- Trading

- Trading

- Markets

- Markets

- Products overview

- Forex

- Commodities

- Metals

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- Platforms

- Platforms

- Platforms

- Platforms

- Platforms overview

- MetaTrader 4

- MetaTrader 5

- Education

- Education

- Education

- Education

- News & analysis

- Education Hub

- Economic calendar

- Help & support

- Help & support

- About

- Trading

- Trading

- Markets

- Markets

- Products overview

- Forex

- Commodities

- Metals

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- Platforms

- Platforms

- Platforms

- Platforms

- Platforms overview

- MetaTrader 4

- MetaTrader 5

- Education

- Education

- Education

- Education

- News & analysis

- Education Hub

- Economic calendar

- Help & support

- Help & support

- About

- Home

- News & Analysis

- Economic Updates

- Xpeng tops first quarter expectations – the stock falls on future outlook

- Home

- News & Analysis

- Economic Updates

- Xpeng tops first quarter expectations – the stock falls on future outlook

- 1 Month -9.21%

- 3 Month -41.99%

- Year-to-date -56.33%

- 1 Year -24.55%

- Citigroup $67

- Barclays $39

- Morgan Stanley $42

- B of A Securities $66

News & AnalysisNews & Analysis

News & AnalysisNews & AnalysisXpeng tops first quarter expectations – the stock falls on future outlook

24 May 2022 By Klavs ValtersXpeng tops first quarter expectations – the stock falls on future outlook

Xpeng Inc. (XPEV) reported its first quarter financial results before the opening bell on Wall Street on Monday.

The Chinese electric vehicle company reported revenue of $1.175 billion in the quarter (up by 152.6% year-over-year) vs. $1.165 billion expected.

The company reported a loss per share of -$0.16 per share vs. -$0.30 loss per share expected.

He Xiaopeng, Chairman and CEO of Xpeng on the latest results: ”Our first quarter performance marked a strong start to 2022. Demand for our high-quality EV products was robust and our proprietary suite of technologies continue to lead the industry.”

”Superior in-house technology development capability and proactive supply chain management enabled us to address supply chain challenges more efficiently. We remain confident in expanding our market share despite the impact of semi-conductor shortage and COVID-19,” Xiaopeng commented on the challenges the company has and is facing.

”We are pleased to begin the year with a strong quarter. Our total revenues grew rapidly by 152.6% year-over-year in the first quarter of 2022 and our gross margin held up well,” said Dr. Hongdi Brian Gu, Honorary Vice Chairman and President of the electric vehicle company.

”We will continue to manage supply chain uncertainties and we remain confident in our exciting product pipeline planned for 2022 and beyond. In addition, we expect to further leverage our economies of scale and continue to improve our operating efficiency,” Dr. Hongdi Brian Gu concluded.

The company expects deliveries of between 31,000 and 34,000 vehicles in the second quarter.

Revenues expected to be in region of $1.022 billion and $1.127 billion in Q2, which falls short of analyst estimate of $1.216 billion.

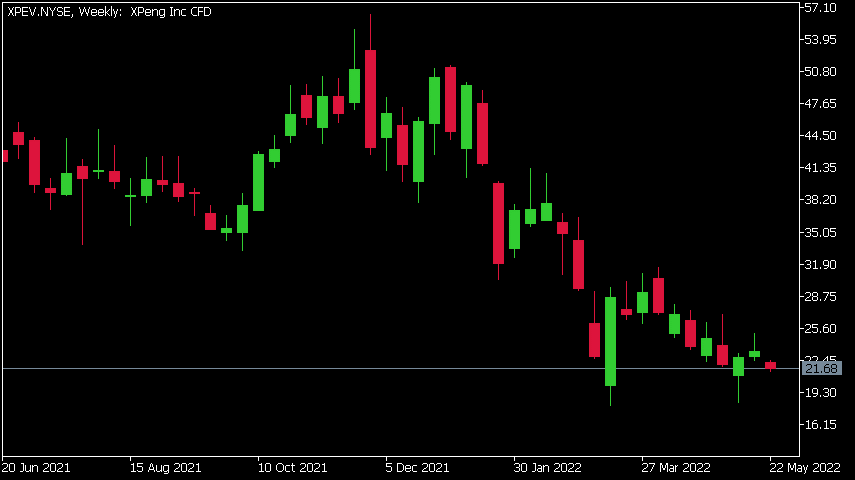

Xpeng Inc. (XPEV) chart

Shares of Xpeng were down by 5.84% at the end of the trading on Monday after beating Q1 estimates, but future outlook had a negative impact on the stock price.

Here is how the stock has performed in the past year:

Xpeng price targets

Xpeng Inc. is the 850th largest company in the world with a market cap of $19.91 billion.

You can trade Xpeng In. (XPEV) and many other stocks from the NYSE, NASDAQ, HKEX and the ASX with GO Markets as a Share CFD.

Sources: Xpeng Inc., TradingView, MarketWatch, Benzinga, CompaniesMarketCap

The information provided is of general nature only and does not take into account your personal objectives, financial situations or needs. Before acting on any information provided, you should consider whether the information is suitable for you and your personal circumstances and if necessary, seek appropriate professional advice. All opinions, conclusions, forecasts or recommendations are reasonably held at the time of compilation but are subject to change without notice. Past performance is not an indication of future performance. Go Markets Pty Ltd, ABN 85 081 864 039, AFSL 254963 is a CFD issuer, and trading carries significant risks and is not suitable for everyone. You do not own or have any interest in the rights to the underlying assets. You should consider the appropriateness by reviewing our TMD, FSG, PDS and other CFD legal documents to ensure you understand the risks before you invest in CFDs. These documents are available here.

#Economy #Economics #Finance #MarketsNext Article

Semi-conductor supply crunch

The global market has seen what can happen when there are disruptions to critical supply chains. However a lesser known critical material or part of the electronic supply chain is the delicate supply of semi-conductors. The Covid -19 Pandemic and the Russian and Ukraine war have highlighted how vulnerable secure supply chains can be to global volat...

May 24, 2022Read More >Previous Article

Deere & Co. tops estimates

Deere & Co. (DE) reported its financial results on Friday for the second quarter ended May 1, 2022. The American manufacturer of farm machinery...

May 22, 2022Read More >Please share your location to continue.

Check our help guide for more info.

- Trading