- Trading

- Trading

- Markets

- Markets

- Products overview

- Forex

- Commodities

- Metals

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- Platforms

- Platforms

- Platforms

- Platforms

- Platforms overview

- MetaTrader 4

- MetaTrader 5

- Education

- Education

- Education

- Education

- News & analysis

- Education Hub

- Economic calendar

- Help & support

- Help & support

- About

- Trading

- Trading

- Markets

- Markets

- Products overview

- Forex

- Commodities

- Metals

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- Platforms

- Platforms

- Platforms

- Platforms

- Platforms overview

- MetaTrader 4

- MetaTrader 5

- Education

- Education

- Education

- Education

- News & analysis

- Education Hub

- Economic calendar

- Help & support

- Help & support

- About

- Home

- News & Analysis

- Economic Updates

- Xpeng tops estimates in Q4

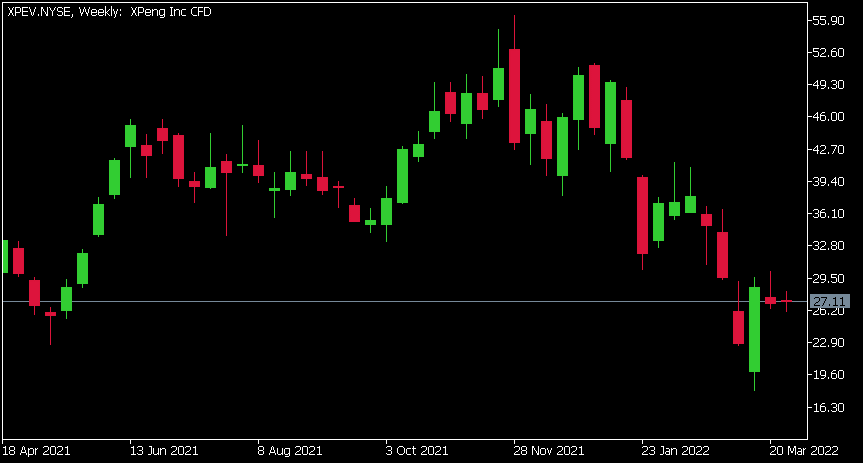

- 1 Month: -25.41%

- 3 Month: -41.11%

- Year-to-date: -46.10%

- 1 Year: -13.63%

News & AnalysisXpeng Inc. reported its Q4 2021 financial results before the market open in the US on Monday. The Chinese electric vehicle company topped Wall Street expectations, beating both revenue and earnings per share estimates.

World’s 21st largest automaker reported total revenue of $1.764 billion in the quarter (200.1% increase year-over-year) vs. $1.226 billion expected.

Earnings per share reported at $0.03 per share, analysts were expecting a loss per share of -$0.33.

The company delivered 41,751 cars in Q4, representing a 222% increase year-over-year.

Full year deliveries reached 98,155 vehicles – a 263% increase from 2020.

”2021 was marked by impressive growth with record-breaking fourth quarter deliveries led by our blockbuster P7 model and our newly launched P5 family sedan. For both the full year and fourth quarter, our total deliveries more than tripled year-over-year, fueled by the fast-growing EV penetration in China and our competitive Smart EV products. In addition, fast expansion of our sales and services, and supercharging stations networks and the accelerated rollout of new products are paving the way for even deeper penetration into China’s mid- to high-end market segment where robust demand for our products continues to outpace supply,” said He Xiaopeng, Chairman and CEO of Xpeng after the latest results were announced.

Xpeng Inc. chart

Shares of Xpeng were little changed at the end of trading day on Monday, up by 0.30% at $27.11 per share.

Here is how the stock has performed in the past year –

Xpeng is the 809th largest automaker in the world with a market cap of $23.23 billion.

You can trade Xpeng Inc. (XPEV) and many other stocks from the NYSE, NASDAQ, HKEX and the ASX with GO Markets as a Share CFD.

Sources: XPeng Inc., TradingView, CompaniesMarketCap

The information provided is of general nature only and does not take into account your personal objectives, financial situations or needs. Before acting on any information provided, you should consider whether the information is suitable for you and your personal circumstances and if necessary, seek appropriate professional advice. All opinions, conclusions, forecasts or recommendations are reasonably held at the time of compilation but are subject to change without notice. Past performance is not an indication of future performance. Go Markets Pty Ltd, ABN 85 081 864 039, AFSL 254963 is a CFD issuer, and trading carries significant risks and is not suitable for everyone. You do not own or have any interest in the rights to the underlying assets. You should consider the appropriateness by reviewing our TMD, FSG, PDS and other CFD legal documents to ensure you understand the risks before you invest in CFDs. These documents are available here.

#Economy #Economics #Finance #MarketsNext Article

Dividends and who’s paying them in April?

A dividend is a distribution of profits by a corporation to its shareholders. When a corporation earns a profit or surplus, it is able to pay a proportion of the profit as a dividend to shareholders. How do stock dividends work? A dividend is paid per share of stock — if you own 30 shares in a company and that company pays $2 in annual cas...

March 29, 2022Read More >Previous Article

Market set for another volatile week

The market looks for another volatile week as geopolitical concerns and high commodity prices look likely to remain a key factor in the last week of M...

March 28, 2022Read More >Please share your location to continue.

Check our help guide for more info.

- Trading