, Goldman Sach’s commented: “We expect the transition to omni-channel sales to be a critical next step in competition, even after COVID. Per our proprietary “Digital Readiness Scorecard”, WOW is the most advanced in its digitization efforts, as evidenced through its online penetration (~10% as of FY22) and 13.3m Everyday Rewards Members and significant ~12m digital traffic weekly, materially outperforming peers”.

Lastly, Goldman Sach believes that Woolworths’ has defensive qualities in an inflationary environment. They have stated: “WOW, being the largest grocer in Australia at ~35% market share as of FY21, has demonstrated historical success in managing through commodity inflation via a series of levers including price pass-through, mix improvement and cost efficiency initiatives. We expect that it will have strong pricing power and scale advantage to manage well through this cycle”.

All in all, Goldman Sachs’ green light on Woolworths has given many investors a lot to ponder. It is up to Woolworths to keep up with expectations and continue to deliver value for investors. Only time will reveal whether or not Goldman Sachs’ broker note will hold true.

If you would like to take this opportunity to invest in Woolworths and don’t already have a trading account, you can register for a Shares or Shares CFD account at GO Markets.

Sources: GO Markets MT5, ASX, Wikipedia, Woolworths, Fool

The information provided is of general nature only and does not take into account your personal objectives, financial situations or needs. Before acting on any information provided, you should consider whether the information is suitable for you and your personal circumstances and if necessary, seek appropriate professional advice. All opinions, conclusions, forecasts or recommendations are reasonably held at the time of compilation but are subject to change without notice. Past performance is not an indication of future performance. Go Markets Pty Ltd, ABN 85 081 864 039, AFSL 254963 is a CFD issuer, and trading carries significant risks and is not suitable for everyone. You do not own or have any interest in the rights to the underlying assets. You should consider the appropriateness by reviewing our TMD, FSG, PDS and other CFD legal documents to ensure you understand the risks before you invest in CFDs. These documents are available here.

#Economy #Economics #Finance #MarketsNext Article

Paychex beats estimates

Paychex Inc. reported its latest financial results before the opening bell on Wall Street on Wednesday. The US payroll services company reported total revenue of $1.276 billion for the quarter ending February 28, 2022 (a 15% increase year-over-year) vs. $1.22 billion expected. Earnings per share reported at $1.15 per share, above analyst esti...

March 31, 2022Read More >Previous Article

JB Hi-Fi may have just successfully weathered the pandemic

JB Hi-Fi is an Australian/New Zealand consumer electronics, Home Appliances and Technology retailer. The company operates 316 stores across Australia ...

March 31, 2022Read More >Please share your location to continue.

Check our help guide for more info.

- Trading