- Trading

- Trading

- Markets

- Markets

- Products overview

- Forex

- Commodities

- Metals

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- Platforms

- Platforms

- Platforms

- Platforms

- Platforms overview

- MetaTrader 4

- MetaTrader 5

- Education

- Education

- Education

- Education

- News & analysis

- Education Hub

- Economic calendar

- Help & support

- Help & support

- About

- Trading

- Trading

- Markets

- Markets

- Products overview

- Forex

- Commodities

- Metals

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- Platforms

- Platforms

- Platforms

- Platforms

- Platforms overview

- MetaTrader 4

- MetaTrader 5

- Education

- Education

- Education

- Education

- News & analysis

- Education Hub

- Economic calendar

- Help & support

- Help & support

- About

- Home

- News & Analysis

- Articles

- Economic Updates

- Zoom exceeds Wall Street expectations for Q4

- Home

- News & Analysis

- Articles

- Economic Updates

- Zoom exceeds Wall Street expectations for Q4

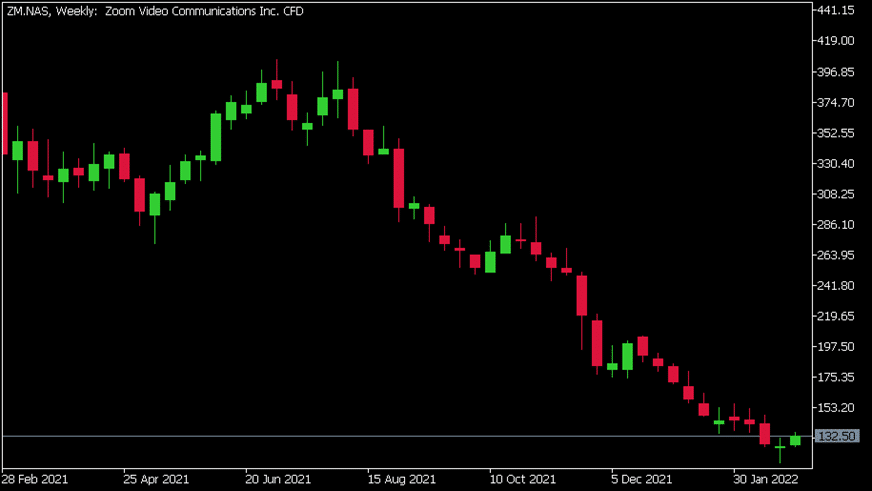

- 1 Month: -14.05%

- 3 Month: -39.45%

- Year-to-date: -27.90%

- 1 Year: -67.63%

News & AnalysisNews & Analysis

News & AnalysisNews & AnalysisZoom Video Communications Inc. (ZM) reported its fourth-quarter 2021 financial results after the closing bell over in the US on Monday.

The US based company, which offers a cloud-based video conferencing service reported total revenue of $1.071 billion (up by 21% year-over-year), which was above analyst estimate of $1.054 billion.

Earnings per share also exceeded estimates at $1.29 per share vs. $1.07 expected.

”In fiscal year 2022, we delivered strong results with total revenue of more than $4 billion growing 55% year over year along with increased profitability and operating cash flow growth as our global customer base continued to grow and find new use cases for our broadening communications platform,” Founder and CEO of Zoom, Eric S. Yuan said in a statement following the latest results.

”Looking forward, we are addressing a large opportunity as we expect customers will continue to transform how they work and engage with their customers. It is apparent that businesses want a full communications platform that is integrated, secure, and easy to use. We are proud to lead the charge of the digital transformation for communications. To sustain and enhance our leadership position, in fiscal year 2023 we plan to build out our platform to further enrich the customer experience with new cloud-based technologies and expand our go-to-market motions, which we believe will enable us to drive future growth,” Yuan added.

Zoom Video Communications Inc. (ZM) chart

Shares of Zoom were up by 5.81% at the end of trading on Monday at $132.50 per share.

Here is how the stock has performed in the past year –

Zoom Video Communications Inc. is the 460th largest company in the world with total market cap of $39.51 billion.

You can trade Zoom (ZM) and many other stocks from the NYSE, NASDAQ, HKEX and the ASX with GO Markets as a Share CFD.

Sources: Zoom Video Communications Inc., TradingView, MetaTrader 5, CompaniesMarketCap

The information provided is of general nature only and does not take into account your personal objectives, financial situations or needs. Before acting on any information provided, you should consider whether the information is suitable for you and your personal circumstances and if necessary, seek appropriate professional advice. All opinions, conclusions, forecasts or recommendations are reasonably held at the time of compilation but are subject to change without notice. Past performance is not an indication of future performance. Go Markets Pty Ltd, ABN 85 081 864 039, AFSL 254963 is a CFD issuer, and trading carries significant risks and is not suitable for everyone. You do not own or have any interest in the rights to the underlying assets. You should consider the appropriateness by reviewing our TMD, FSG, PDS and other CFD legal documents to ensure you understand the risks before you invest in CFDs. These documents are available here.

#Economy #Economics #Finance #MarketsNext Article

Surging commodities and high volatility the theme as the Ukraine conflict continues

US and European equity markets remained volatile as fighting between Russian and Ukraine forces continued and negotiation talks failed to result in any progress. Both parties however have committed to another round of discussions. The VIX, Wall Street’s volatility measure surged 12% to 30 indicating the increased fear investors are feeling fro...

March 2, 2022Read More >Previous Article

Russia takes a hit

Last week, Russia took a step that not many people thought it would take – they invaded Ukraine. Even though the tensions have been building in the ...

March 1, 2022Read More >Please share your location to continue.

Check our help guide for more info.

- Trading